[ad_1]

- BNB was up by greater than 1.8% within the final 24 hours.

- Most metrics and indicators regarded bullish on the coin.

After a week-long value decline, Binance Coin [BNB] gained bullish momentum as its day by day chart turned inexperienced. In actual fact, issues can get even higher subsequent week, as BNB’s value is transferring inside a bull sample.

Does this imply BNB will attain new highs quickly?

A bull sample kinds on BNB’s chart

In line with CoinMarketCap, BNB bears dominated the market during the last week, because the coin’s worth dropped by over 3%.

Nevertheless, issues modified in traders’ favor as its value surged by greater than 1.8% within the final 24 hours. On the time of writing, the coin was buying and selling at $587.39 with a market capitalization of over $87 billion.

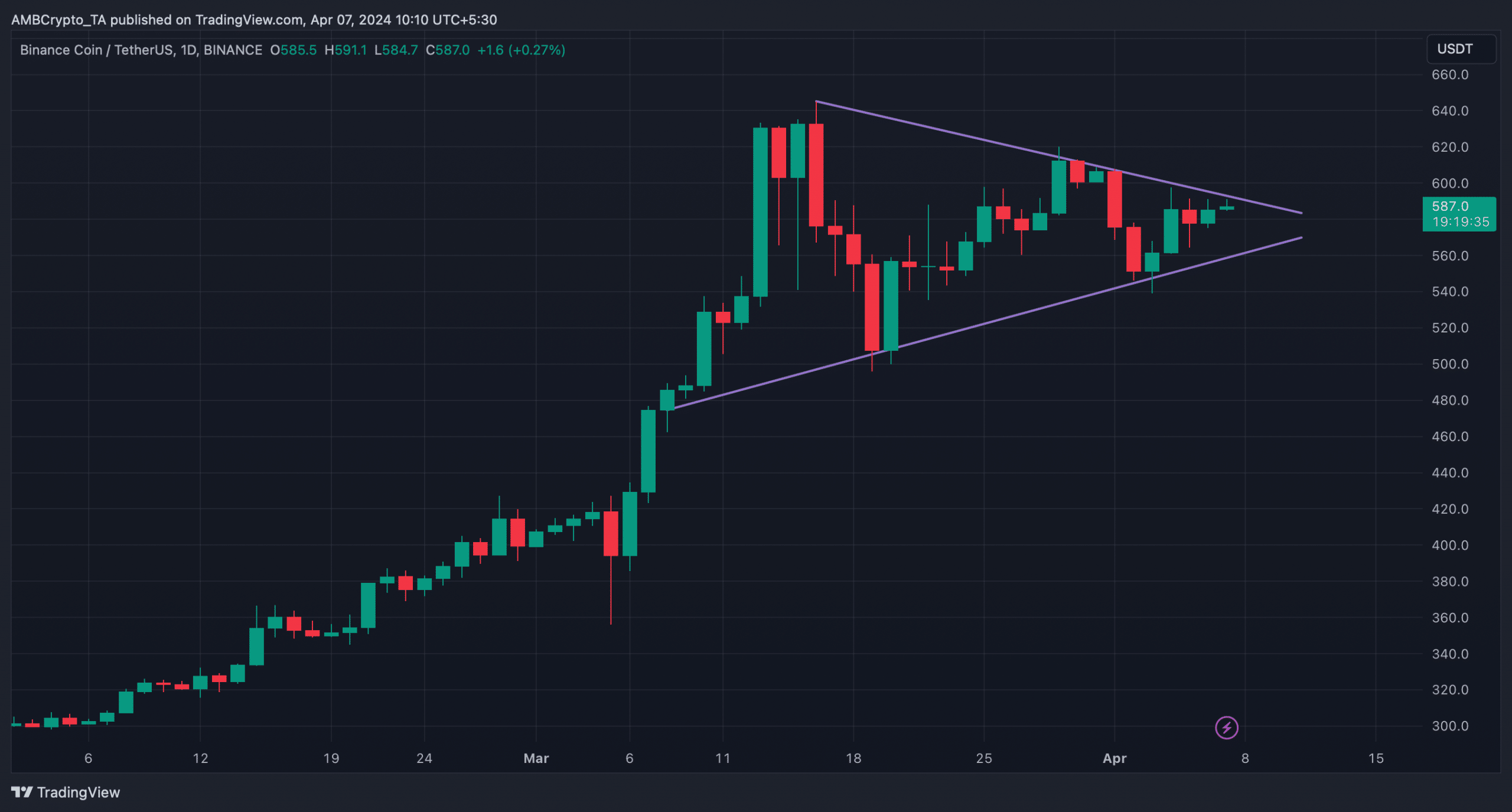

Within the meantime, AMBCrypto evaluation of the coin’s day by day chart revealed that the coin’s value was transferring inside a bullish symmetrical triangle sample.

A breakout from such a sample typically leads to bull rallies, suggesting that BNB traders would possibly quickly take pleasure in large earnings.

To be exact, to ensure that BNB to provoke a bull rally, it should break above the resistance zone at $590. So, AMBCrypto examined Hyblock Capital’s knowledge to see the subsequent potential goal ranges.

Our evaluation revealed that BNB’s liquidation will rise sharply close to $600. Due to this fact, if a northbound value motion occurs, the primary viable goal appears to be $600.

Going additional north, if the coin crosses $600 efficiently, then the subsequent goal could possibly be $630.

Will BNB breakout?

