[ad_1]

- Returning long-term holders and a decline in dialogue counsel a better worth.

- The Open Curiosity indicated that consumers have been extra aggressive.

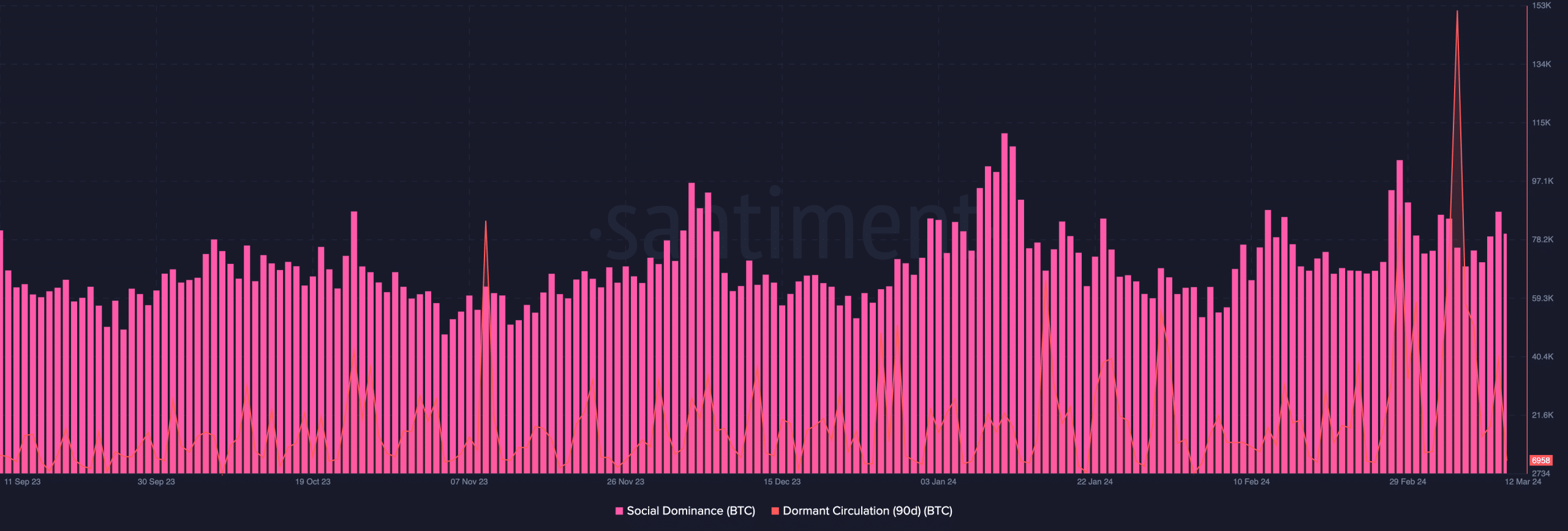

In case you imagine that Bitcoin’s [BTC] rise to $72,000 is the tip, a number of on-chain metric are saying “no, it’s simply the beginning.” For instance, AMBCrypto’s evaluation confirmed {that a} excessive variety of dormant cash are shifting into circulation.

A surge in dormant circulation implies that sidelined Lengthy-term holders have an interest available in the market. Traditionally, it is a affirmation of the bull market. Moreover, the Social Dominance signaled that BTC would possibly rise way more than its press time worth.

When evaluating Bitcoin’s worth and Social Dominance, we noticed that the correlation was low. In previous bull cycles, low dialogue about BTC regardless of the worth leap was an indication that the coin has not reached the highest.

Bitcoin has not hit its peak

With these indicators, it’s not misplaced to say that the $80,000 to $100,000 predictions is perhaps possible. However earlier than you get too excited, it’s essential to assess different metrics.

