[ad_1]

- The three-day value evaluation revealed that LDO may soar to $22.

- Capital influx elevated, suggesting that the downtrend time was up.

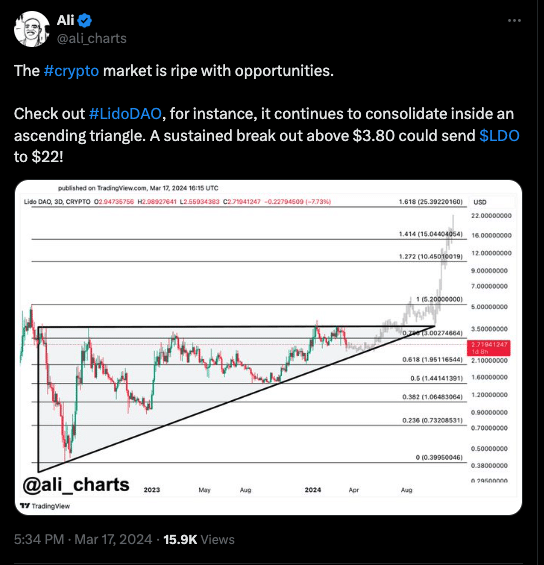

Lido DAO [LDO], the native token of liquid staking challenge Lido Finance, may very well be set to interrupt out of its consolidation part. If that occurs, LDO’s value may rally to $22, analyst Ali Martinez famous.

Martinez pointed this out after evaluating Lido’s 3-day chart. In response to the chart, LDO had fashioned an ascending triangle. However for the worth to hit double-digits, it has to interrupt via $3.80.

Frail bears could also be leaving the token however…

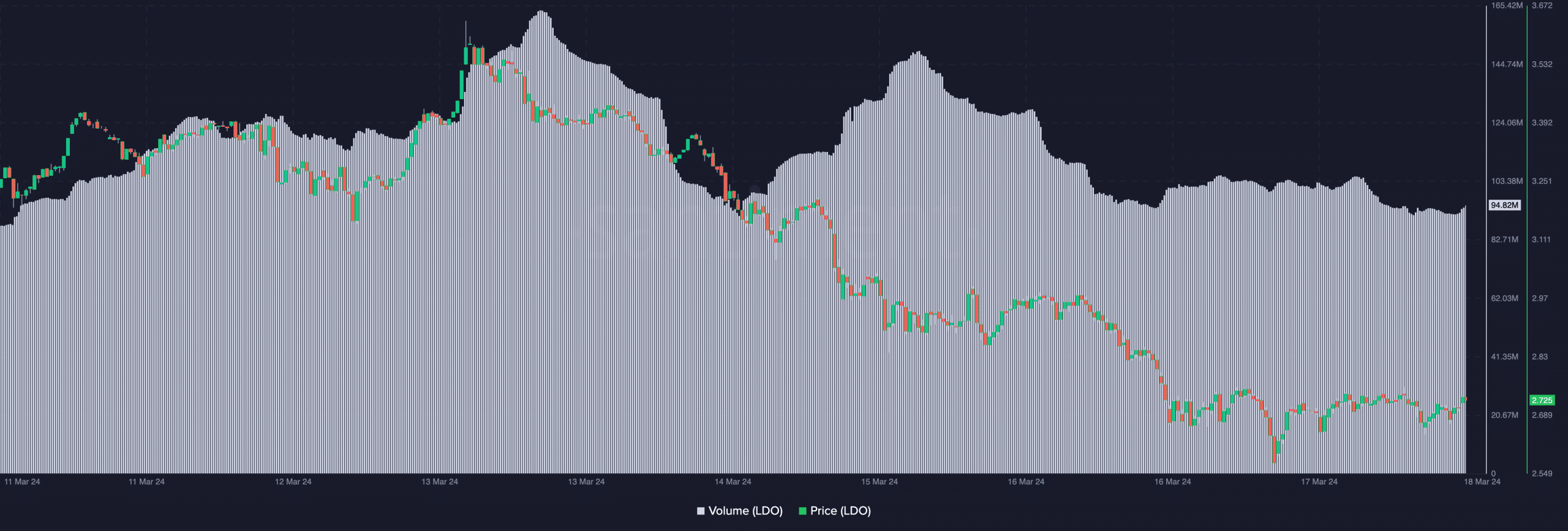

At press time, the cryptocurrency modified palms at $2.72, representing a 16.93% lower within the final seven days. AMBCrypto additionally observed that the quantity has been reducing.