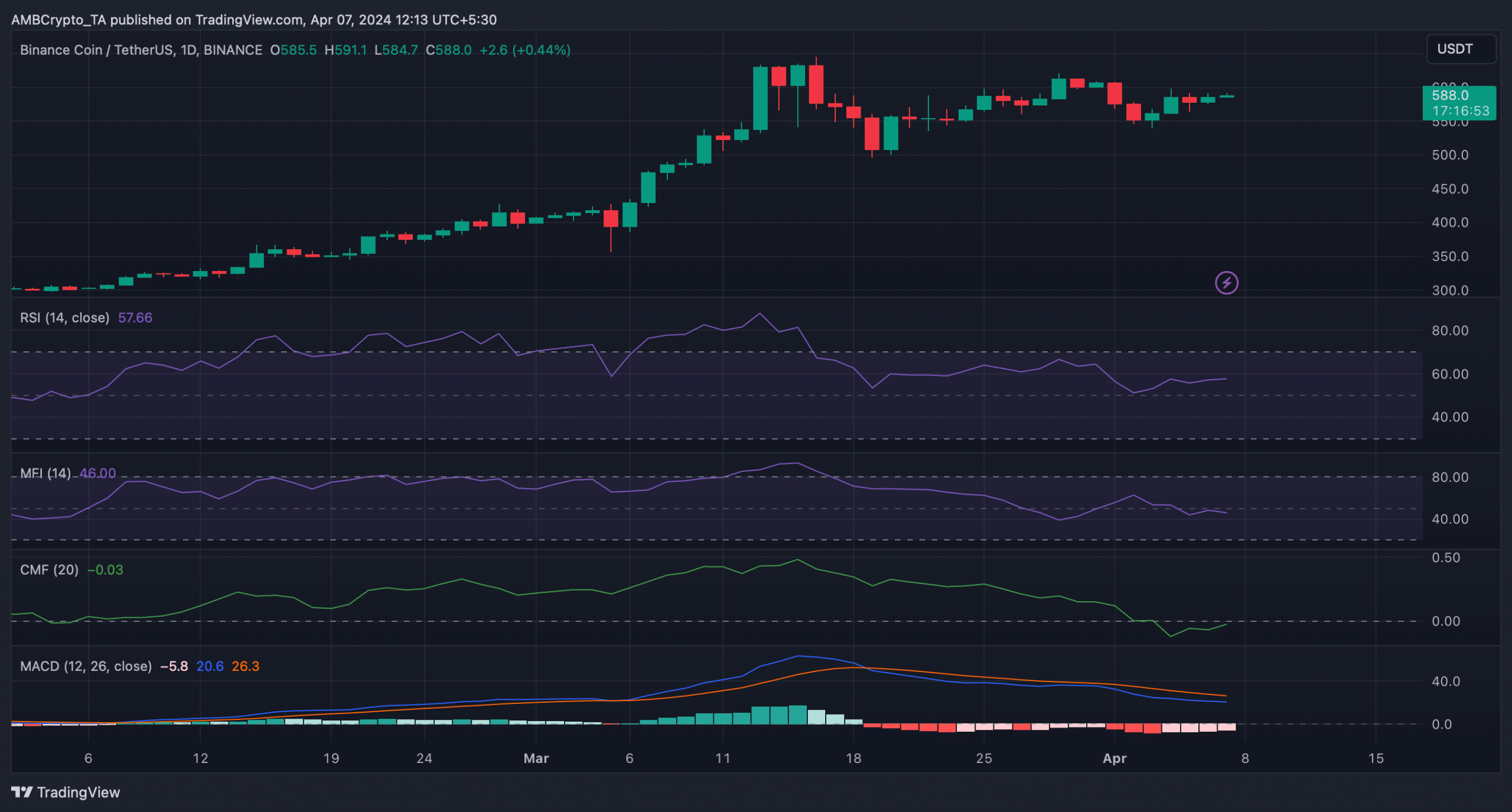

AMBCrypto checked the coin’s technical indicators to see how possible it’s for the coin to interrupt above the bull sample. We discovered that the coin’s Relative Energy Index (RSI) registered an uptick.

The Chaikin Cash Circulation (CMF) additionally adopted an identical rising pattern, whereas the MACD displayed the potential for a bullish crossover.

All these technical indicators hinted that the possibilities of BB crossing $590 have been excessive.

Nonetheless, the Cash Circulation Index (MFI) moved sideways, which steered that traders would possibly as effectively witness just a few extra slow-moving days.

