[ad_1]

On Wednesday, January 10, the US Securities and Alternate Fee (SEC) finally approved the launch of spot Bitcoin ETFs, representing a outstanding occasion in US buying and selling historical past.

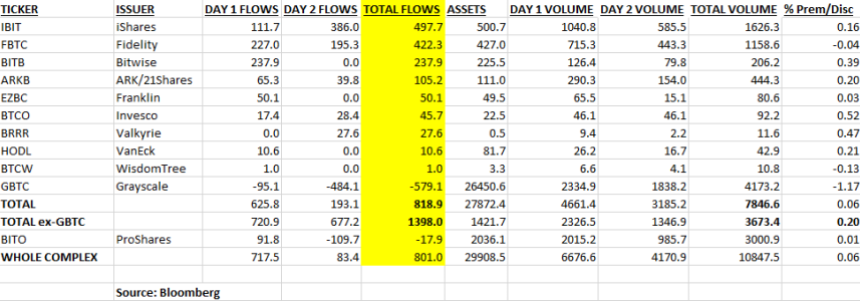

Thus far, market information on these funding funds have confirmed theories of elevated institutional demand for Bitcoin, with over $800 million in whole web inflows and $3.6 billion in buying and selling quantity recorded throughout the primary two days of buying and selling.

Though these inflows are but to be mirrored in BTC’s value, because the premier cryptocurrency dipped by 2% within the final week, the spot Bitcoin ETFs have definitely kicked off with a blast which is indicative of potential features for the world’s largest asset and the overall crypto market.

Spot Bitcoin ETFs Appeal to Over $1.4 Billion In Two Days – Bloomberg Knowledge

In an X post on January 13, Bloomberg ETF analyst Eric Balchunas shared some perception on the spectacular efficiency of the spot Bitcoin ETFs of their debut buying and selling week.

Balchunas famous that of the 11 permitted spot BTC ETFs, 9 have recorded a complete influx of over $1.4 billion. Main the lot is BlackRock’s IBIT, with an estimated asset influx of $497.7 million, carefully adopted by Constancy’s FBTC, which boasts about $422.3 million in funding.

The BTC spot ETFs of Bitwise and ARK/21 Shares have additionally produced a considerably constructive efficiency attracting $237.9 million and 105.2 million, respectively. Then again, Grayscale’s GBTC has been the market outcast, recording a surprising $579 million in outflows over the primary two days of buying and selling.

Supply: Bloomberg

Following the SEC’s approval on Wednesday, traders cashed in closely on GBTC, which was lately transformed from a closed-end fund to a spot ETF. SkyBridge Capital founder Anthony Scaramucci has already commented on this pattern describing it as one of many potential causes behind Bitcoin’s dip within the final week.

In whole, the spot Bitcoin ETF market recorded a powerful web influx of $818.9 million in its debut buying and selling week. These figures are probably to enhance within the subsequent few weeks as promoting quantity ultimately declines. In the meantime, traders nonetheless anticipate the debut of Hashdex’s spot ETF – DEFI – which is present process fund conversion from the corporate’s Bitcoin futures ETF.

BTC Value Overview

On the time of writing, Bitcoin exchanges arms at $42,980 reflecting a 0.73% loss within the final day. In the meantime, the token’s every day buying and selling quantity has plummeted by 62.33% and is now valued at $16.9 billion. Nevertheless, with a market cap of $842.23 billion, Bitcoin stays the biggest cryptocurrency on the planet.

BTC buying and selling at $42,916.07 on the every day chart | Supply: BTCUSDT chart on Tradingview.com

Featured picture from Yahoo Finance, chart from Tradingview

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site totally at your personal danger.

[ad_2]

Source link