Falling quantity alongside a reducing value may indicate that the downtrend was getting weak. Ought to this proceed, the worth of LDO may reverse within the upward path.

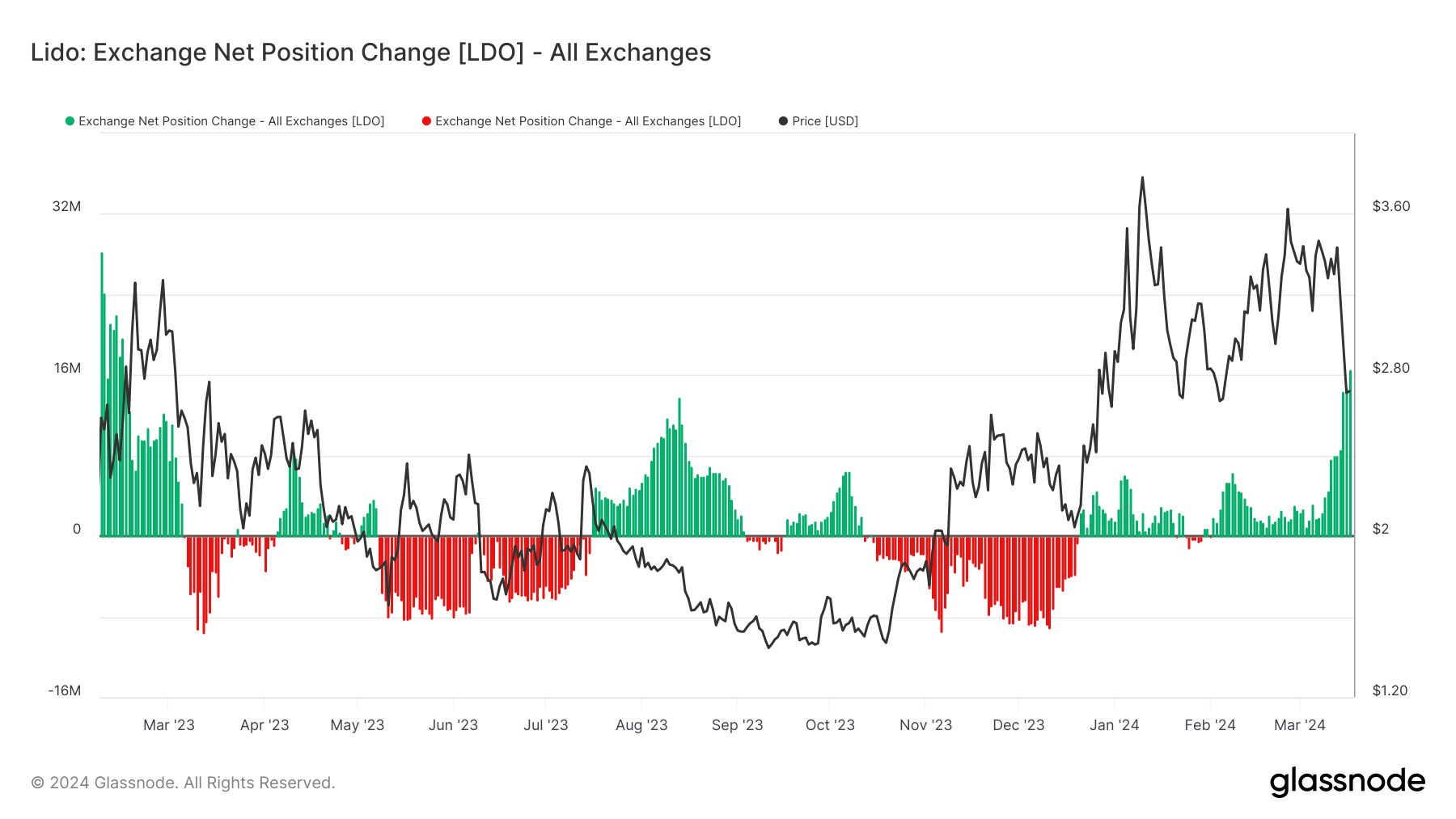

For the quick time period, you will need to test if the worth can hit $3.80 for a begin. To do that, we analyzed the Alternate Internet Place Change utilizing Glassnode, an on-chain knowledge supplier.