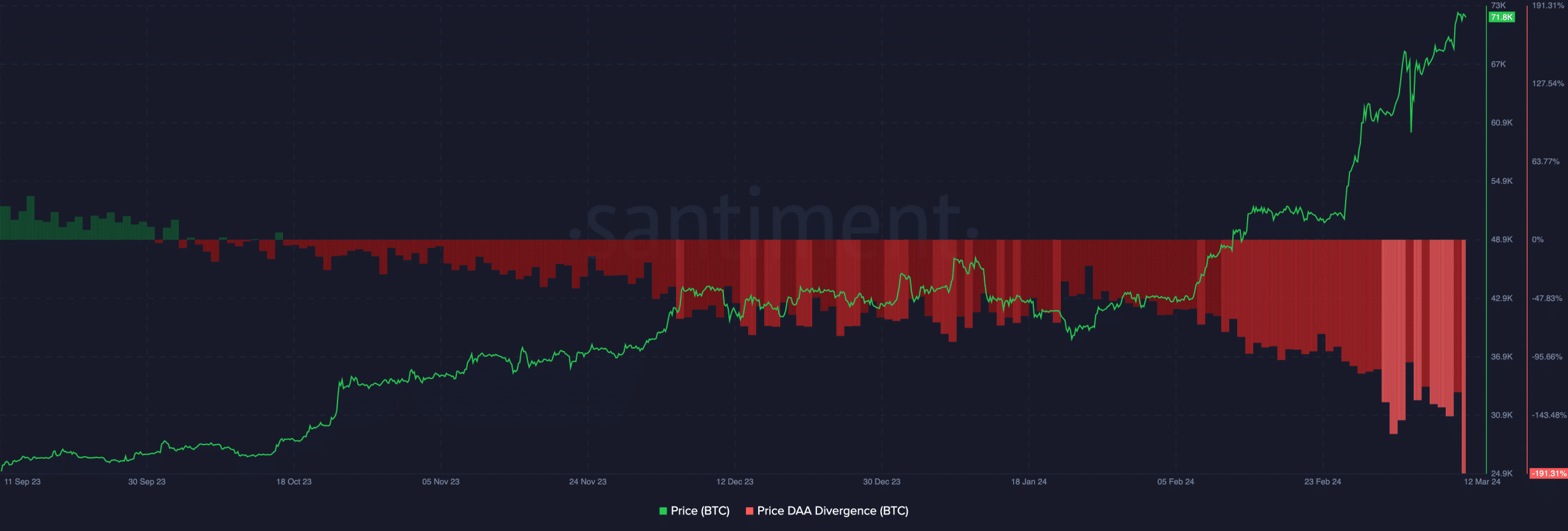

One metric we are able to at all times run to to present notable forecasts in a bull market is the price-DAA divergence. DAA stands for Each day Lively Addresses. As such, the connection between the worth and Bitcoin’s DAA has been instrumental in highlighting market backside and tops.

Thus, merchants can use this to establish when to purchase and the interval to promote. At press time, on-chain knowledge confirmed that the price-DAA was -191.31%. Because of this the DAA had fallen way more than the worth.

In less complicated phrases, the brink registered implied that regardless of BTC’s unimaginable surge, it has not been in a position to appeal to many new or retail investors.

From a buying and selling perspective, this divergence may function a powerful purchase sign. Subsequently, if exercise on the Bitcoin community begins to achieve impeccable heights, then the worth would possibly rise greater than $72,000.

Nonetheless, you will need to notice that this parameter is perhaps greatest for short-term merchants.

One other breakout appears shut

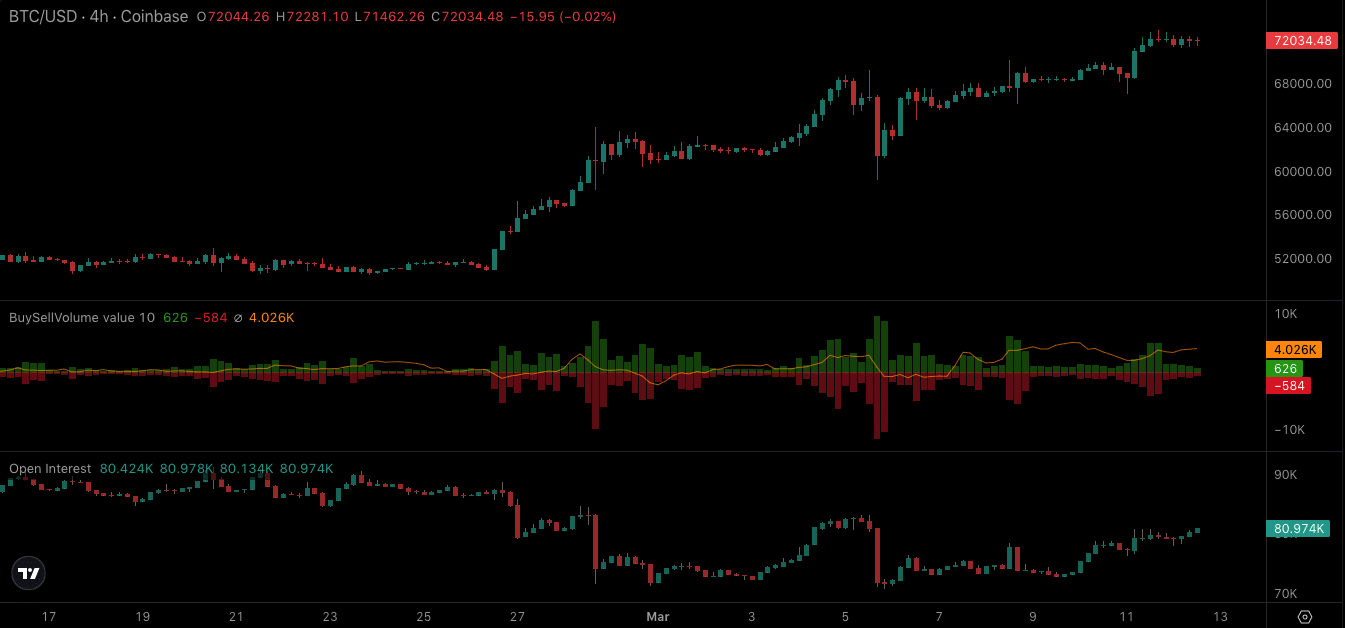

On the technical aspect, the purchase BTC quantity was a lot greater than the promote aspect. This means that the worth would possibly hold swinging in the direction of $80,000 as sellers appear to be behind.

Moreover that, the Open Curiosity (OI) has been growing, indicating a surge in internet positioning. Although the OI reveals a 50-50 buyer-seller cohort, the rise implies that consumers have been extra aggressive.

Is your portfolio inexperienced? Examine the BTC Profit Calculator

Worth-wise, this rise in OI might be bullish for Bitcoin because the uptrend would possibly collect extra power. If the OI continues to extend, a breakout candlestick would possibly seem on the BTC/USD chart.

Ought to this be the case, shorts with high-leverage positions may face a wipeout. Although longs would possibly revenue from the potential rise, merchants would possibly must be careful as volatility is perhaps excessive.

[ad_2]

Source link