[ad_1]

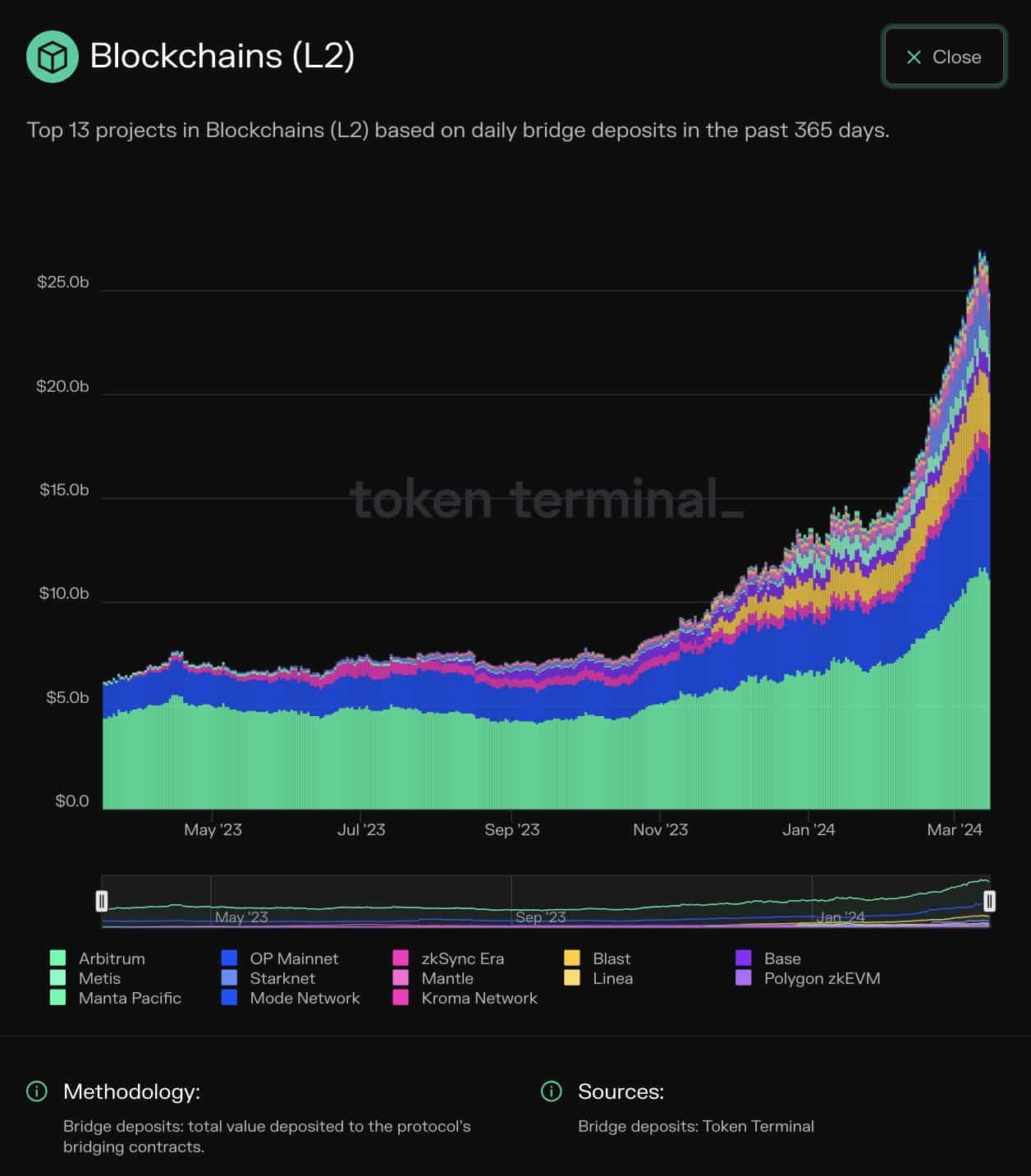

- ETH’s complete worth deposited surpassed $25 billion.

- The heightened demand seemingly stemmed from the anticipation of the Dencun improve.