For these unfamiliar, the Alternate Internet Place Change measures the 30-day circulate of belongings which have entered or exited exchanges.

If the metric is damaging, then it means exchanges have extra outflows than inflows.

Regarding the value, this situation would have been a bullish sign, as it might point out much less promoting stress. Nonetheless, Lido’s Alternate Internet Place Change was 16.64 million tokens at press time.

A price like this indicates excessive change influx, which may have performed an element within the current drawdown.

Moreover, the state of the metric at press time prompt that LDO may see extra downswing earlier than it breaks out.

LDO to hit $7.15 quickly?

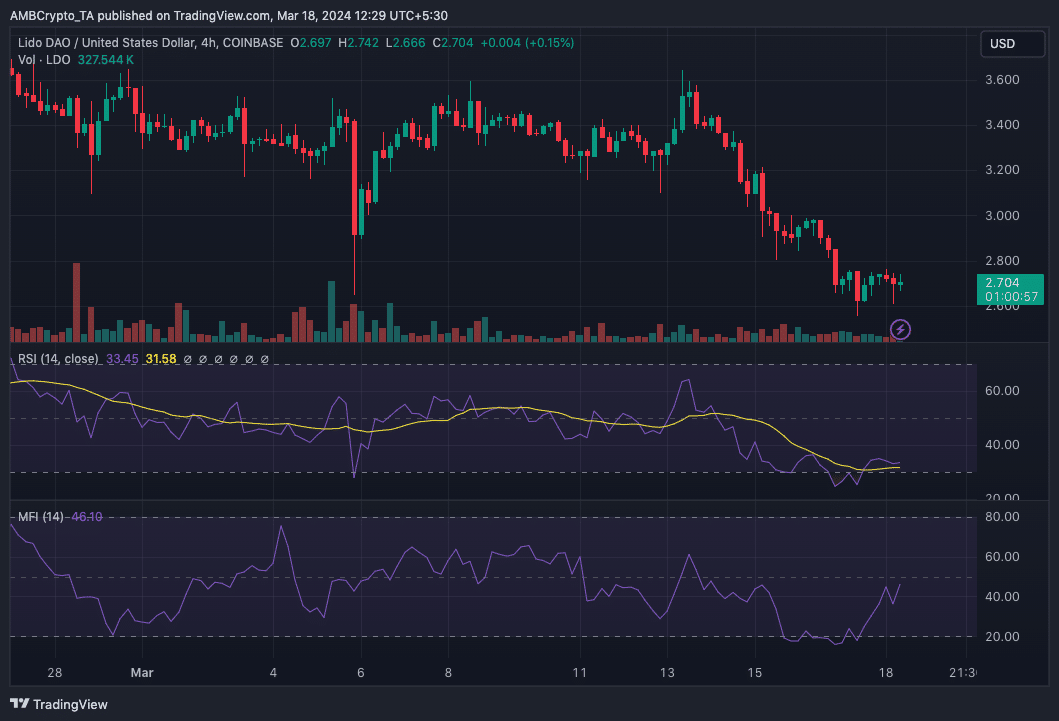

Past on-chain evaluation, AMBCrypto additionally evaluated LDO from a technical standpoint.

In response to the LDO/USD 4-hour chart, the token’s momentum had develop into extraordinarily bearish as proven by the Relative Energy Index (RSI).

At press time, the RSI was 33.45, reinforcing the notion that sellers had been in management. Nonetheless, the declining oscillator studying may very well be good for LDO.

That’s, if the RSI falls beneath 30.00 the place it may very well be thought-about oversold.

If the token turns into oversold, then a bullish reversal may very well be on the playing cards.

Ought to shopping for stress appear when LDO hits the oversold area, the Fibonacci indicator confirmed that the worth may rally as excessive as $7.15 within the midterm.

Moreover, an evaluation of the Cash Movement Index (MFI) confirmed that LDO may expertise notable modifications quickly.

On the seventeenth of March, the MFI was across the oversold area, indicating an enormous outflow of capital.

Lifelike or not, right here’s LDO’s market cap in ETH’s terms

However as of this writing, it was now not the case, because the studying was 46.10. A spike within the MFI inside such a brief interval may very well be proof {that a} value enhance was shut.

Ought to funds proceed to circulate into the LDO market, then an increase past $3.80 may happen inside a couple of days.

[ad_2]

Source link