[ad_1]

- Toncoin, Neo, and LEO outperformed registered features over most property available in the market.

- Core, Wormhole, and Uniswap topped the largest losers chart.

The week ended on a troublesome observe for the broader crypto market, as Bitcoin [BTC] nearly slipped under $60,000 on the thirteenth of April. Regardless of the turmoil, some cryptocurrency costs had been capable of acquire.

Nevertheless, extra initiatives noticed their values shrink than people who gained. Right here’s AMBCrypto’s listing of crypto’s greatest winners and losers this week.

Greatest winners

Toncoin [TON]

Regardless of the turbulence that hit the market, Toncoin [TON] defied all odds and jumped by 19.47%. This helped the token to rise to the ninth place in the marketplace cap standings.

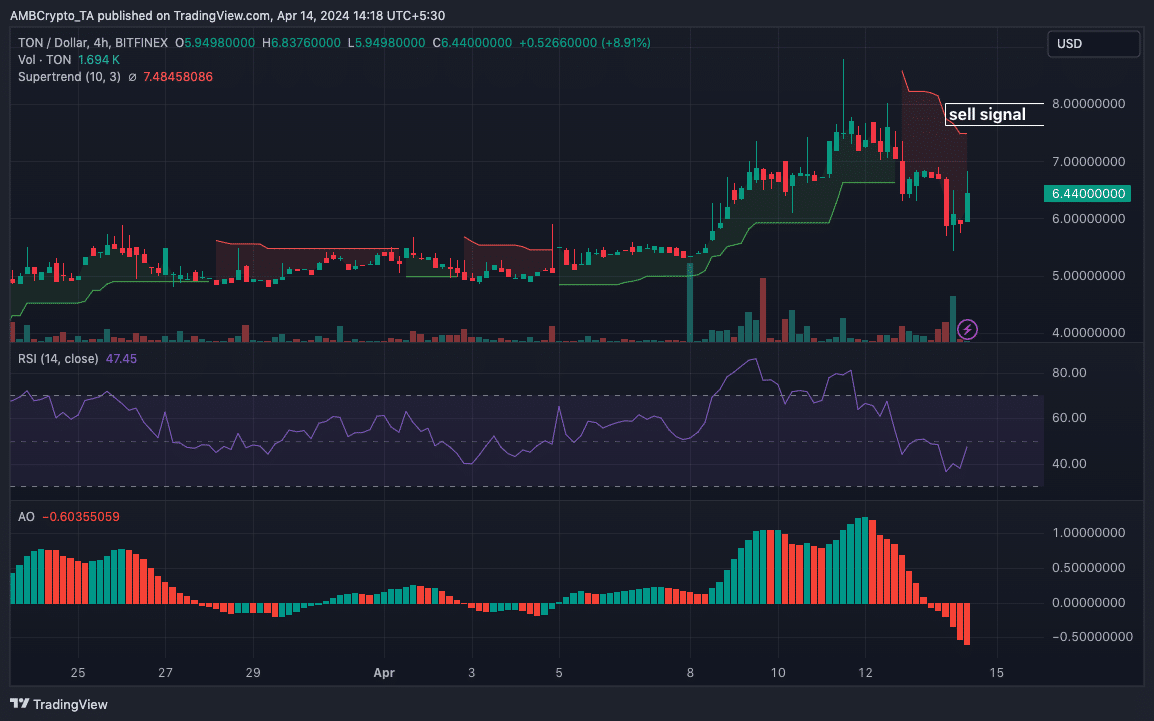

Although TON rallied towards $9 earlier, indicators revealed that it might be time for the token to step again.

For instance, the Superior Oscillator (AO) on the 4-hour chart was detrimental, suggesting growing downward momentum.

The Relative Energy Index (RSI) was under 50.00, indicating that the momentum was bearish. Likewise, the Supertrend flashed a promote sign at $7.49.

Subsequently, if TON rises towards that stage, it may face some resistance and the worth would possibly decline.

Neo [NEO]

The value of Neo [NEO] elevated by 10.21% within the just-concluded week. Although the worth had decreased within the final 24 hours, the worth rallied above $20 earlier.

At press time, NEO’s value was $17.11. There has additionally been a decline in its buying and selling quantity. Nevertheless, if the amount decreases alongside the worth, the downtrend may turn out to be weak, and sellers may be exhausted.

Ought to this be the case, NEO would possibly expertise a rebound within the quick time period.

UNUS SED LEO [LEO]

The huge downturn available in the market meant a token like UNUS SED LEO [LEO] was one of many greatest gainers. At press time, LEO modified fingers at $5.82, representing a 1.12% improve within the final seven days.

Nevertheless, this was one of many lowest the token hit, as its value nearly crossed $6 on the eleventh of April. The final hours have additionally seen the worth tried to bounce.

