[ad_1]

- ETH was down by greater than 2% within the final 24 hours.

- Market indicators regarded bearish on Ethereum.

Ethereum [ETH] not too long ago managed to go above $3.6k mark because it closed final week. Throughout that point, traders’ confidence within the king of altcoins rose sparkly as a key metric hit an all-time excessive. Nonetheless, their confidence didn’t assist ETH, as its day by day chart turned crimson.

Ethereum traders are growing

Santiment not too long ago posted a tweet highlighting the truth that ETH took a leap this weekend, rebounding above $3.6K after dropping as a lot as 25% between eleventh and nineteenth March.

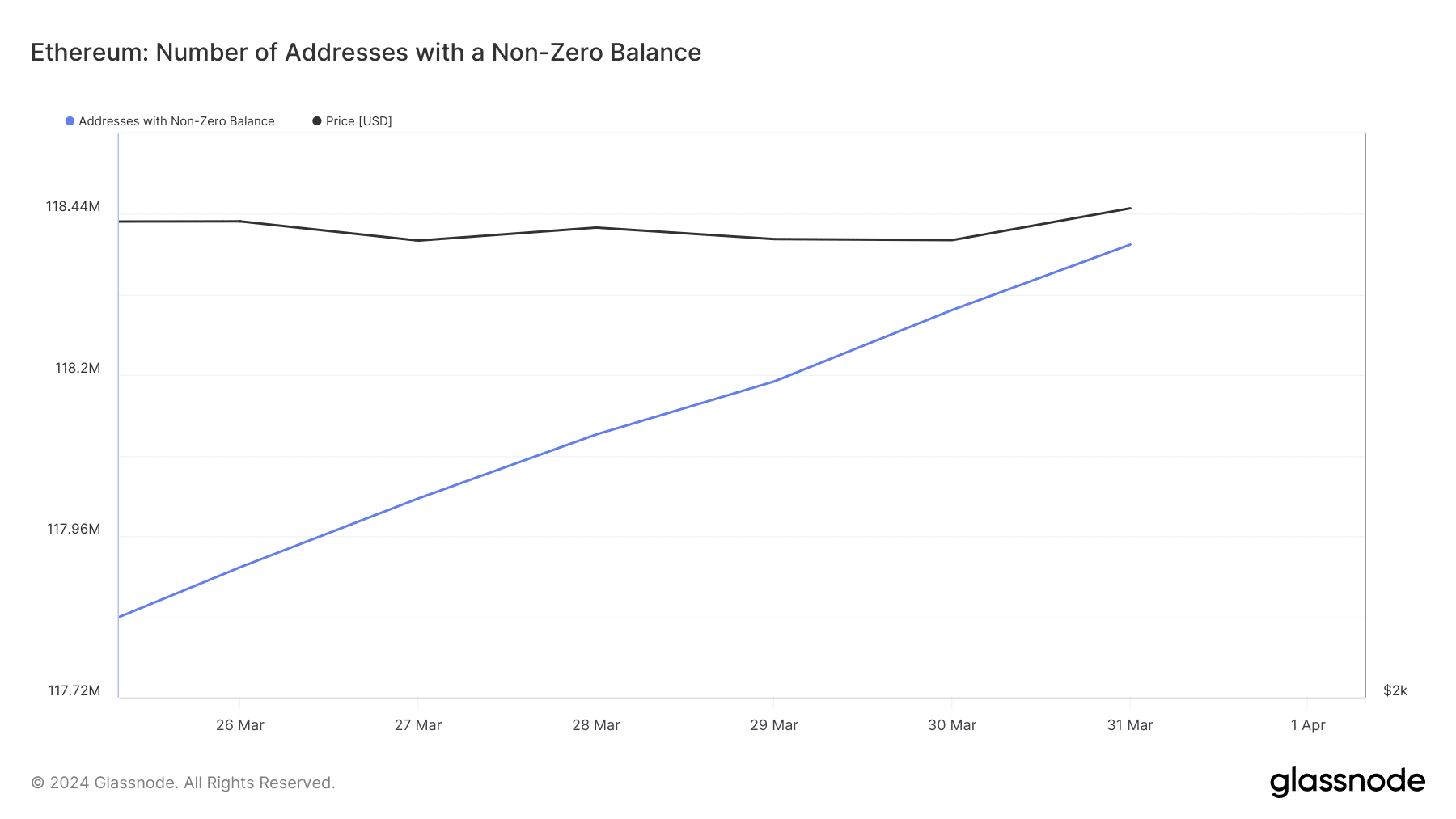

Whereas the king of altcoin’s value recovered, its whole variety of addresses with non-zero addresses surged and exceeded 118.23K. Moreover, its mid-term MVRV ratio gave a slight bullish sign.

