[ad_1]

- ‘Silk Street’ discussions would possibly gas a doable return to $69,000 and above

- The liq ranges signaled a bullish bias that would go away shorts in ruins

On 4 April, Bitcoin [BTC] bounced again above $69,000 earlier than it fell to $67,500 hours later. In accordance with AMBCrypto’s evaluation, there have been particular causes for the rebound. One of many extra important ones was the ten,000 BTCs the U.S. authorities bought.

When gross sales like these occur, the anticipated response is a fall in worth. Nonetheless, the alternative occurred due to the response of the broader market to the event.

The bumpy path appears like choice

For these unfamiliar, the BTC bought was from Silk Road, a market that took benefit of Bitcoin to facilitate the sale of illicit items.

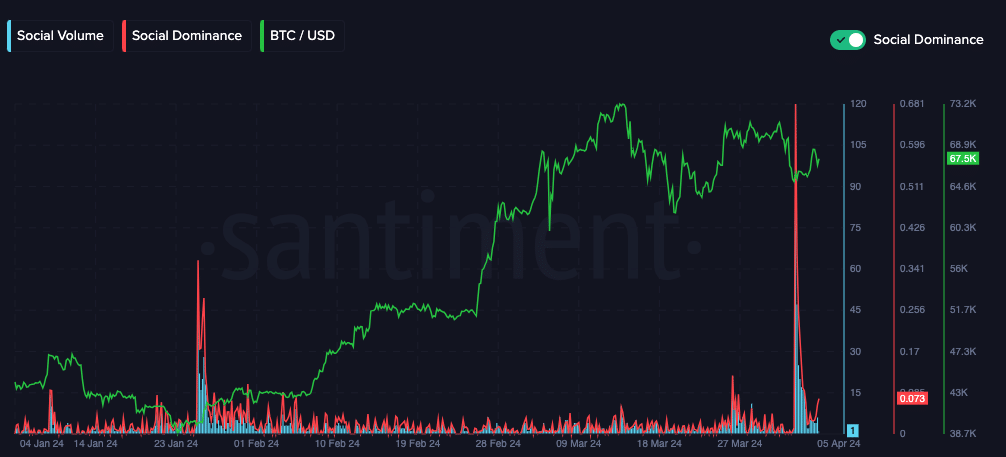

Based mostly on our evaluation, market individuals displayed Concern, Uncertainty, and Doubt (FUD) since extra BTC seized might be bought later within the 12 months. Utilizing Santiment’s social software, we noticed that the phrase “Silk Street” jumped amongst individuals, indicating that they have been petrified of the implications on Bitcoin.

In January, there have been additionally talks about the identical subject which triggered an uptick in social quantity. On the time, Bitcoin’s worth appreciated.

Due to this fact, if crowd expectations proceed to languish in FUD, the value of the coin would possibly retest $69,000. Nonetheless, if the mud settles, BTC would possibly find yourself buying and selling sideways until there’s a wave of shopping for stress that changes the tone.

