[ad_1]

- Constructive sentiment round FLOKI remained excessive.

- Market indicators turned bearish on the meme coin.

Floki Inu’s [FLOKI] 15-minute value chart flagged a bullish sign, because the meme coin’s worth went above a resistance stage. The uptrend hinted that its worth may attain $0.00025447 as soon as once more.

Subsequently, AMBCrypto checked FLOKI’s metrics to seek out out what to anticipate.

FLOKI breaks above a resistance zone

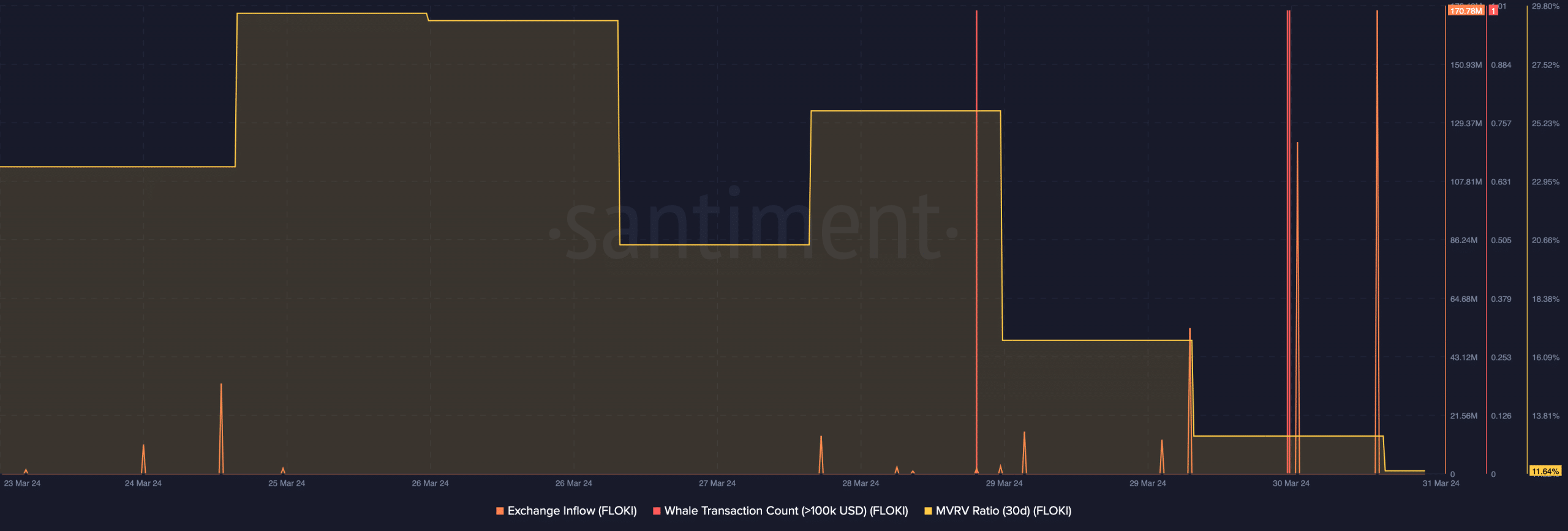

AMBCrypto’s evaluation by way of Santiment revealed that FLOKI’s Whale Transaction Depend had elevated sharply over the previous few days. Although this may look bullish at first look, the state of affairs was truly the alternative.

Notably, the meme coin’s Alternate Influx spiked throughout that point. This clearly meant that the large gamers within the crypto house had been dumping FLOKI.

An increase in promoting stress normally places an finish to an asset’s bull rally. Moreover, its MVRV ratio plummeted sharply in the previous few days, which was additionally a bearish sign.

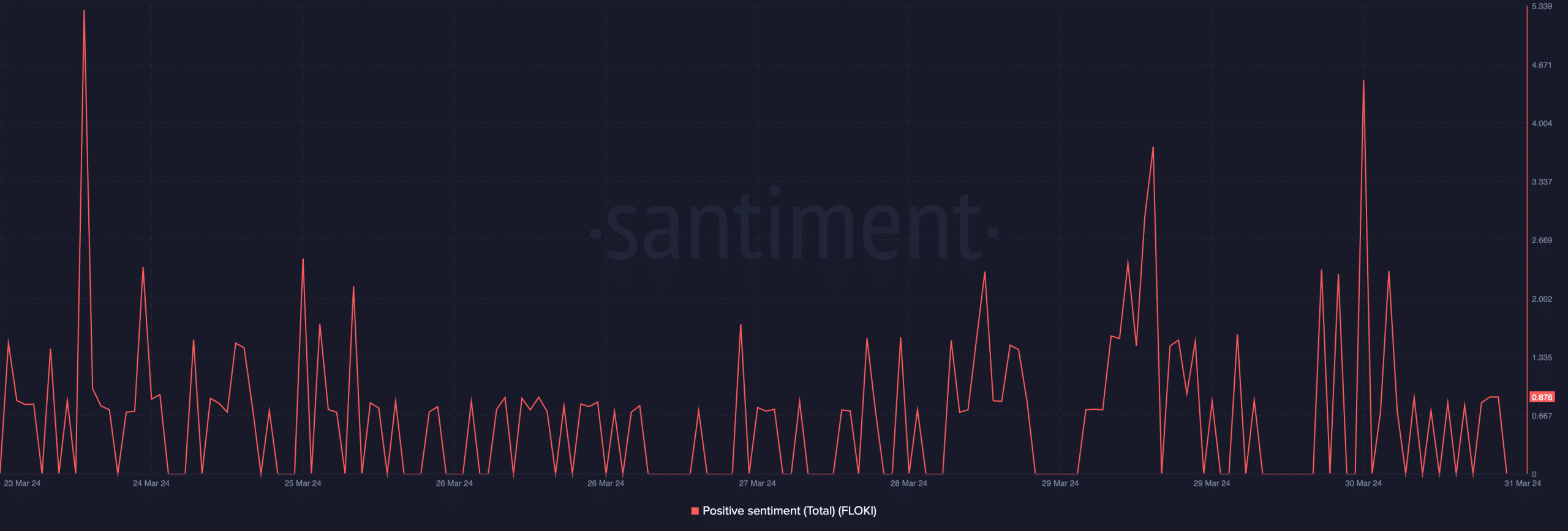

Regardless of the bearish metrics, optimistic sentiment round FLOKI spiked fairly a number of instances final week, reflecting traders’ confidence. This might have performed an extra half in FLOKI’s latest bullish motion.

Based on CoinMarketCap, in the previous few hours alone, the meme coin’s worth surged by over 4%, permitting it to go above the aforementioned resistance stage.

At press time, the meme coin was buying and selling at $0.0002494 with a market capitalization of over $2.38 billion, making it the fifty fifth largest crypto.

To grasp whether or not traders’ confidence in FLOKI will translate right into a continued bull rally, AMBCrypto then took a take a look at its every day chart.

Our evaluation revealed that the majority of FLOKI’s indicators had been downward-looking at press time. Notably, the MACD displayed a bearish crossover.

Real looking or not, right here’s FLOKI’s market cap in BTC’s terms

The Relative Power Index (RSI) additionally went sideways, indicating that traders may count on a number of slow-moving days. Equally, the Bollinger Bands revealed that FLOKI’s value was in a much less risky zone.

Thus, the probabilities of an unprecedented northward bull rally within the close to time period appeared slim.

[ad_2]

Source link