[ad_1]

- SOL resisted a nosedive regardless of the massive alternate influx.

- Technical evaluation instructed a bearish bias for the token.

4 Solana [SOL] transactions valued at virtually $160 million have been despatched to Coinbase, in accordance with a Whale Alert publish on X. From AMBCrypto’s commentary, all transactions occurred across the identical interval.

Usually, when whales ship a lot of tokens, the cryptocurrency affected, experiences a decline. It is because the intent is often to promote.

SOL proves robust

For SOL, this has not been the case. At press time, Solana’s value was $196.37— an identical value that it was 24 hours in the past. The worth of the cryptocurrency signifies that the participant concerned won’t have offered the tokens but.

If the identical goes by way of, then the price of the token may decline. Ought to promoting stress be intense, the worth of SOL may drop under $190.

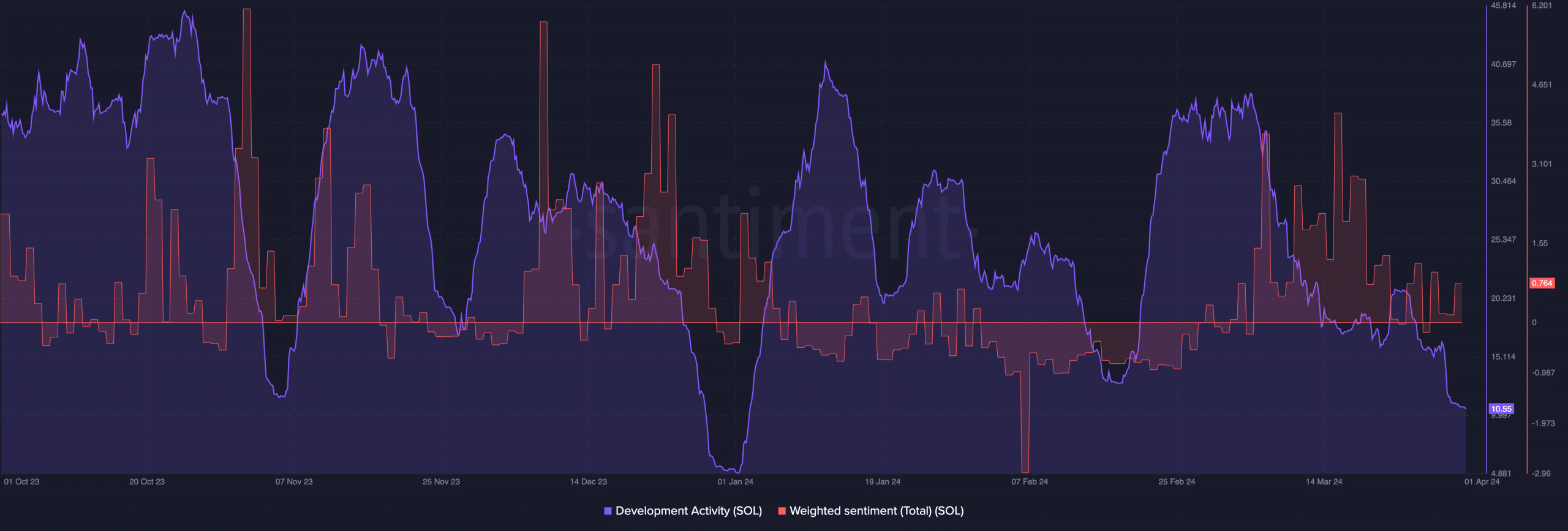

Apart from this hypothesis, AMBCrypto checked out Solana’s on-chain situation. In line with Santiment, improvement exercise on the community had dropped to 10.55.

Growth exercise tracks the general public GitHub repositories devoted to a venture. If the metric will increase, then it means builders are contributing codes to the right functioning of the community

Nonetheless, the decline within the metric implies that options shipped on the community had diminished. Regarding the sentiment round SOL, this situation implies that contributors have been bearish on the token.

