[ad_1]

- PEPE noticed its market construction flip bearishly, indicating additional losses had been doubtless.

- The on-chain metrics flashed a robust purchase sign, however market sentiment remained fearful.

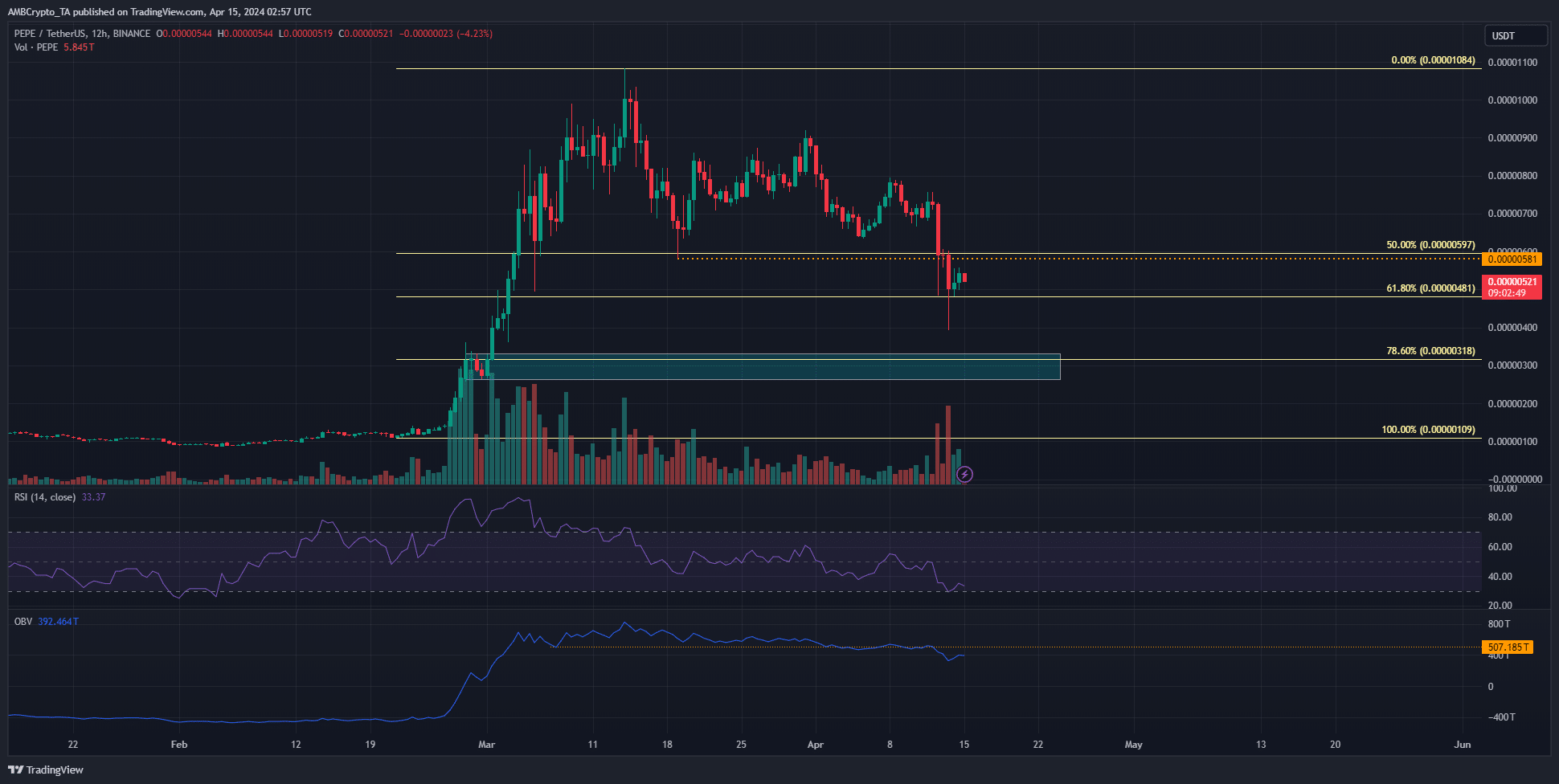

Pepe [PEPE] was unable to defend the $0.00000581 degree on the second time asking and has shed near 50% up to now 5 days. Nearly all of these losses got here from the eleventh to the thirteenth of April.

