[ad_1]

- Massive BTC addresses confirmed uncertainty amid market correction.

- Retail curiosity declined as whales made important strikes.

As Bitcoin’s [BTC] value rose to new heights, optimistic sentiment across the king coin grew considerably.

Nevertheless, in the previous few days, the bullish sentiment round Bitcoin barely fell as the worth of BTC fell under the $70,000 mark.

Whale makes large strikes

Nevertheless, a big Bitcoin tackle confirmed indicators of uncertainty in response to a latest market correction.

Knowledge revealed {that a} substantial quantity of Bitcoin, totaling 16,003 BTC, with an age ranging between 5–7 years, had been moved on-chain by a major whale.

The motion of long-dormant Bitcoin suggests elevated exercise by giant holders.

This might point out a wide range of actions, together with profit-taking, portfolio rebalancing, or strategic positioning in response to market dynamics.

Wanting on the bigger image

Given the appreciable dimension of those BTC holdings, the conduct of the addresses holding these Bitcoins may have a major affect on value dynamics and dealer sentiment.

Nevertheless, regardless of the conduct of this one important whale, the broader sentiment for BTC throughout giant addresses holding wherever between 100 to 100,000 BTCs was comparatively optimistic.

There was an uptick in accumulation noticed throughout these cohorts with no indicators of slowing down.

