[ad_1]

- The token’s worth elevated, and so did ETH.

- RNDR’s recognition grew amongst merchants, suggesting a major value hike in the long run.

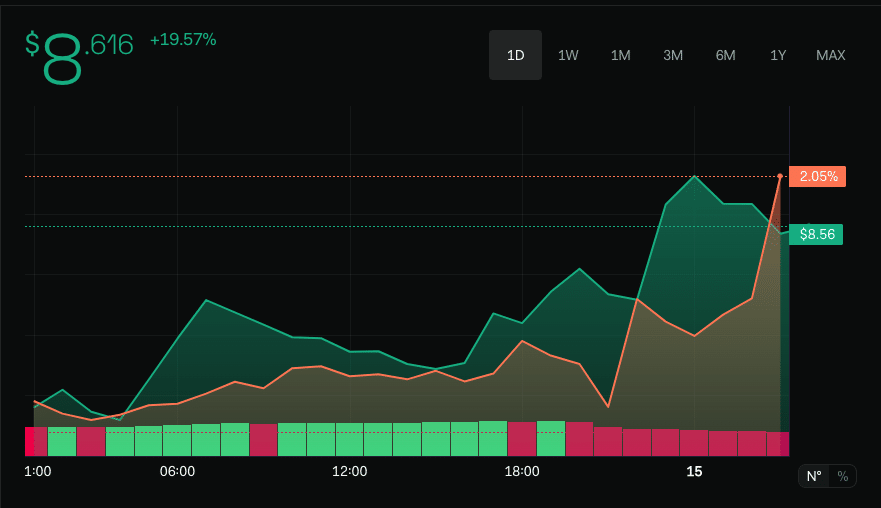

Render [RNDR], the native token of the distributed GPU community constructed on Ethereum [ETH] jumped by an unbelievable 18.85% within the final 24 hours.

This efficiency made RNDR one of many high property with one of the best restoration fee after the broader market skilled a drawdown. Apparently, the bounce occurred as ETH itself was in a position to reclaim $3,000 and rise above it.

Nevertheless, there have been different causes the worth of RNDR elevated. The very first thing AMBCrypto seen was the rise in social dominance.

Did ETH “Render” assist?

Analyzing data from LunarCrush, we noticed that Render’s social dominance elevated by a mind-blowing 116% inside the similar timeframe the worth skyrocketed.

The rise in social dominance implied that the challenge’s popularity amongst merchants surged. From our findings, merchants had been drawn to RNDR due to its fundamentals.

Anybody conversant with the market would have noticed that many market individuals are bullish on initiatives with the DePIN narrative. DePIN stands for Decentralized Bodily Infrastructure Networks.

Within the crypto house, initiatives constructed round this narrative like Render, use tokens to incentivize holders who make the most of the protocol.