If it retains up the momentum, LEO would possibly surpass the $6 milestone inside just a few days.

Greatest losers

Core

Core’s [CORE] value dropped by a whopping 45.66% within the final seven days. This made it the worst-performing asset out of the highest 100.

At press time, CORE modified fingers at $1.41. However through the week, the worth of the token went decrease than that.

As an illustration, on the thirteenth of April, the worth fell to $1.25 as promoting strain hit the broader market. Curiosity within the token has additionally declined, with the amount lowering and the market cap shrinking.

Going into the brand new week, CORE would possibly erase a few of its losses, however a return above $2 may be unlikely.

Wormhole

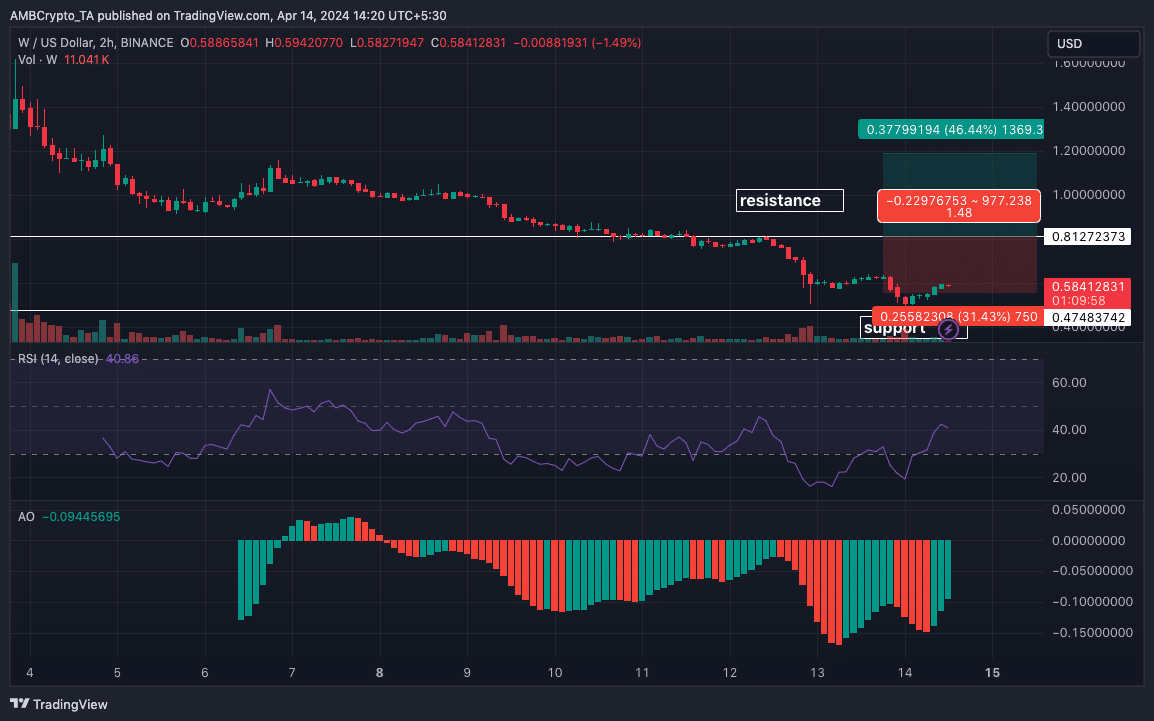

For the second week in a row, Wormhole [W] was one of many greatest losers. As of this writing, the worth of the token was $0.59, that means it had misplaced 44.57% of its worth within the final seven days.

Nevertheless, the technical perspective supplied a glimmer of hope for Wormhole. At press time, AMBCrypto observed that bulls had shaped assist at $0.47. This was what made the worth improve to $0.58.

However an overhead resistance stood at $0.81. If bulls clear this path, W would possibly rally towards $1.20. However, a breakdown may trigger the worth to drop under $0.50.

Nevertheless, the RSI studying was rising, indicating that the bullish thesis may be legitimate so long as sellers don’t neutralize it.

Uniswap

Uniswap [UNI] couldn’t keep away from being one of many greatest losers after the FUD it skilled through the week.

Beforehand, AMBCrypto had reported how the SEC warning prompted panic available in the market and triggered a wave of sell-offs.

Reasonable or not, right here’s W’s market cap in TON’s terms

In consequence, UNI’s value fell by 35.19% inside the final week. At one level, the worth of the token plunged to $5.85. But it surely has been capable of bounce off the lows, buying and selling at $7.32 at press time.

Over the subsequent few days, UNI would possibly expertise a little bit of stability, however a tougher push northward may not occur within the quick time period.

[ad_2]

Source link