[ad_1]

- WIF has sturdy assist on the $3.55-$3.8 area

- The indications famous persistent demand and agency bullish momentum

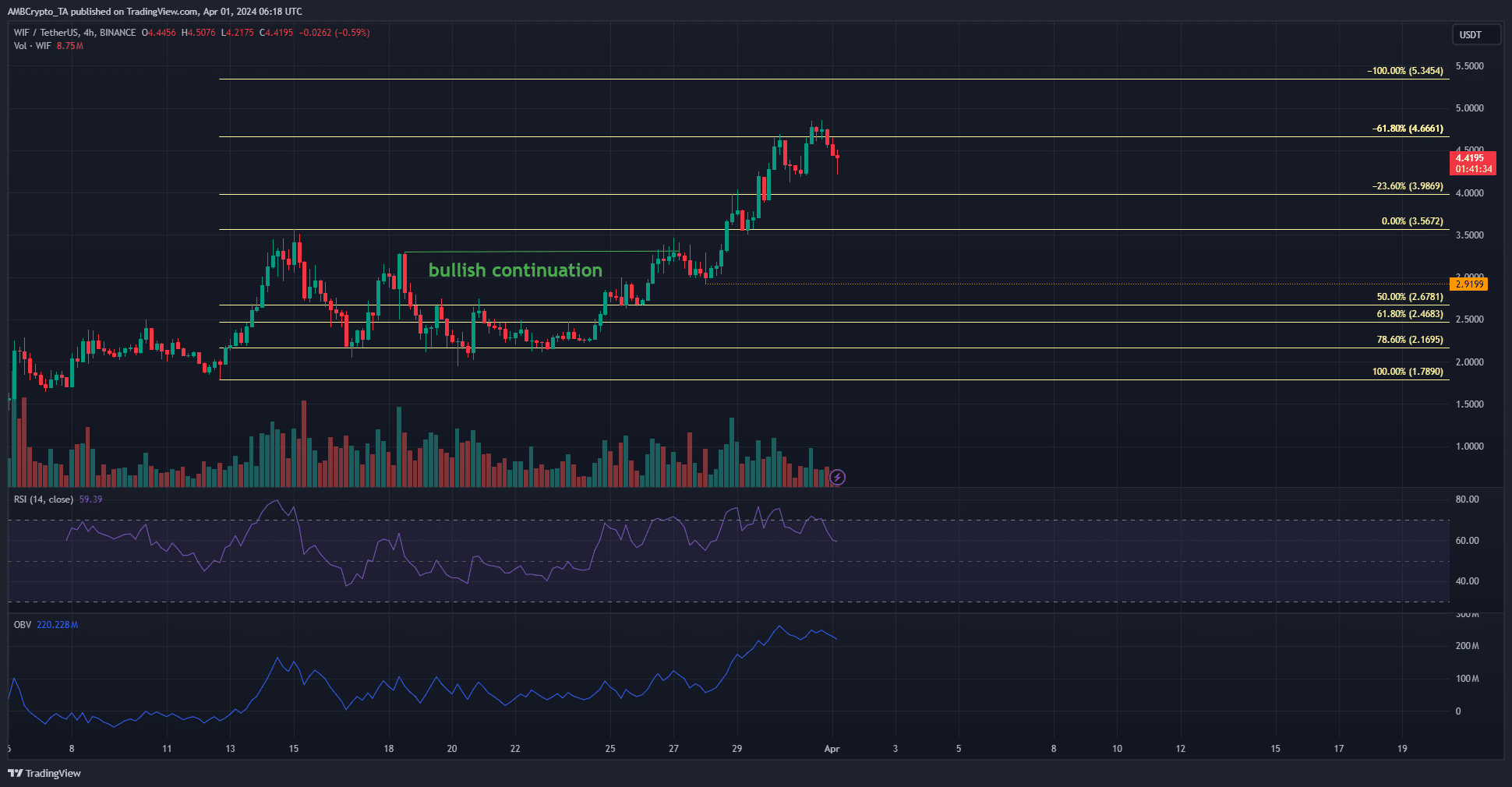

dogwifhat [WIF] set a brand new all-time excessive at $4.83 on the thirty first of March. It has a strongly bullish outlook for this week. Technical evaluation confirmed that $5.34 was the subsequent space of curiosity.

An AMBCrypto analysis from twentieth March famous that the $2.4 stage was a key resistance and that WIF holders have been unwilling to promote again then. This concept was vindicated when costs broke out previous $2.46 and rallied almost 100% inside every week.

WIF posts a brand new swing low because the uptrend continues

The 4-hour chart’s worth motion confirmed a continuation within the bullish market construction when the earlier excessive at $3.3 was breached. This was a robust bullish sign as WIF is now within the strategy of setting a brand new excessive.

The swing low at $2.92 is the extent bulls have to defend to keep up the bullish construction. The OBV shot larger on the twenty ninth of March and was comparatively flat prior to now 24 hours.