Nonetheless, the truth turned out to be completely different as ETH’s value dropped by greater than 2.4% within the final 24 hours because it plummeted below $3.6k in keeping with CoinMarketCap.

On the time of writing, Ethereum was buying and selling at $3,547.34 with a market capitalization of over $425 million. Regardless of the drop in value, it was fascinating to notice that ETH’s variety of addresses with non-zero balances nonetheless continued to rise.

What to anticipate from Ethereum

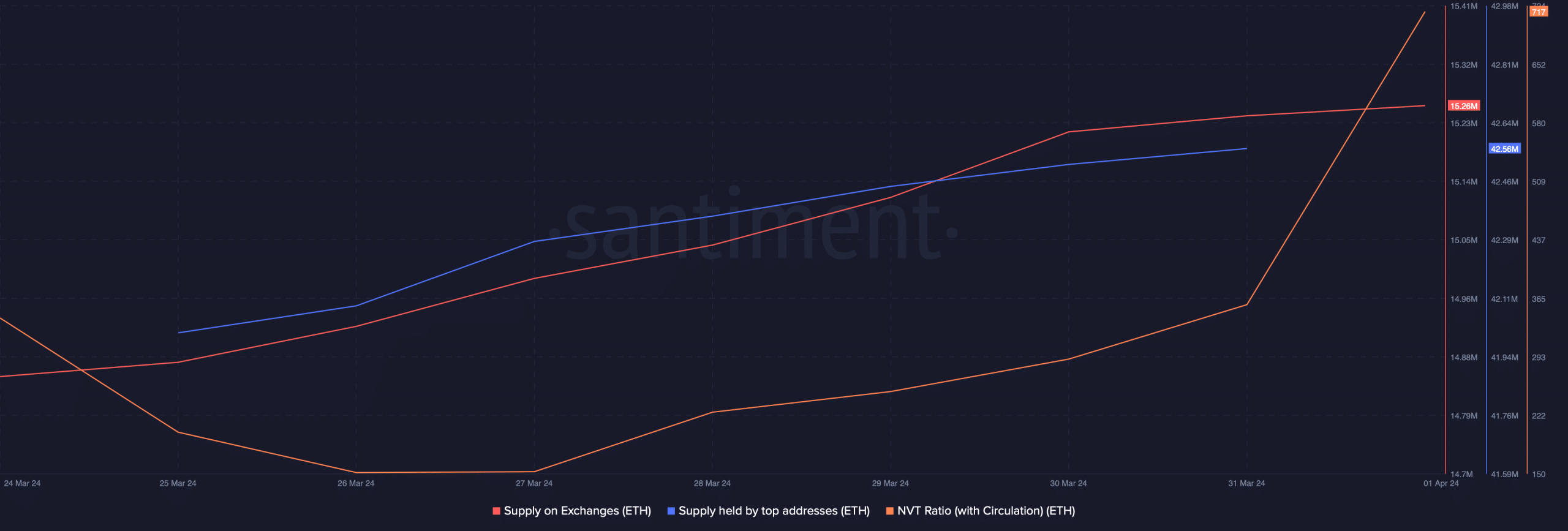

For the reason that token’s worth dropped within the final 24 hours, AMBCrypto checked its metrics to see which means it was headed in April. We discovered that regardless of the rise in non-zero addresses, its provide on exchanges elevated. This meant that promoting strain was excessive.

As per CryptoQuant’s data, ETH’s internet deposit on exchanges was excessive in comparison with the final seven-day common, additional suggesting that traders have been promoting ETH.

Curiously, whales had confidence in Ethereum as its provide held by high addresses elevated. Nonetheless, Ethereum’s network-to-value ratio registered a pointy uptick.

An increase within the metric implies that an asset is overvalued, which means that the potential for a value correction is excessive.