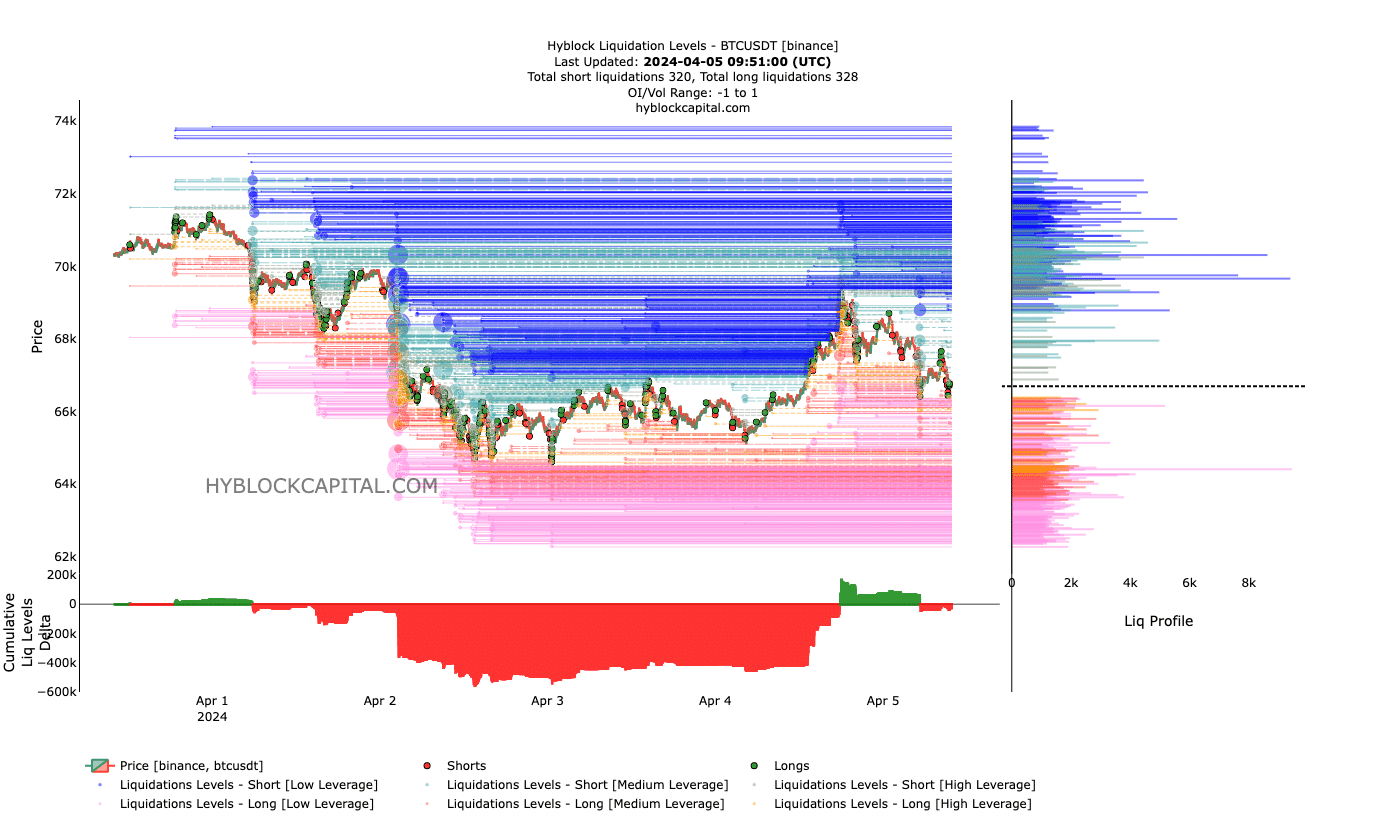

In the meantime, AMBCrypto additionally seemed on the liquidation ranges. In accordance with our evaluation of the indicator, there’s a cluster of liquidity from $68,000 to $71,000, indicating that the value of Bitcoin would possibly rise towards these ranges.

Cautious shorts! This isn’t your time

If so, shorts with excessive leverage positions would possibly see their funds worn out.

Apart from that, we additionally thought-about the Cumulative Liquidation Ranges Delta (CLLD). The CLLD is the sum of the distinction between lengthy liquidations and shorts. When optimistic, the CLLD signifies that there are extra lengthy liquidations.

Then again, a detrimental studying of the CLLD means that lengthy liquidations are greater than shorts.

Nonetheless, the indicator does greater than establish quick or lengthy variations because it additionally provides insights into the value motion. From the chart above, we are able to see that Bitcoin registered a slight dip. Consequently, shorts have been making an attempt to make the most of the decline. Quite the opposite, lengthy liquidation ranges have been getting hit as the value slowly recovered.

This pattern signifies a bullish bias for the coin. If care will not be taken, shorts who insist on capitalizing on the motion could be liquidated.

Is your portfolio inexperienced? Examine the Bitcoin Profit Calculator

Going ahead, Bitcoin’s worth would possibly climb again in direction of $70,000. Nonetheless, merchants would possibly have to be cautious as volatility might be intense. In mild of the prevailing worth motion, anybody who opens a high-leverage place might fall sufferer to forceful place closure.

[ad_2]

Source link