[ad_1]

A dealer who nailed the ground worth of Bitcoin (BTC) throughout the 2018 bull market believes Solana (SOL) and Polygon (MATIC) are about to witness bursts to the upside.

Pseudonymous analyst Bluntz tells his 229,100 followers on the social media platform X that Solana seems to be able to rally after pulling again to final week’s low of $54.78.

In keeping with the dealer, final week’s correction set the stage for Solana to print a brand new 2023 excessive.

“SOL trying like a sequence of 1-2s from the lows on low time frames. The subsequent leg up ought to hopefully take us as much as $80 and past.”

Bluntz practices Elliott Wave principle, a sophisticated technical evaluation methodology that makes an attempt to foretell future worth motion by following crowd psychology which tends to manifest in waves. In keeping with the idea, a bullish asset goes by way of a five-wave rally with every main wave consisting of its personal 5 sub-waves.

Trying on the dealer’s chart, he appears to foretell that SOL will initially rally to about $70 after which $82.50. At time of writing, SOL is buying and selling for $59.66.

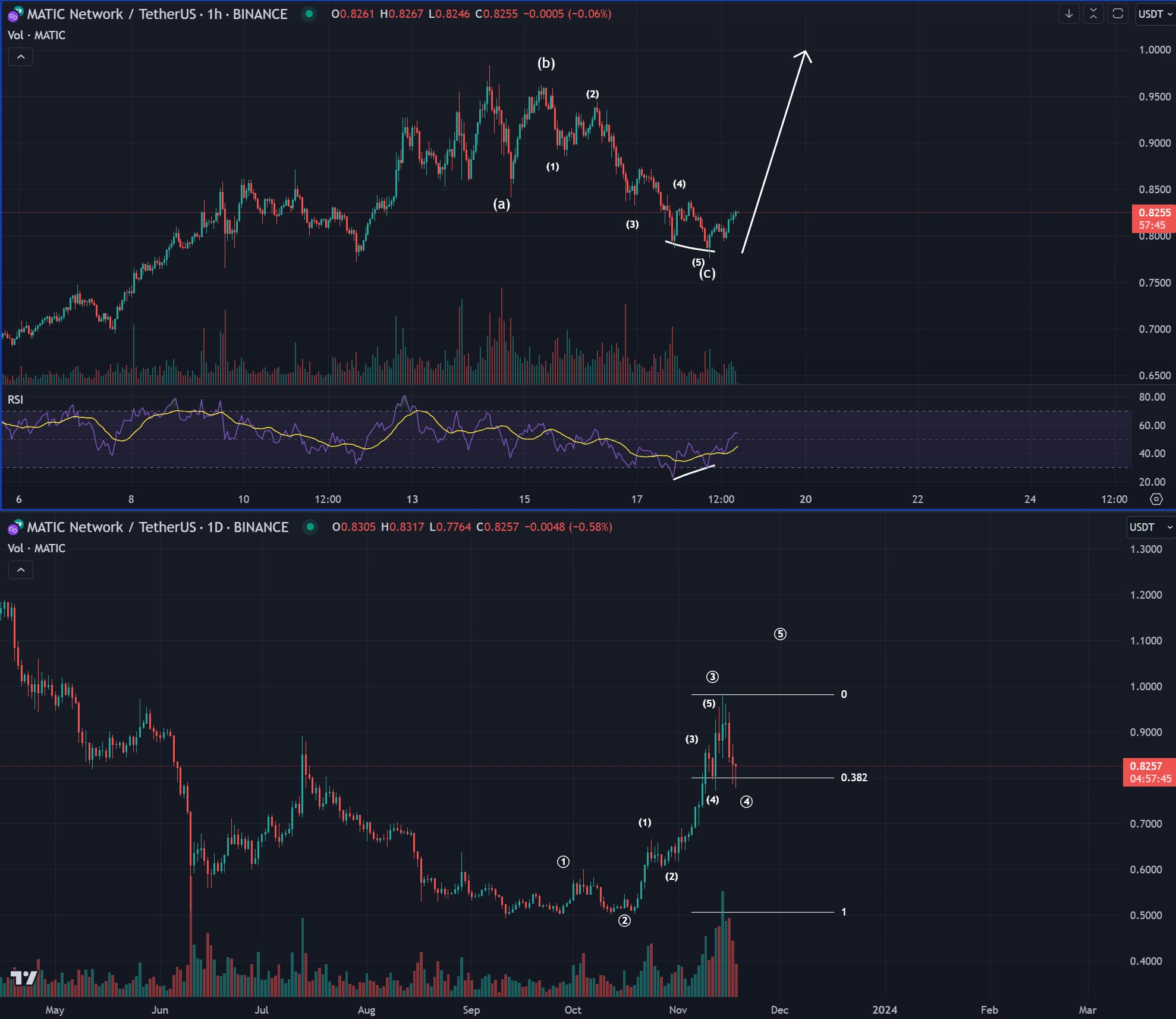

Subsequent up is MATIC, the native asset of the Ethereum (ETH) scaling answer Polygon. In keeping with Bluntz, MATIC seems to be bullish after respecting a key assist degree whereas printing a bullish divergence on the hourly timeframe.

A bullish divergence is historically seen as a reversal sign because it means that bulls are gaining momentum despite the fact that the asset’s worth is making new lows.

Says Bluntz,

“MATIC gearing up for a possible 20% push into new highs in my view.

High chart is the low timeframe. The underside is day by day. Had a pleasant 0.38 Fibonacci retest. Seems to be like a three-wave transfer down and obtained some good [bullish] divergence on the lows.”

Trying on the dealer’s chart, he appears to foretell that MATIC will rally to $1. At time of writing, MATIC is price $0.844.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Price Action

Observe us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses you might incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Quardia

[ad_2]

Source link