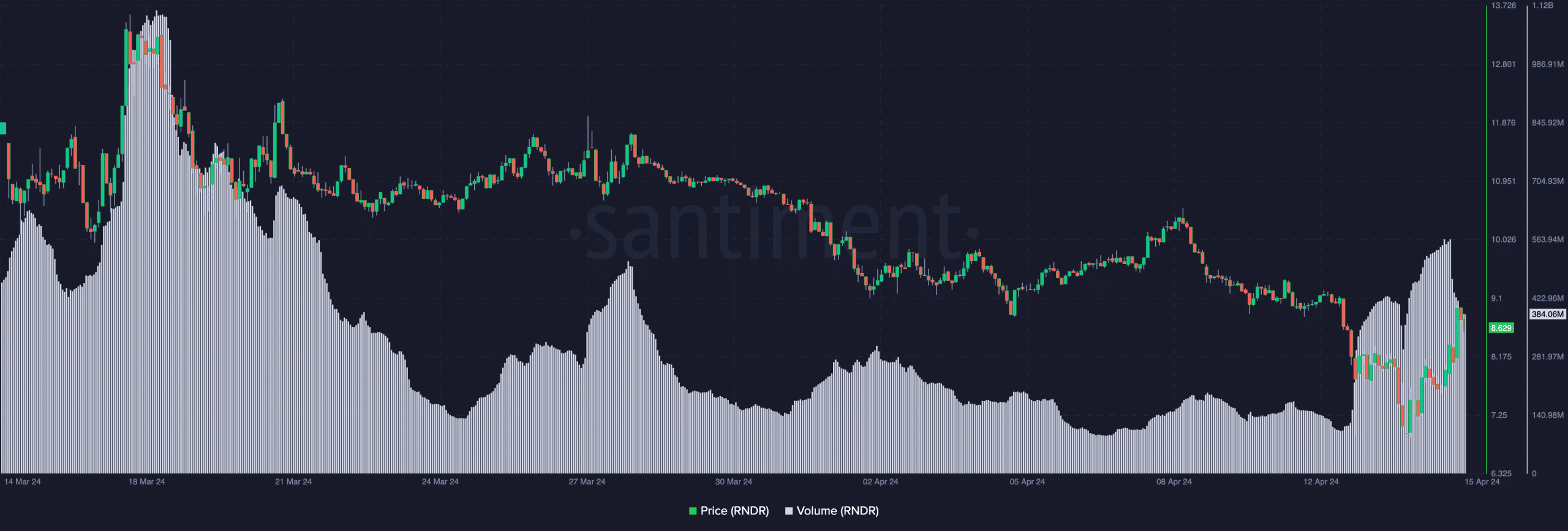

Moreover, AMBCrypto noticed one other proof of the curiosity in RNDR. This time, it was the trading volume. In keeping with Santiment, Render’s buying and selling quantity rose to 556.65 million on the 14th of April.

This improve represented a 37.72% leap from the worth on the thirteenth. Nevertheless, the amount decreased barely at press time, indicating that RNDR may not have a strong backing to proceed its upswing.

Sentiment stays the identical

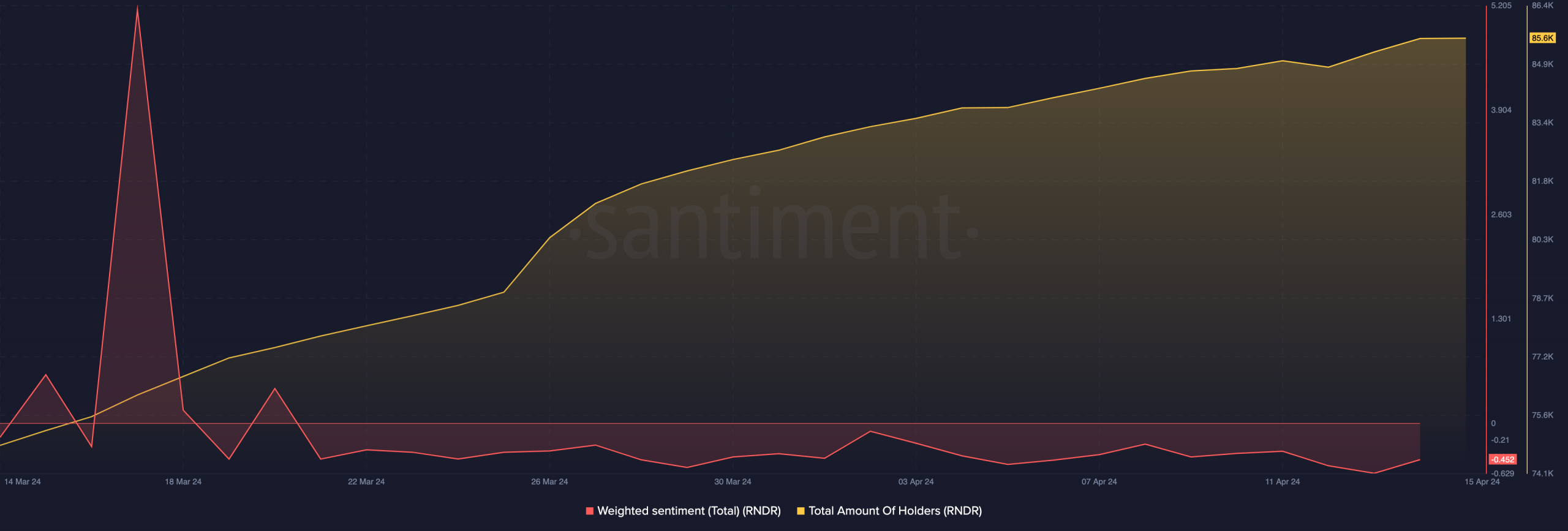

Regardless of RNDR’s potential, it appeared merchants weren’t but satisfied about its short-term efficiency. This was evident from the Weighted Sentiment analyzed on-chain.

The metric tracks the typical constructive or adverse remark a few challenge. If the studying is constructive, it means most market individuals have a bullish view. However, a adverse studying suggests a bearish notion.

At press time, Render’s Weighted Sentiment was -0.45. With this place, demand for RNDR would possibly lower within the quick time period. Ought to this be the case, the worth of the token would possibly fall under $9.

However that does invalidate the long-term optimism across the challenge. AMBCrypto concluded this after checking the quantity of holders.

On the twenty fifth of March, the entire quantity of RNDR holders was lower than 80,000. Nevertheless, that figure had elevated to 85,600 at press time.

Real looking or not, right here’s RNDR’s market cap in ETH terms

A rise within the variety of holders was an indication of traction on the community and adoption of the token. If this continues, RNDR’s value might head to new highs.

Nevertheless, it is very important be aware that there is perhaps corrections within the course of. However so long as the DePIN narrative stays related out there, the token is perhaps destined for the next worth.

[ad_2]

Source link