[ad_1]

- LINK’s value might improve as promoting strain would possibly grind to a halt.

- The liquidation ranges displayed a bullish bias for the token.

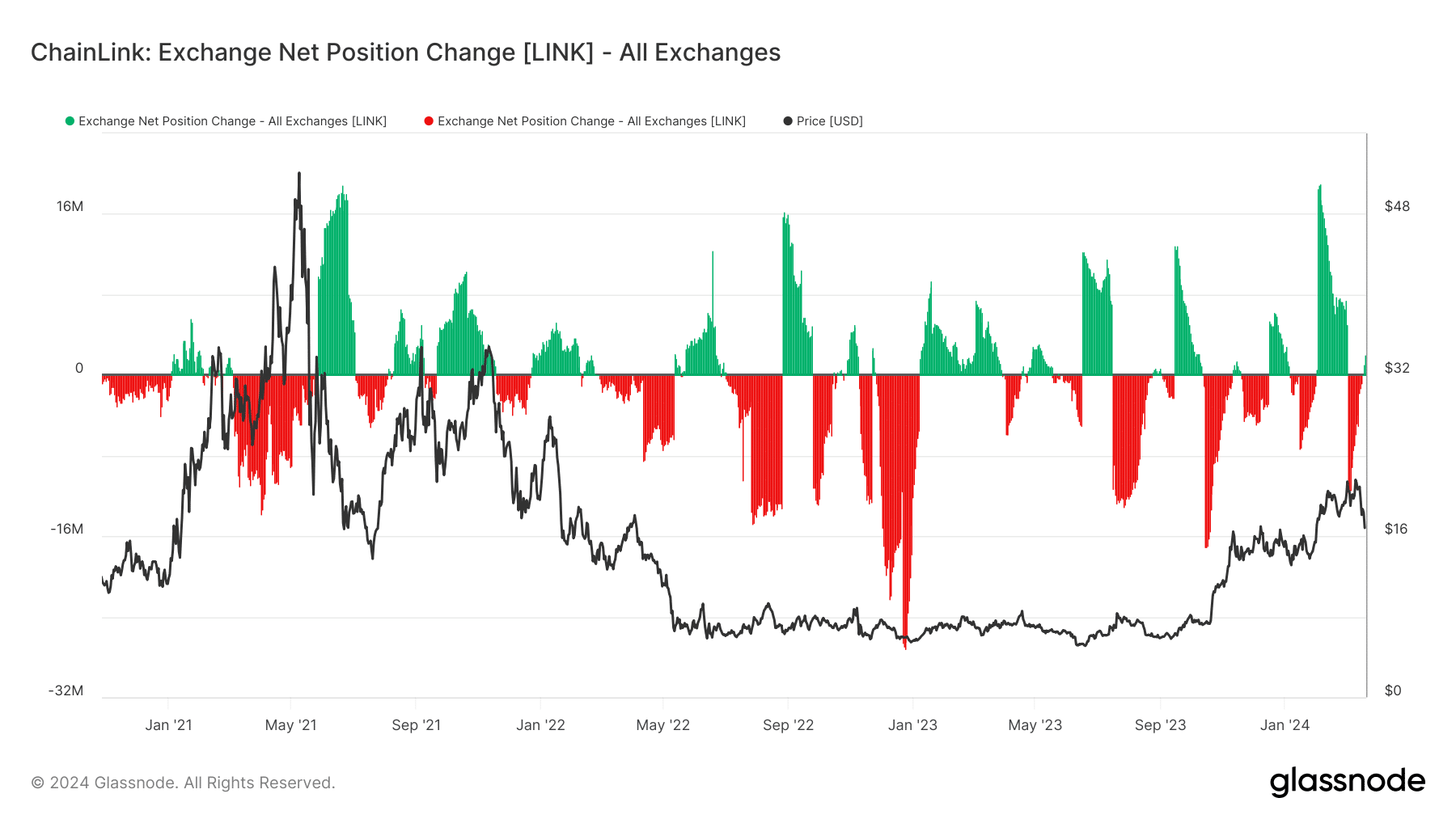

On the twentieth of March, Chainlink’s [LINK] Change Internet Place Change was -5.85 million, indicating that many tokens had been withdrawn from exchanges. This was the case as LINK modified fingers at $17.54.

Change Internet Place Change measures the provision held in change wallets. If the provision will increase, the possibilities of promoting strain have elevated. Nonetheless, if the metric decreases, an asset would possibly evade additional draw back.

The pump is coming

However Chainlink was not the one altcoin present process a correction. In line with CoinMarketCap, no cryptocurrency was spared because the market went down. Thus, LINK’s efficiency meant that it misplaced 14.39% of its worth within the final week.

Nonetheless, if the variety of tokens withdrawn from exchanges continues to lower, then the value would possibly stabilize. Ought to this be the case, the cryptocurrency would possibly exempt itself from the downturn which many haven’t recovered from.

In 2023, Chainlink was one of many few to twenty altcoins that detached from the market development at completely different occasions. For many of this era, the value of the token pumped whereas others moved sideways or declined.

With the current development, there’s a likelihood that LINK might repeat the transfer. To guage the potential, AMBCrypto regarded on the liquidation ranges.

