[ad_1]

A intently adopted crypto strategist believes that Bitcoin (BTC) will quickly make a parabolic transfer just like prior market cycles.

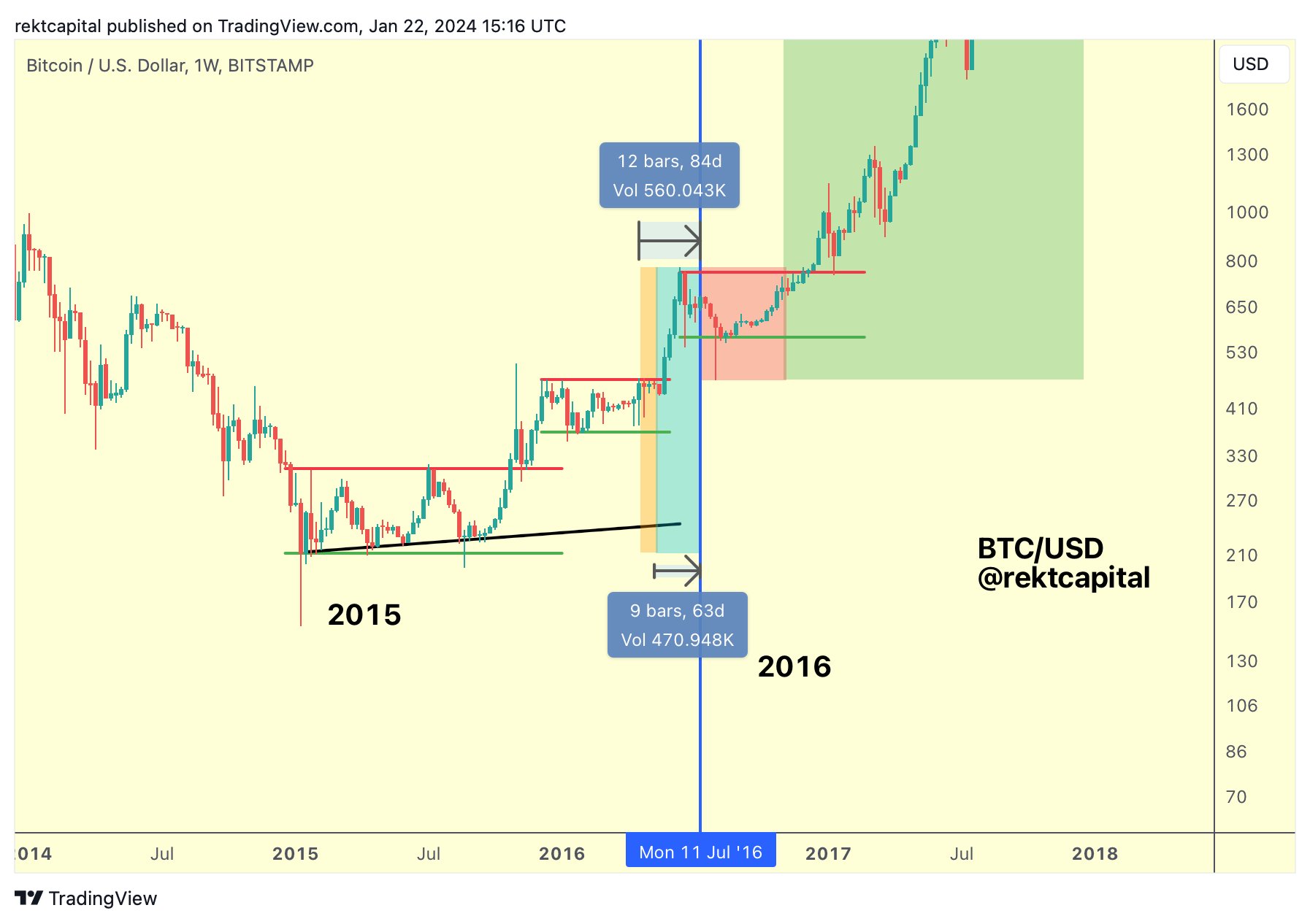

Pseudonymous analyst Rekt Capital tells his 389,700 followers on the social media platform X that he believes Bitcoin’s worth sample will comply with comparable phases from prior halving years, together with 2020 and 2016.

The following halving occasion is predicted in April when miners’ rewards are minimize in half.

In keeping with the dealer, Bitcoin’s worth motion is prone to undergo three distinct phases earlier than the parabolic part 4.

“Entry necessities to the Bitcoin parabolic uptrend (inexperienced):

• Survive this present pullback (orange)

• Survive the Pre-Halving retrace (darkish blue circle)

• Survive Put up-Halving Re-Accumulation (crimson) Straightforward sufficient? Let’s go.”

The analyst additionally warns that Bitcoin might bear a major correction main as much as the halving occasion, just like the earlier than halving years.

“In case you’re sick of this present draw back on Bitcoin, wait till across the halving occasion itself when worth experiences one other minimal -20% draw back.”

Bitcoin is buying and selling for $40,167 at time of writing, up barely within the final 24 hours.

The analyst additionally updates his outlook on the altcoin market. He predicts that the full market cap for alts, excluding the highest 10 digital property by market cap, wants to carry a key degree of round $189 billion on a weekly shut foundation for alts to proceed an uptrend.

“For altcoin market cap to maintain trending up it wants to carry the present black triangular market construction. Presently testing the bottom of it for help. Draw back wicks beneath it are allowed however wants to carry for an opportunity at uptrend continuation.”

The present complete market cap excluding the highest 10 digital property is valued at $187.68 billion at time of writing.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Price Action

Observe us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/d3verro

[ad_2]

Source link