The volatility may catch merchants off guard, however it was additionally a chance. From the lows of thirteenth April, PEPE has bounced by 33% in round 32 hours. Does that imply the native backside has been set? Right here’s what the trail forward may appear to be.

Proof for accumulation

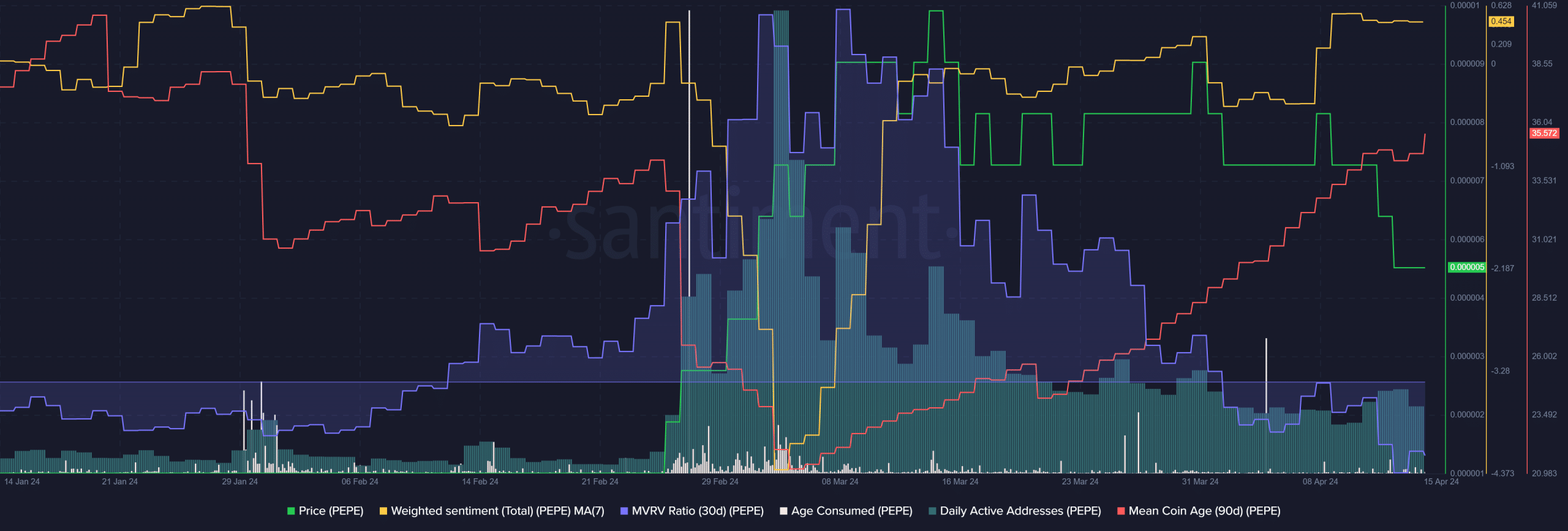

Supply: Santiment

Since mid-March, the memecoin has been retracing the positive aspects it made in late February. But, regardless of the losses on the value chart, the imply coin age has trended greater. This pointed towards network-wide accumulation of PEPE.

This was additional supported by the age consumed metric. It noticed an enormous spike on the 4th of April and two giant ones on the twenty sixth and twenty seventh of March. Collectively, they confirmed giant token actions, however not constant motion like we noticed in early March.

This meant holders offered in panic however many others continued to carry via the losses. The 30-day MVRV was damaging, displaying their losses had been rising. However in live performance with the imply coin age, the damaging MVRV was a purchase sign.

The 7-day weighted sentiment was constructive, which was stunning after the latest developments. There was nonetheless an opportunity of a deeper drop, based mostly on technical evaluation.

The construction breaks and the subsequent demand zone

The retracement to $0.00000581 on the nineteenth of March set a brand new swing low. The latest PEPE dip meant that the shorter timeframe pattern was bearish and so was the market construction. Nonetheless, on the 12-hour chart, the pattern was nonetheless biased bullishly.

The RSI was at 33 to sign downward momentum was dominant. Furthermore, the OBV additionally fell under a month-long assist. Therefore, extra losses are anticipated in April. This might see the meme coin attain the 78.6% retracement degree at $0.00000318.

