[ad_1]

- Ethereum broke its decrease timeframe bullish construction.

- The liquidation ranges heatmap outlined two assist zones.

Ethereum [ETH] noticed a sizeable pullback over the previous few days after its regular bullish march over the previous month. The $4.1k degree was nearly reached earlier than the bulls have been pressured to retreat. Buyers needn’t fear about this dent in prices an excessive amount of.

Bitcoin [BTC] additionally faltered simply above the $73k degree and dragged the remainder of the market down. Whereas the rally is predicted to proceed greater in the long term, additional losses are anticipated over the following few weeks.

Merchants have to be ready for a fall beneath $3500

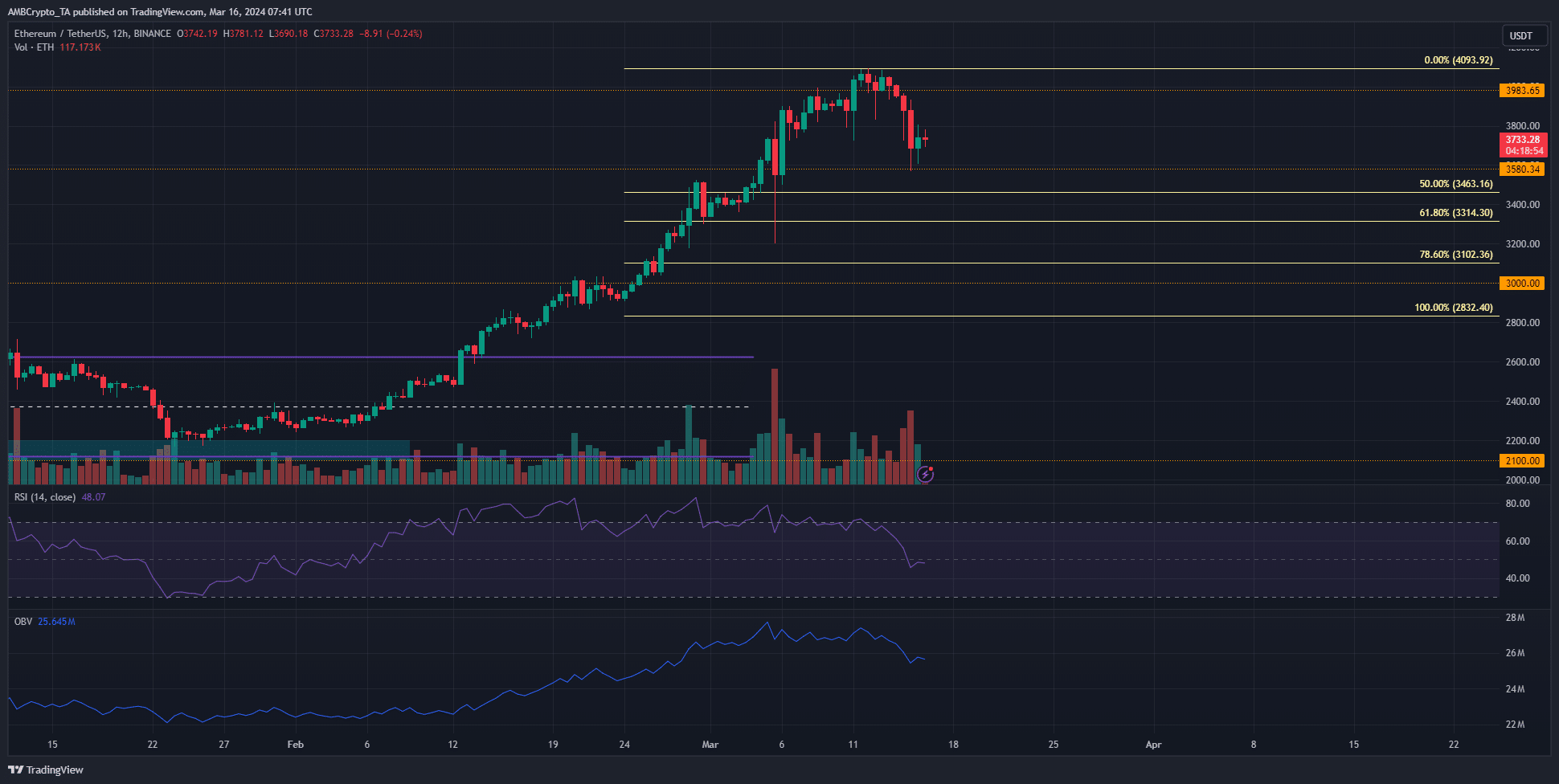

The 12-hour chart confirmed that the bullish bias remained intact based mostly on the value motion. But on the 4-hour timeframe and decrease the construction has flipped bearishly. Even the 12-hour RSI fell beneath the impartial 50 mark to replicate bearish momentum was rising.

The latest pullback will not be a flush of the overleveraged bulls as we noticed on the fifth of March. The rally noticed its momentum stutter after the twelfth of this month, adopted by a rise in selling pressure.