We additionally checked the Weighted Sentiment. In line with on-chain data, the Weighted Sentiment had climbed from the unfavourable area.

This studying implied that feedback about SOL have been principally constructive. If this continues, then the expected decline won’t final for an extended interval. Ought to the sentiment proceed to rise, then SOL may climb previous $210.

A decline could also be subsequent

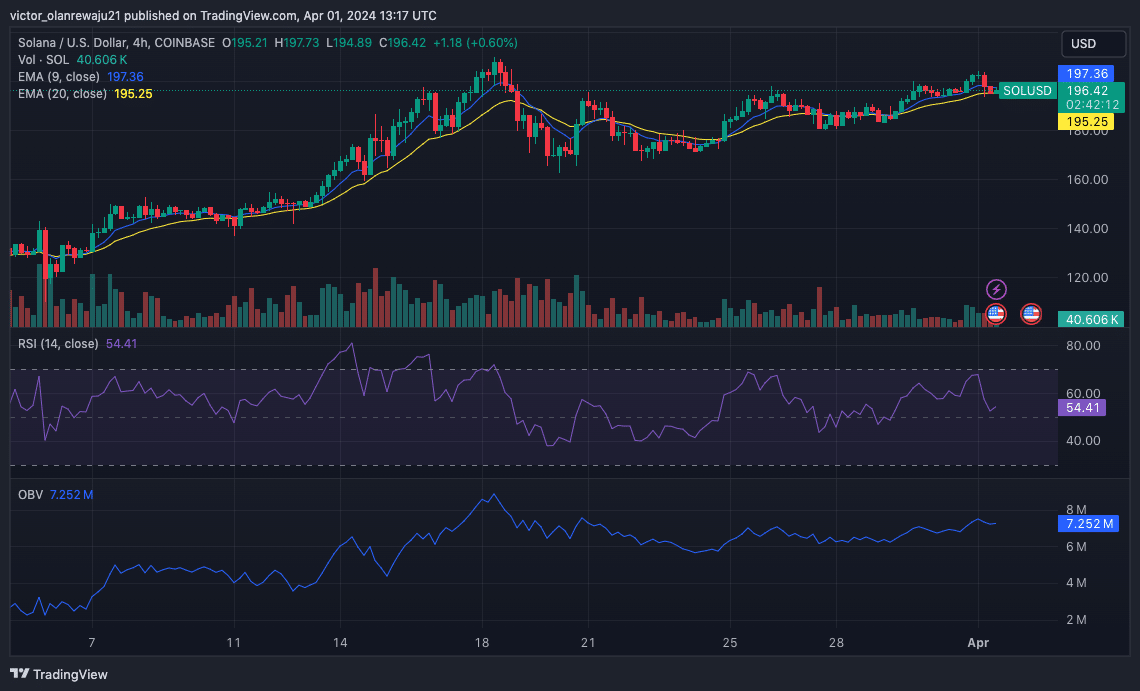

From a technical perspective, AMBCrypto thought-about the Exponential Transferring Common (EMA). As of this writing, the 9 EMA (blue) had crossed over the 20 EMA( yellow). Usually, this may have suggested a bullish bias.

However SOL’s value at press time was on the verge of dropping under the EMAs. As soon as it does, SOL’s bullish thesis is likely to be invalidated.

Moreover, the Relative Power Index (RSI) confirmed that purchasing momentum had decreased. If the studying continues to lower, SOL may discover it laborious to bounce.

A have a look at the On Steadiness Quantity (OBV) revealed that the studying had stalled. This means that purchasing stress was virtually non-existent. Nonetheless, the studying didn’t assist intense promoting stress both.

Learn Solana’s [SOL] Price Prediction 2024-2025

When all of those indicators are mixed, one can assume that Solana won’t be prepared for an upward trajectory. As an alternative, the value of the token may transfer sideways.

In a extremely bullish case, the value of SOL may transfer towards $210. However a bearish thesis for SOL may see the value of the cryptocurrency stoop as little as $171.

[ad_2]

Source link