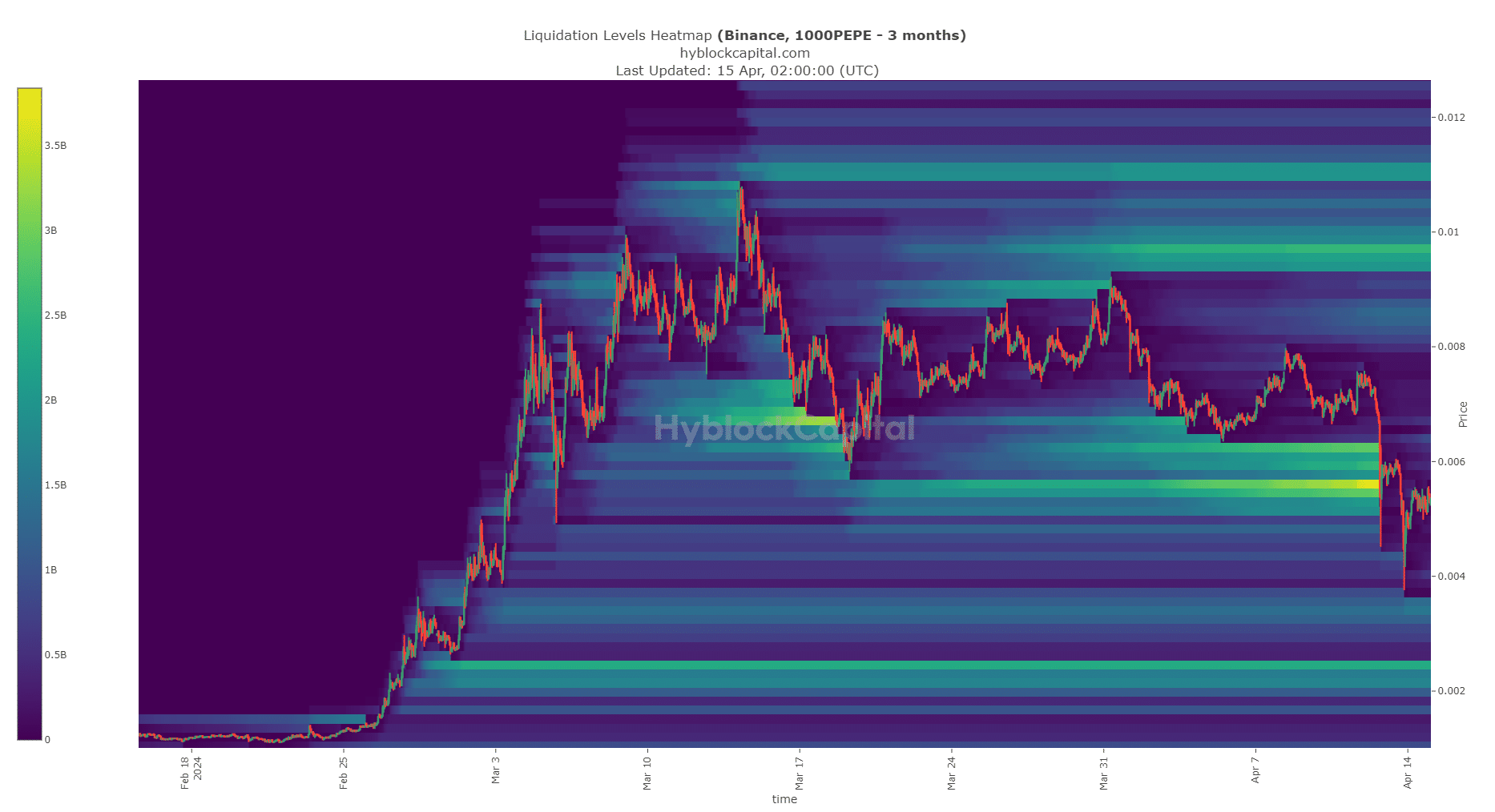

Supply: Hyblock

The liquidation heatmap confirmed sparse liquidation ranges above present market costs. To the south, the $0.00000245 was the subsequent magnetic zone for the costs. But, if Bitcoin [BTC] has reached an area backside, PEPE may bounce greater.

Is your portfolio inexperienced? Verify the Pepe Profit Calculator

Therefore, within the brief time period, the $0.00000955 space was additionally a magnetic zone. Nonetheless, it’s 85% greater than market costs, which was uncertain given the market uncertainty.

General, the metrics advised that it might be an excellent short-term shopping for alternative for PEPE merchants.

[ad_2]

Source link