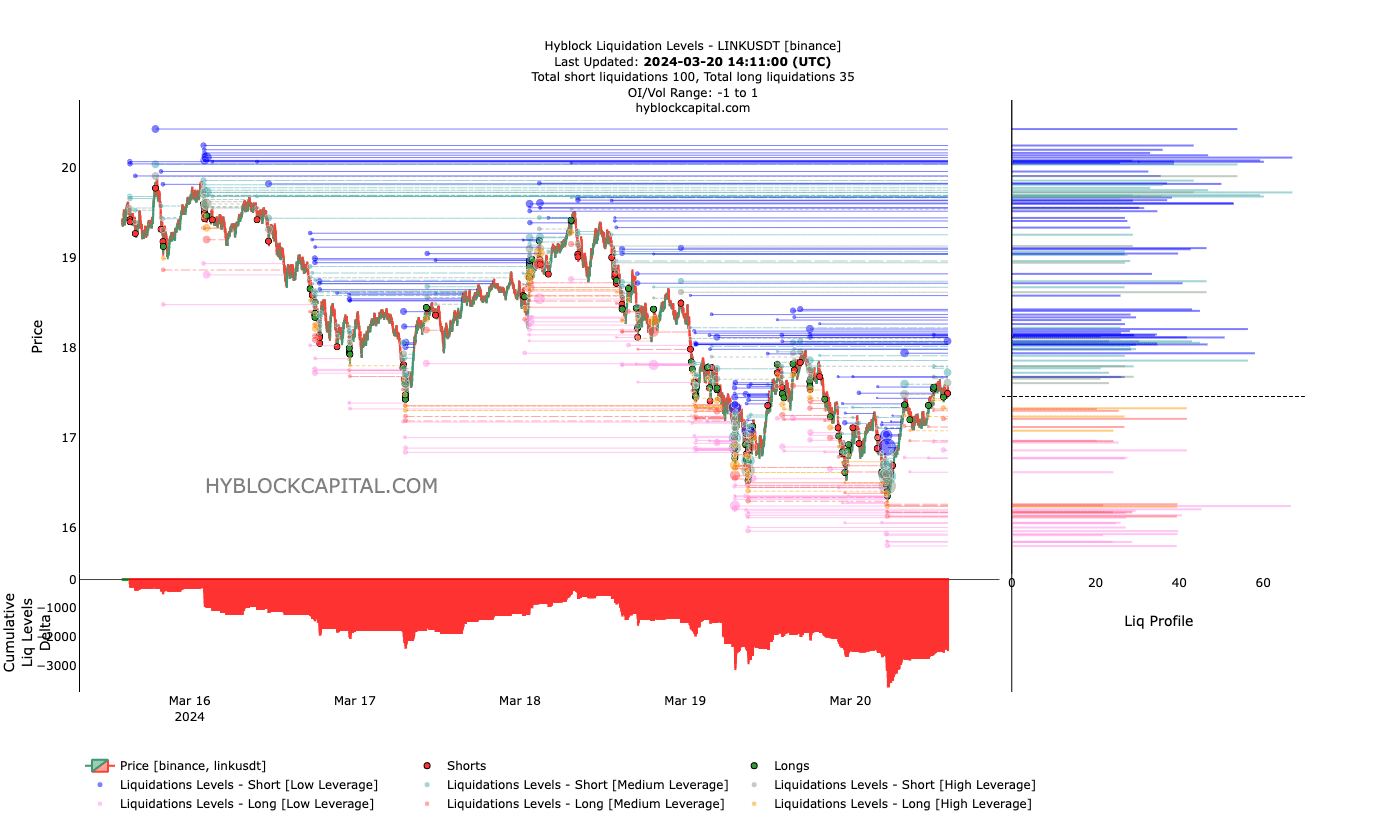

Liquidation ranges are estimated value ranges the place liquidation occasions would possibly happen. Liquidation takes place when a dealer’s place is forcefully worn out because of inadequate margin stability or excessive volatility available in the market.

All bears could also be liquidated

At press time, our evaluation confirmed {that a} excessive variety of liquidations would possibly occur if LINK hit $18.20. As anticipated, shorts had been the potential casualty.

Past the indicator, AMBCrypto additionally assessed the Cumulative Liquidation Ranges Delta (CLLD). The CLLD is a beta of the liquidation ranges. However the distinction is that it could possibly inform the form of bias merchants are displaying and the way it can have an effect on costs.

As of the writing, the CLLD spiked within the destructive path. A transfer like this means that shorts are attempting to catch the dip however may be unsuccessful within the try.

Therefore, this affords LINK a bullish bias, and these late shorts may be liquidated as the value would possibly get well very quickly. Within the meantime, some analysts have talked about that the cryptocurrency’s current decline was a chance.

Reasonable or not, right here’s LINK’s market cap in SOL terms

One of many analysts with this thought was Michaël van de Poppe. This was not the primary time van de Poppe talked about Chainlink as he has been shilling the token because it was beneath $8.

This time, the analyst posted that anybody buying LINK on the present value ranges can be doing so for his/her achieve. Whether or not his opinion can be legitimate or not, the value motion inside the coming weeks will inform.

[ad_2]

Source link