Over the previous yr or so, scaling options have performed a considerable position in boosting demand for the Ethereum [ETH] ecosystem.

Constructed atop the bottom layer of Ethereum, these so-called layer -2 (L2) chains had been envisioned to deal with Ethereum’s scalability downside.

It was deliberate that over time, these L2s would deal with nearly all of low-value transactions, with the bottom layer caring for safety and decentralization.

Effectively, the imaginative and prescient gave the impression to be turning into a actuality.

In line with a current put up by on-chain analytics agency Token Terminal, the variety of property bridged from Ethereum to L2s has jumped dramatically within the first three months of 2024.

Customers capitalize on L2 advantages

Bridging, as you would possibly already bear in mind, is the method of transferring funds from L1 to L2. That is finished to reap the benefits of the high-speed and low-cost capabilities of the L2s.

As seen from the info above, the entire worth deposited has surpassed $25 billion as of the sixteenth of March, representing a 5x soar from the identical time final yr.

Arbitrum [ARB] attracted 42% of the entire deposits, adopted by OP Mainnet [OP].

Dencun was the primary driver

The heightened demand in 2024 seemingly stemmed from the anticipation of the Dencun improve, which went stay final week.

The deployment has resulted in a pointy drop in gasoline charges on L2s, in some chains by as a lot as 90%. Consequently, customers scurried to get their funds transported to benefit from the cheaper prices.

Win-win for ETH?

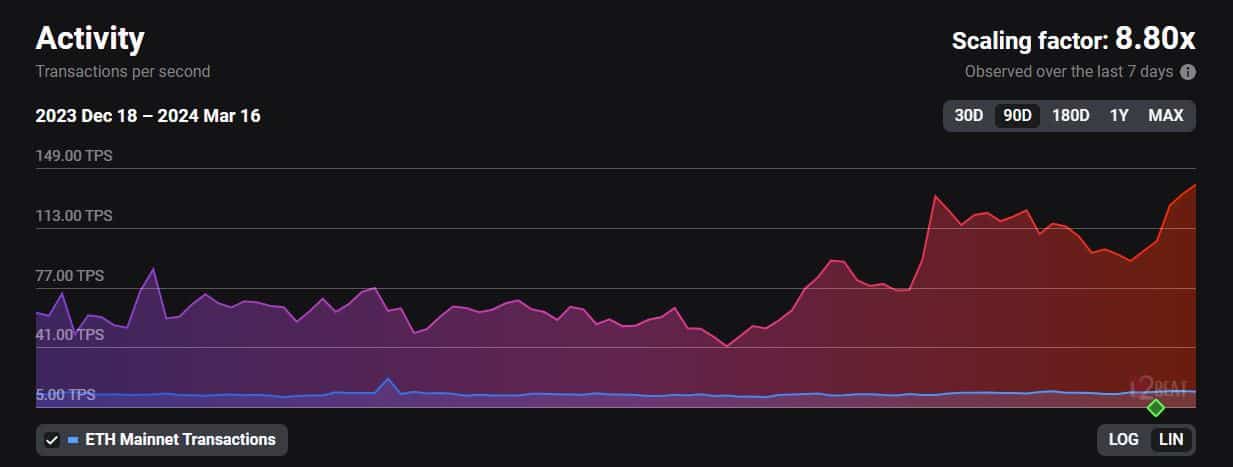

The rising demand has additionally spiked on-chain exercise, with L2s settling greater than eight occasions the transactions at press time, AMBCrypto famous utilizing L2Beats information.

Word that after validation, L2s batch the transactions and ship a compressed model to the bottom layer for settlement.

Is your portfolio inexperienced? Take a look at the ETH Profit Calculator

For every transaction despatched by an L2, the Ethereum community burns a small share of the entire ETH provide. Consequently, excessive community exercise on Ethereum L2s straight accrues worth to ETH.

As of this writing, ETH was exchanging arms at $3,570 with a fall of 4.56% within the final 24 hours, in line with CoinMarketCap.

[ad_2]

Source link