[ad_1]

- Shopping for stress on UNI remained excessive final week.

- Just a few market indicators turned bearish on the token.

Uniswap’s [UNI] worth witnessed an enormous dip in its worth as its weekly chart was pink. However issues began to alter within the final 24 hours, as we noticed a pattern reversal. Nevertheless, this doesn’t assure an additional bull rally, as there are a couple of pink flags.

Uniswap is recovering

The final week was considerably disastrous for UNI, as whereas most cryptos loved bull rallies, Uniswap’s worth dropped.

In response to CoinMarketCap, UNI was down by over 7% within the final seven days. Within the meantime, a whale took the chance to build up extra UNI whereas its worth lay low.

Lookonchain not too long ago posted a tweet revealing {that a} whale withdrew 86,467 UNI, which was value $1.23 million from Binance. Quickly after the acquisition was made, UNI’s rice gained bullish momentum because it registered a restoration.

Within the final 24 hours alone, UNI’s worth spiked by greater than 3.5%. On the time of writing, UNI was buying and selling at $14.32 with a market capitalization of over $8.5 billion.

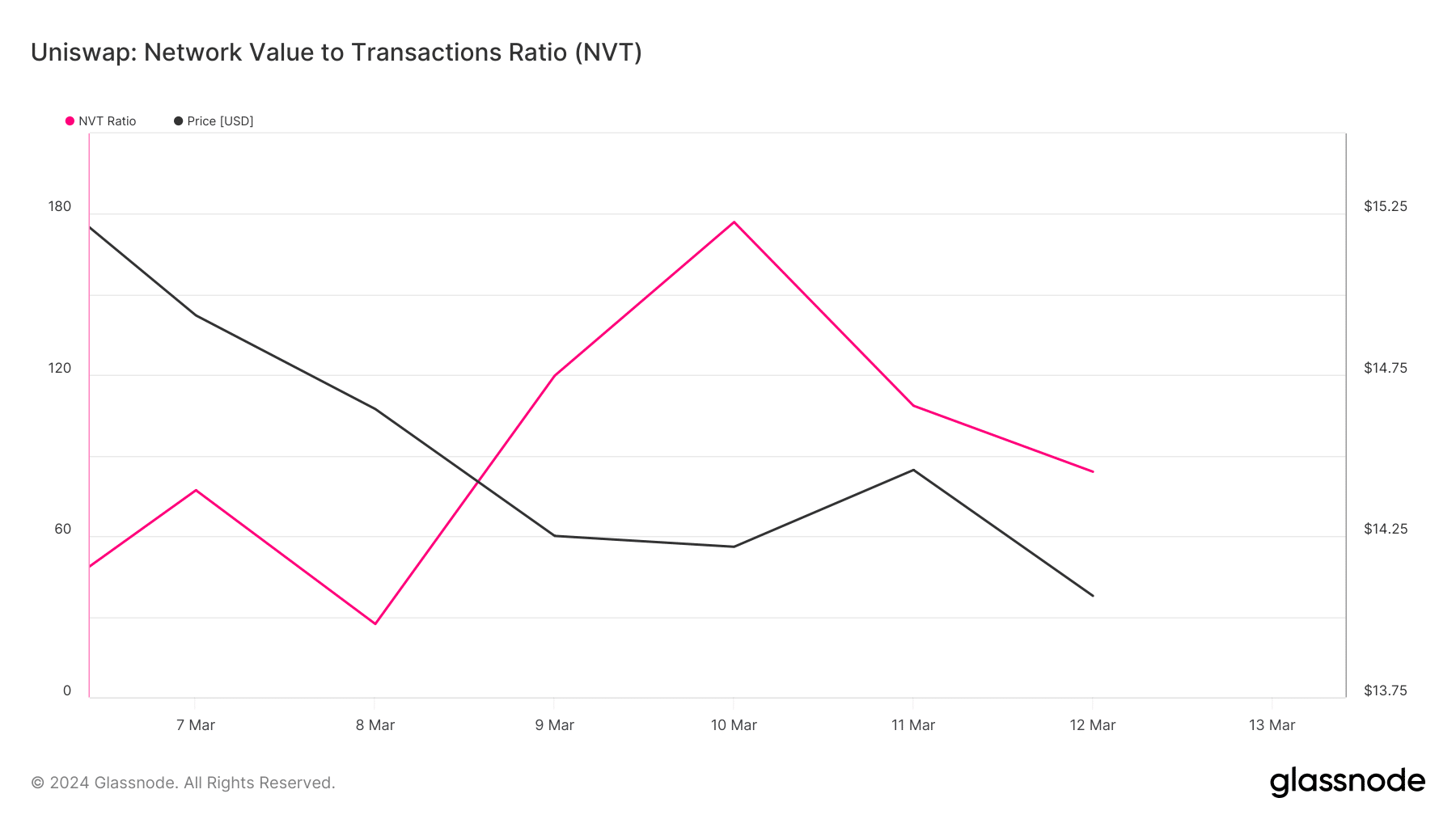

An evaluation of Glassnode’s information revealed that the probabilities of a continued uptrend are excessive. Uniswap’s Community Worth to Transactions (NVT) ratio dipped not too long ago.

At any time when the metric drops, it means that an asset is undervalued, suggesting a worth uptick.

These are the pink flags

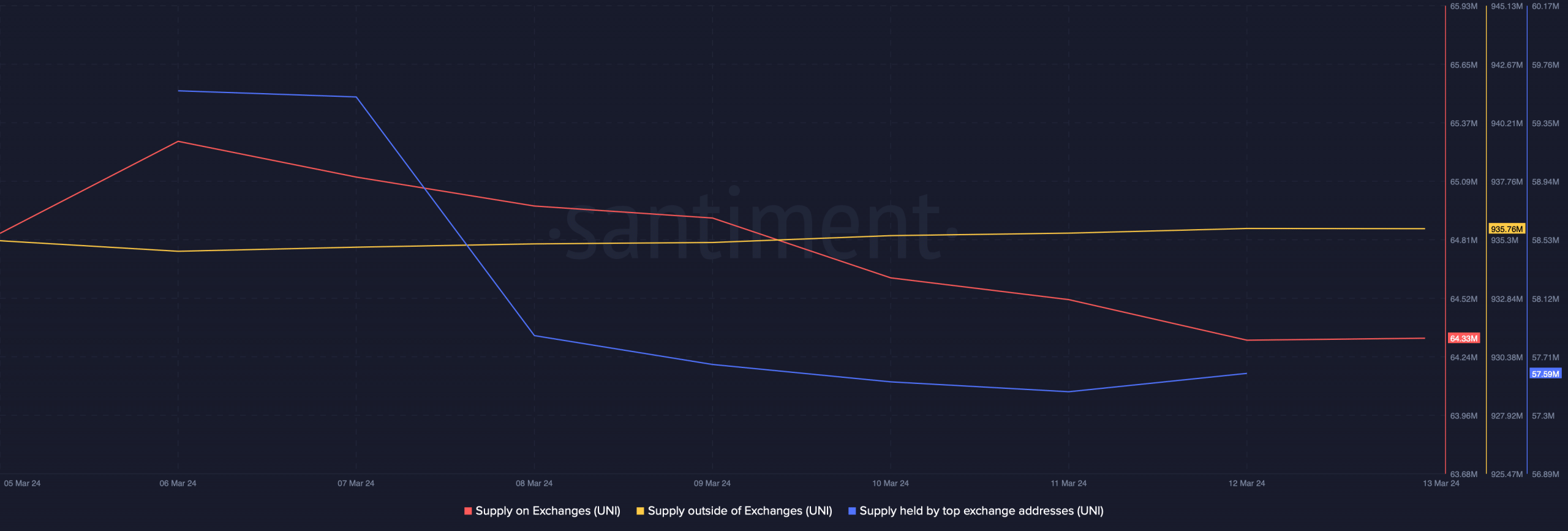

It was attention-grabbing to see that traders had been shopping for Uniswap. The evaluation of Santiment’s information revealed that UNI’s provide on exchanges dropped whereas its provide exterior of exchanges elevated, that means that purchasing stress was excessive.

Nevertheless, the large gamers within the video games, whales, truly bought their holdings as UNI’s provide held by prime addresses fell.

A doable purpose behind this was revealed once we took a take a look at Hyblock Capital’s information. We discovered {that a} substantial quantity of UNI will get liquidated when its worth touches the $14.6 mark.

A hike in liquidation means excessive promoting stress, which could put an finish to the token’s bull rally within the coming days.

