[ad_1]

- MarginFi, a preferred lending platform on Solana, witnessed an enormous variety of withdrawals.

- Regardless of the rise in unfavorable sentiment, the general state of Solana remained positive.

Solana [SOL] was one of many few networks that gained huge reputation over the previous couple of months. Nonetheless, one area the place Solana was noticed to be going through challenges was the lending sector.

Simply by a Margin

MarginFi, a lending platform on the Solana blockchain, skilled a record-breaking day of withdrawals. In a single day, lenders pulled out a staggering $80 million, signaling a possible lack of confidence.

The mass withdrawal contributed to a decline in MarginFi’s Complete Worth Locked (TVL), a key metric reflecting the whole worth of crypto belongings deposited within the platform.

This might be because of current management adjustments at MarginFi. Edgar Pavlovsky, the CEO of the corporate behind the crypto borrow-and-lend platform MarginFi, resigned on tenth April as inside conflicts inside the distinguished Solana DeFi undertaking grew to become public.

In a resignation discover posted on X, previously Twitter, Pavlovsky said that he doesn’t agree with the best way issues have been carried out internally or externally. MarginFi’s official account referred to the departure of its co-founder because of inside operational disagreements.

Regardless of this, MarginFi reassured customers that every one merchandise stay absolutely operational and unaffected by the departure, emphasizing the decentralized nature of DeFi protocols the place core contributors can go away, and the protocol continues to function.

MarginFi’s troubles observe weeks of points with its withdrawal operate and the introduction of a factors program previous a surge in growth-driven incentivization loyalty schemes throughout the Solana DeFi ecosystem.

How is Solana doing?

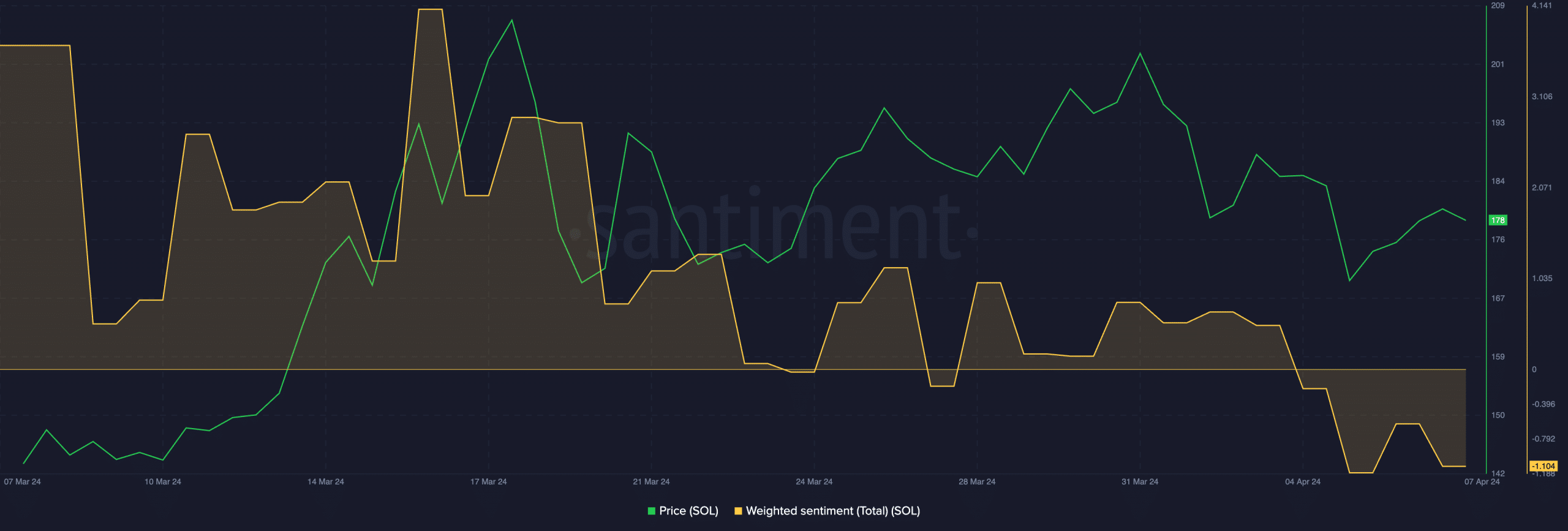

These components might closely influence sentiment across the Solana ecosystem. At press time, the weighted sentiment round Solana had fallen considerably. This indicated that the variety of unfavorable feedback round Solana outnumbered the optimistic ones over the previous couple of days.

Regardless of these components, the whole worth(TVL) collected by Solana remained constant and didn’t witness an excessive amount of of a decline.

Practical or not, right here’s SOL’s market cap in BTC’s terms

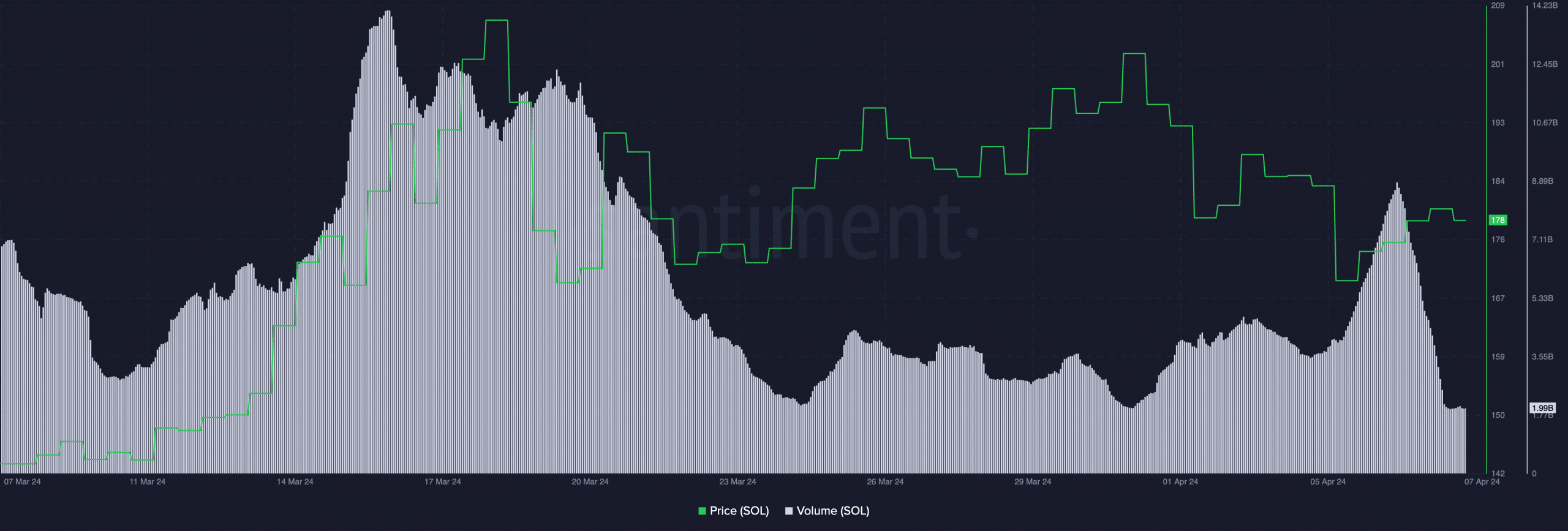

Together with its TVL, the value of SOL additionally remained unaffected. Previously 24 hours, the value of SOL grew by 1.56%. At press time, SOL was buying and selling at $172.24.

Coupled with the uptick in worth, the quantity at which SOL was buying and selling at had additionally grown by 21.70% throughout this era.

[ad_2]

Source link