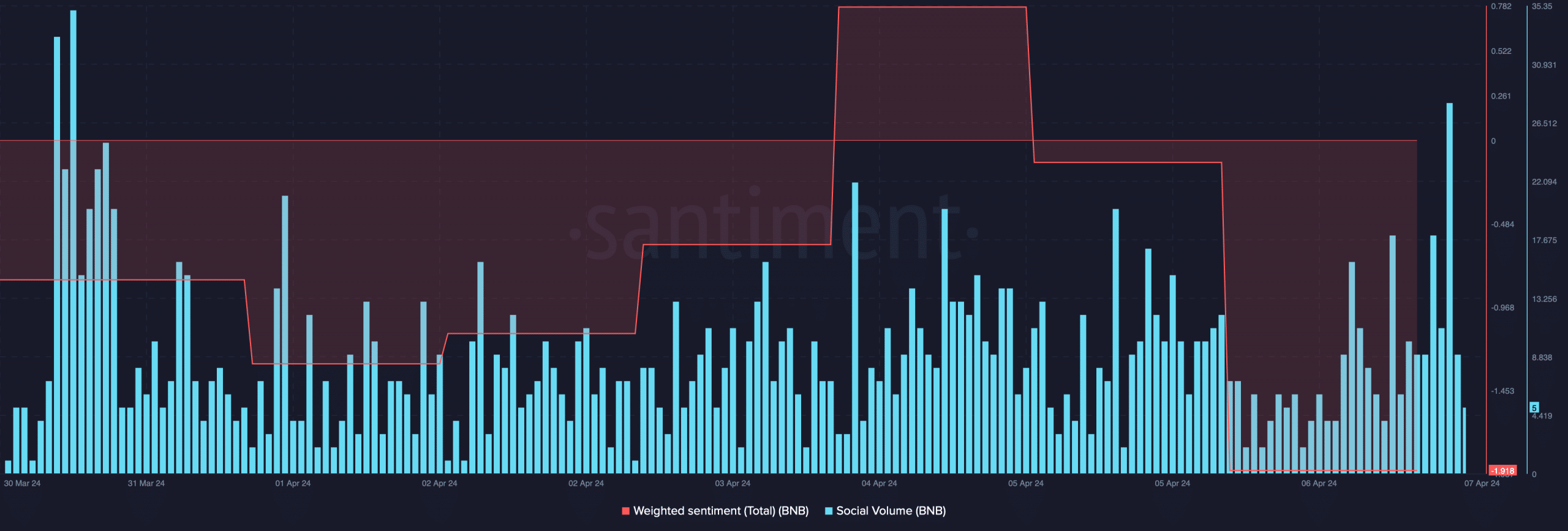

It was stunning to notice that regardless of the rise in value, bearish sentiment across the coin remained dominant out there as its Weighted Sentiment dropped.

Nevertheless, its Social Quantity spiked, reflecting its reputation within the crypto area.

Learn Binance Coin’s [BNB] Price Prediction 2024-25

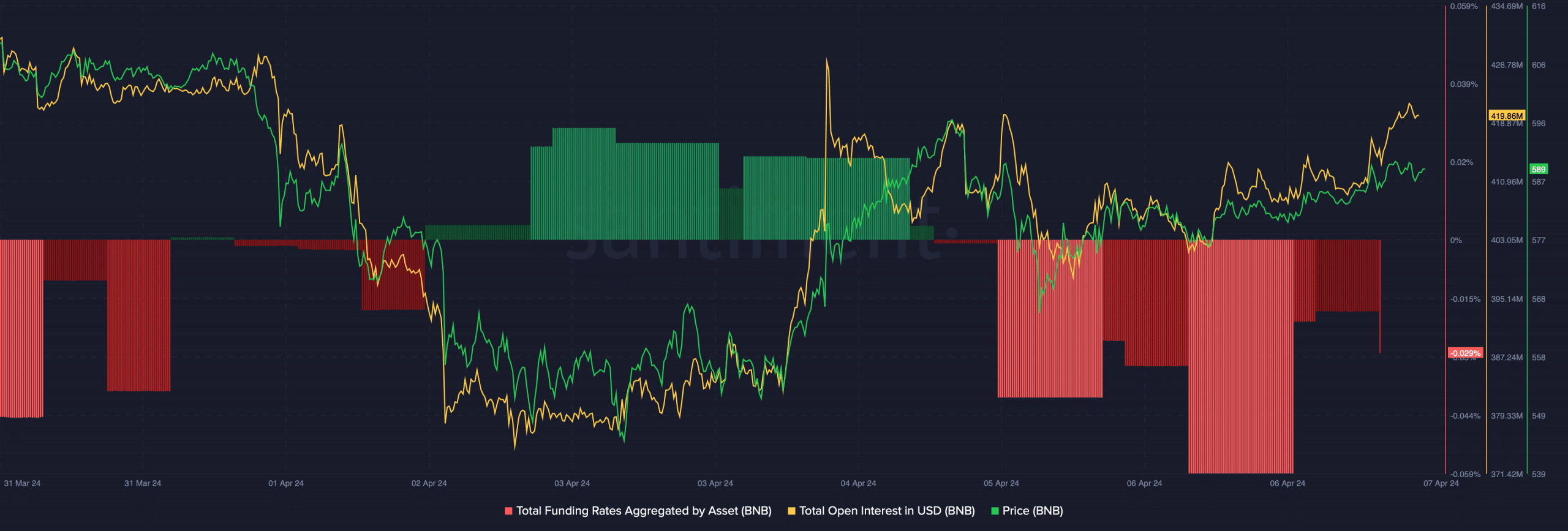

Issues within the derivatives market additionally regarded optimistic. As an example, Binance Coin’s Open Curiosity registered an uptick together with the value, indicating the present value pattern will proceed.

Typically, costs have a tendency to maneuver in a distinct route than the Funding Fee. On this case, BNB’s Funding Fee dropped sharply, additional suggesting a bull rally within the coming days.

[ad_2]

Source link