The OBV started to drop decrease to assist this concept. The Fibonacci retracement ranges (pale yellow) highlighted that the 61.8%-78.6% area at $3100-$3315 would probably be retested as support. The $3463 degree may additionally halt the bearish progress.

Lengthy-term buyers have to brace for additional losses

Supply: Hyblock

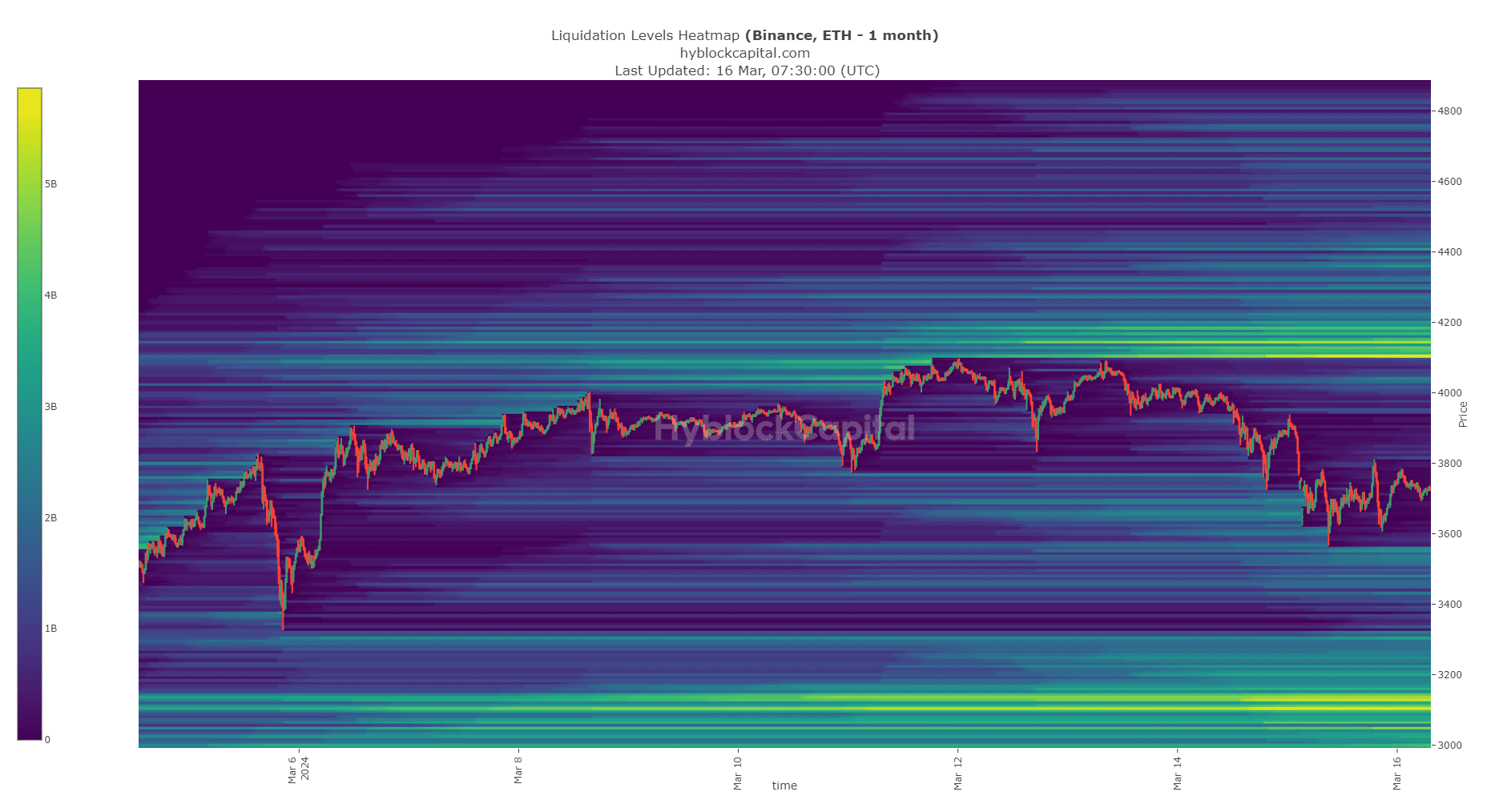

AMBCrypto’s evaluation of the liquidation ranges heatmap confirmed that ETH would probably publish extra losses. The $3560 degree was estimated to set off $2.6 billion value of liquidations.

These massive liquidation ranges have been concentrated within the $3520-$3560 area, marking it as a assist zone. Ethereum may see a bullish response from right here.

Is your portfolio inexperienced? Test the Ethereum Profit Calculator

Beneath the $3520 degree, the following massive liquidation ranges sat at $3300 and $3130. The previous was estimated to have $2.2 billion in liquidations, and the latter to have $5.4 billion.

It additionally had confluence with the 78.6% retracement degree at $3102.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

[ad_2]

Source link