[ad_1]

Hannah Phung, a lead analyst at on-chain analytics platform SpotOnChain, just lately gave her opinion on the impression that Bitcoin Halving might have on the flaghsip crypto’s worth. This provides to the continuing debate on whether or not or not the Halving occasion might trigger Bitcoin’s price to rise to $100,000.

Bitcoin’s Worth Surge May Not Come Instantly

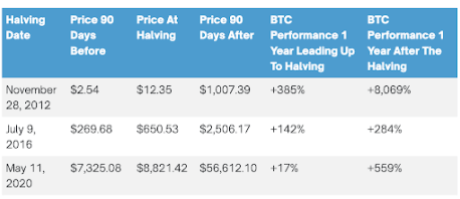

Phung talked about throughout an interview with BeInCrypto that Bitcoin’s worth tends to extend round 6 to 12 months after the Halving and never instantly. That is evident from the previous Halving occasions, as Bitcoin’s significant price gains happened one yr after the Halving had occurred. After the primary Halving on November 28, 2021, Bitcoin noticed a worth improve of over 8,000% one yr after the occasion.

Source: Milk Road

In the meantime, BTC noticed a worth improve of 284% and 559% one yr after the second and third Halving occasions, which befell on July 9, 2016, and Could 11, 2020, respectively. Phung additional famous that Bitcoin’s worth good points come from the discount in Bitcoin miners’ supply, which helps improve shortage and drive up its worth, particularly when demand is steady.

In February, NewsBTC reported that Bitcoin’s demand was far outpacing the miners’ provide. This led to a number of crypto analysts making bullish predictions that Bitcoin’s worth might improve exponentially when miners’ rewards are additional reduce in half later this month. One such analyst was MacronautBTC, who raised the potential for Bitcoin rising to $237,000.

This Bitcoin Halving Might Be Completely different

Regardless of the crypto market being identified to observe historical patterns, Phung emphasised that the market can be unpredictable, opening the potential for this Halving being totally different from previous ones. Furthermore, this cycle has already confirmed totally different, contemplating that for the primary time, Bitcoin hit a new all-time high (ATH) earlier than the Halving.

Moreover, the analyst acknowledged that the Bitcoin market is “a lot bigger and extra established in comparison with earlier halvings.” Nonetheless, Phung nonetheless expects a worth improve after the halving, though she admitted that the precise timing is unsure, that means it may very well be earlier and even later than ordinary.

Crypto analyst Rekt Capital additionally echoed the same sentiment about how issues may very well be totally different this cycle when he shared his analysis of the 5 phases of the Bitcoin Halving. Particularly, he said that the Re-accumulation section “could not final very lengthy earlier than further uptrend continuation” since that is the primary time the Re-accumulation vary can be round a brand new ATH.

Market Sentiment Might Decide Bitcoin’s Worth Publish-Halving

Phung additionally elaborated on how the market sentiment after the halving might present insights into Bitcoin’s future trajectory. She predicts that crypto investors will possible be bullish as soon as the halving takes place, contemplating the importance of the occasion on Bitcoin’s provide.

Nonetheless, as soon as the thrill concerning the halving wears off, a number of metrics, equivalent to worth charts, buying and selling quantity, social media discussions, and on-chain knowledge like energetic addresses or exchange supply, will should be analyzed to find out whether or not or not buyers are nonetheless bullish.

In the meantime, Phung advised that the value surge that happens instantly after the Bitcoin halving is probably not shortlived this time round since extra institutional investors are actually concerned and have helped create a “extra mature market.”

BTC worth rises to $70,700 | Supply: BTCUSD on Tradingview.com

Featured picture from Bitcoin Information, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site totally at your individual threat.

[ad_2]

Source link