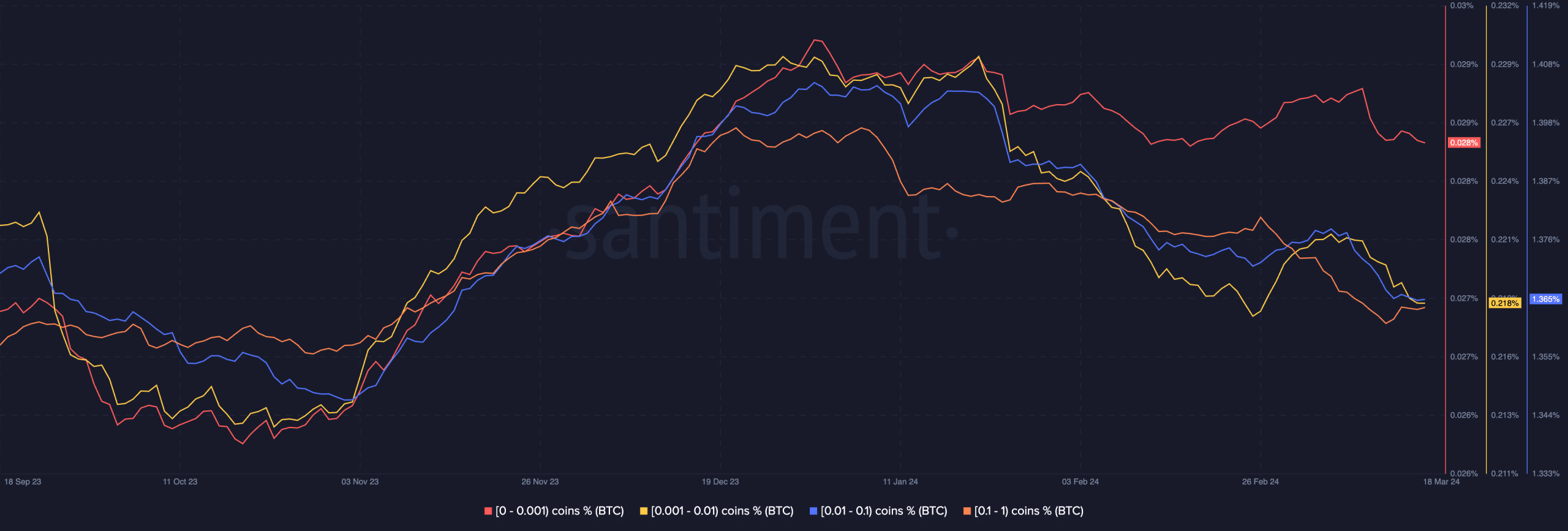

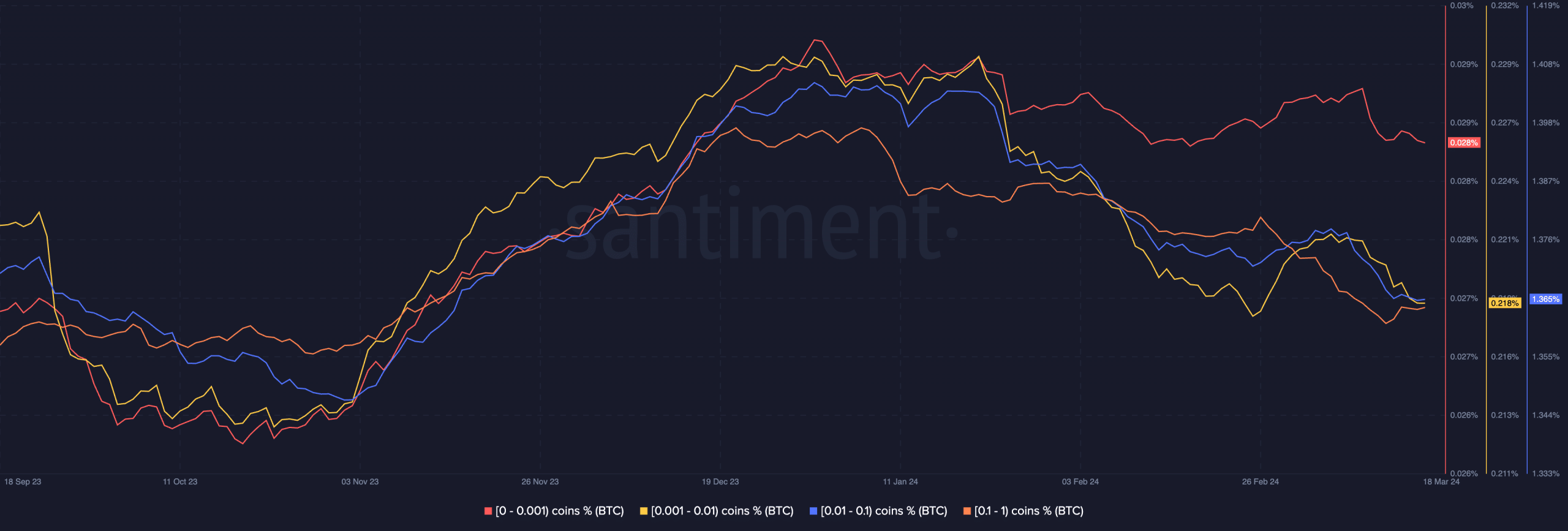

However, retail curiosity in BTC declined considerably. Most addresses holding cash between 0.001 to 0.1 had slowly began to promote their holdings.

The conduct exhibited by the retail traders may very well be one of many causes for the latest correction in BTC’s value.

Nevertheless, whale enthusiasm could assist help the worth motion and help BTC in rallying again as much as the $70,000 mark.

At press time, BTC was buying and selling at $67,687.92 and its value had grown by 2.44% within the final 24 hours.

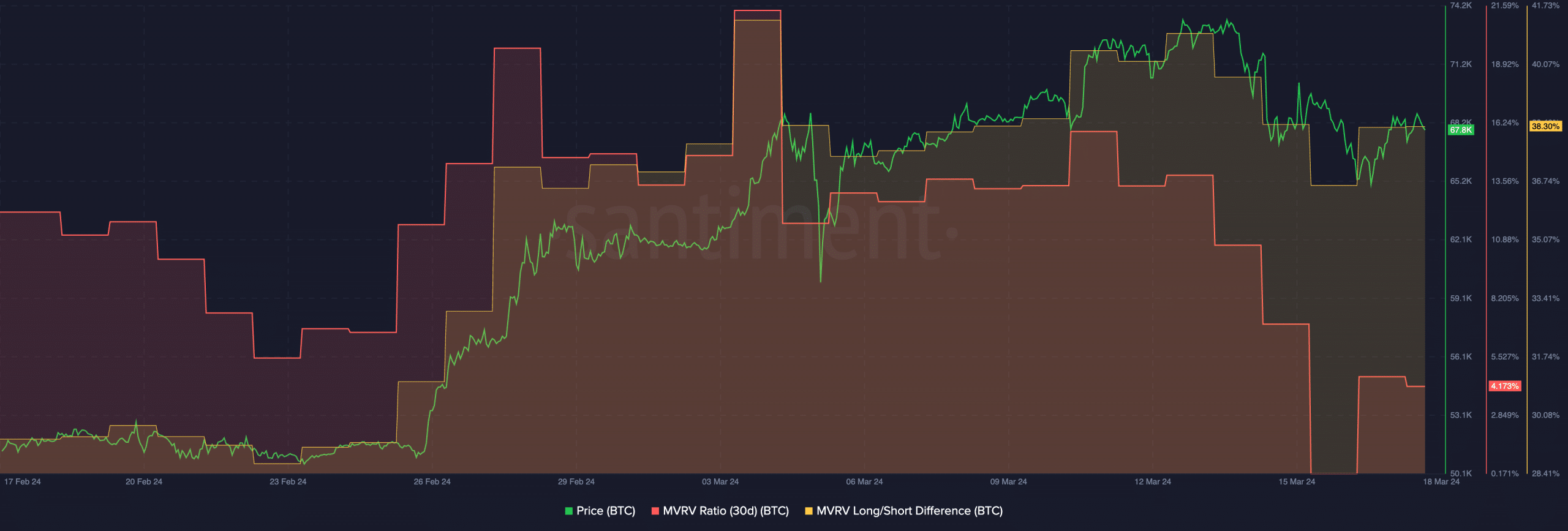

Furthermore, the MVRV ratio for BTC additionally grew, showcasing that almost all addresses have been nonetheless worthwhile and had an incentive to promote.

The Lengthy/Brief distinction for BTC remained excessive, implying that the share of long-term holders was greater than the short-term holders on the time of writing.

How a lot are 1,10,100 BTCs worth today?

Lengthy-term holders don’t react to minor value actions and are more likely to HODL their BTC in occasions of market uncertainty.

The presence of long-term holders may benefit the sustainability of BTC’s rally in the long term.

[ad_2]

Source link