Learn Ethereum’s [ETH] Price Prediction 2024-25

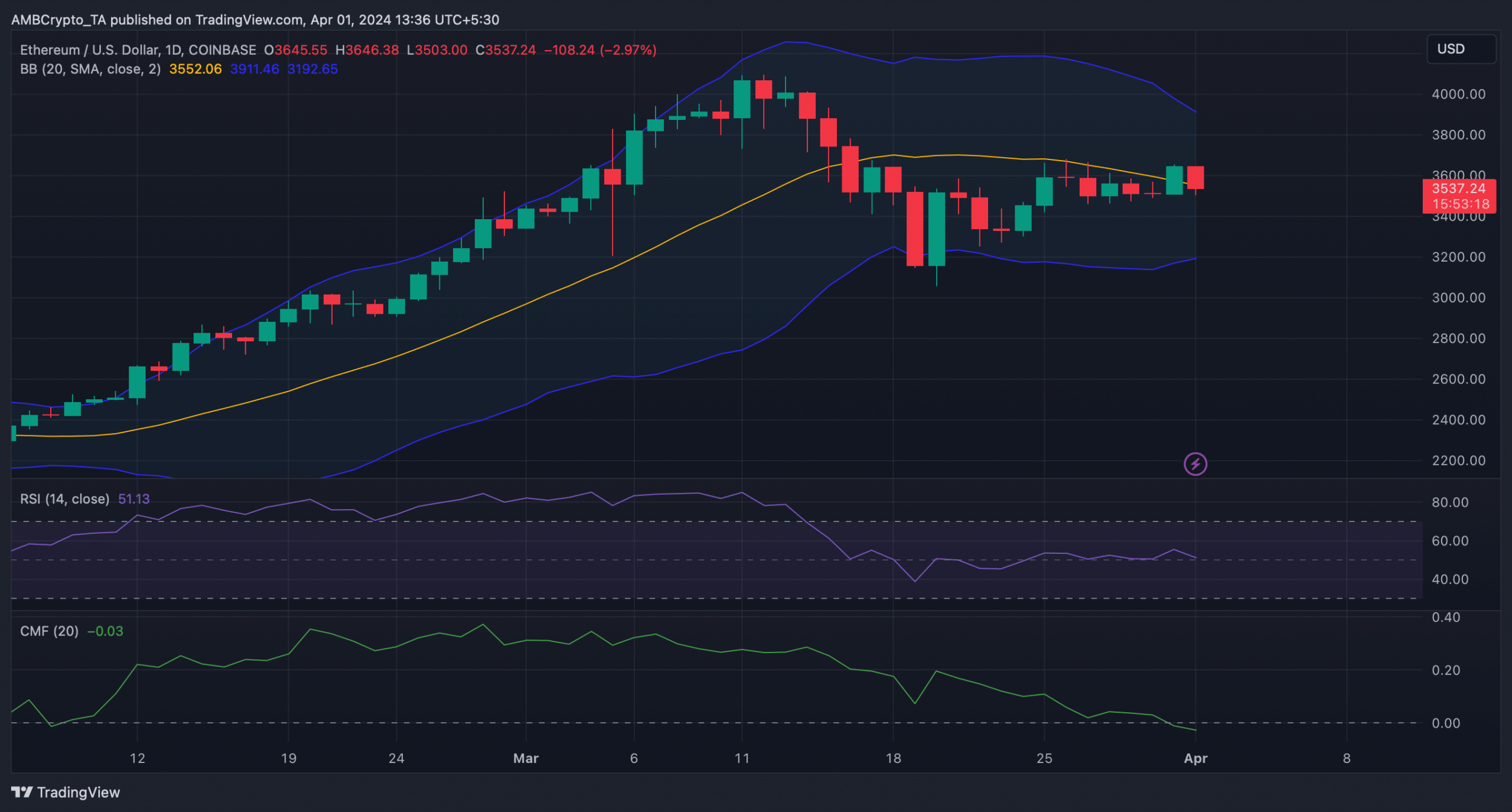

Our evaluation of Ethereum’s day by day chart revealed that its Relative Power Index (RSI) went southward from the impartial mark. Its Chaikin Cash Circulation (CMF) additionally adopted RSI and registered a pointy downtick.

Furthermore, its Bollinger Bands revealed that ETH’s value was coming into a much less unstable zone, reducing the possibilities of an unprecedented value uptick within the quick time period.

[ad_2]

Source link