The RSI has been above impartial 50 since twenty fourth March, when the decrease timeframe resistance at $2.46 was breached. The buying and selling quantity additionally dwindled over the previous two days which might be an indication {that a} short-term consolidation was doable.

This could give bulls time to catch their breath earlier than the next push higher.

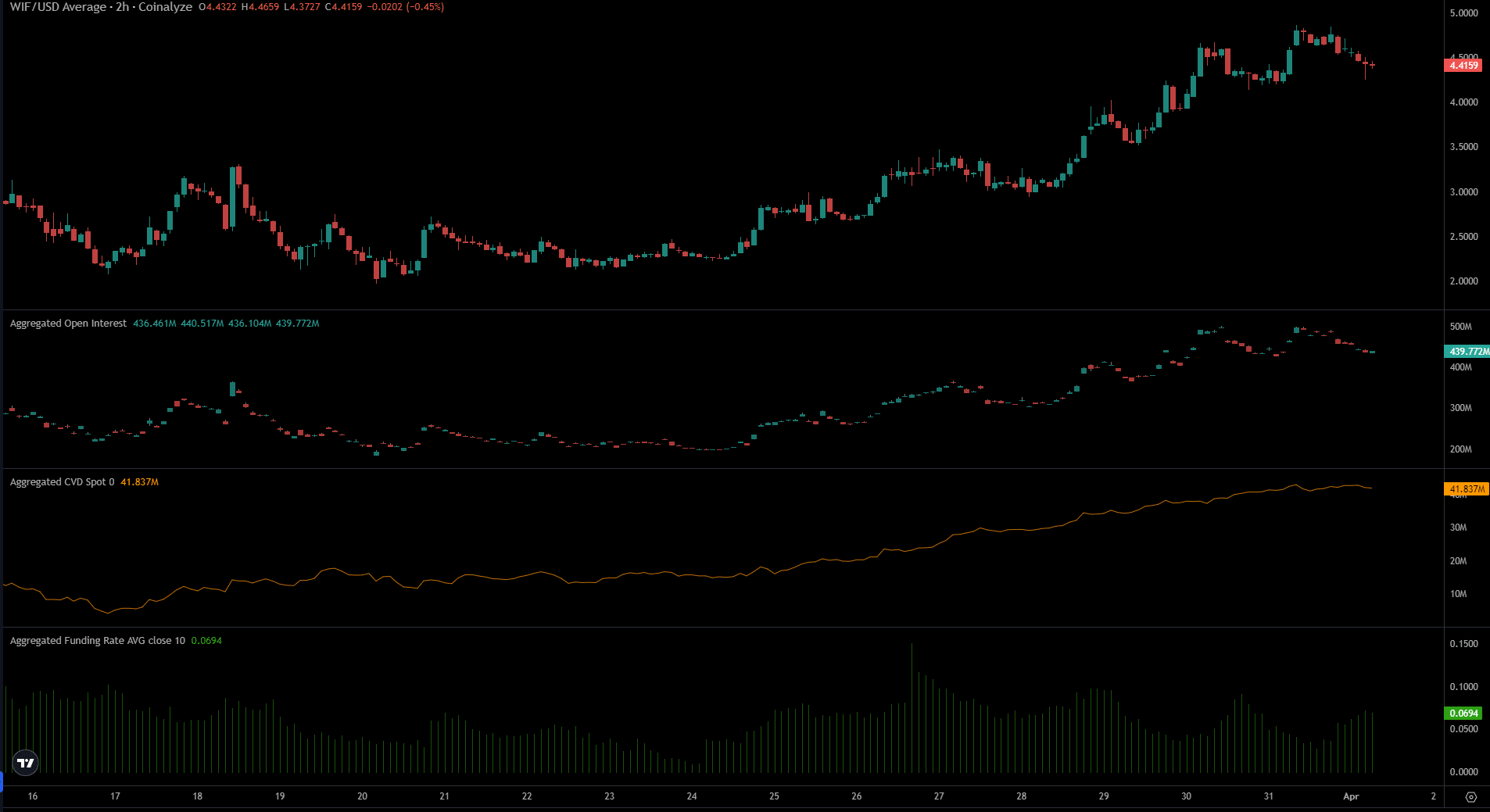

Bullish sentiment picked up pace final week

Supply: Coinalyze

The Open Curiosity had been transferring sideways from the nineteenth to the twenty fourth. When WIF shot previous $2.46, bulls have been inspired.

Speculators have been prepared to wager on the meme coin making swift positive factors. The funding fee was firmly constructive, displaying contributors most well-liked to go lengthy relatively than brief.

Is your portfolio inexperienced? Verify the dogwifhat Profit Calculator

The spot CVD didn’t halt its regular uptrend. This was an indication of sturdy demand within the spot market. It meant additional positive factors this week and supported the concept of a rally past $5.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.

[ad_2]

Source link