How a lot are 1,10,100 UNIs worth today

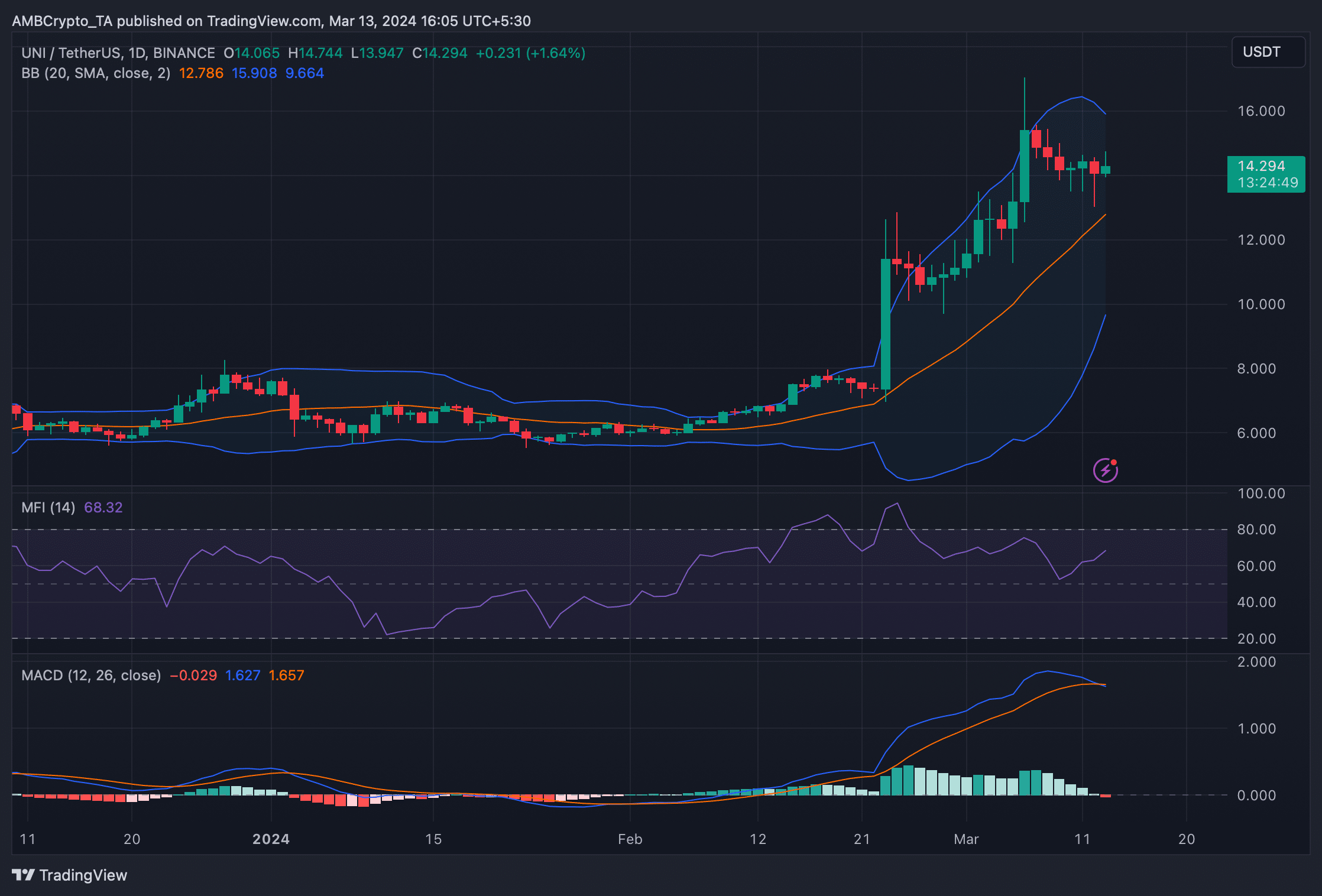

To examine what to anticipate from UNI, we analyzed Uniswap’s day by day chart. We discovered that UNI’s worth was getting into a much less unstable zone, as revealed by the Bollinger bands.

Its MACD additionally displayed a bearish crossover, additional suggesting that the bull rally may finish quickly. Nonetheless, the Cash Move Index (MFI) registered an uptick, which was a bullish growth.

[ad_2]

Source link