[ad_1]

Rising optimism in crypto has pushed institutional traders into making their largest allocation of capital into digital belongings markets in over a 12 months.

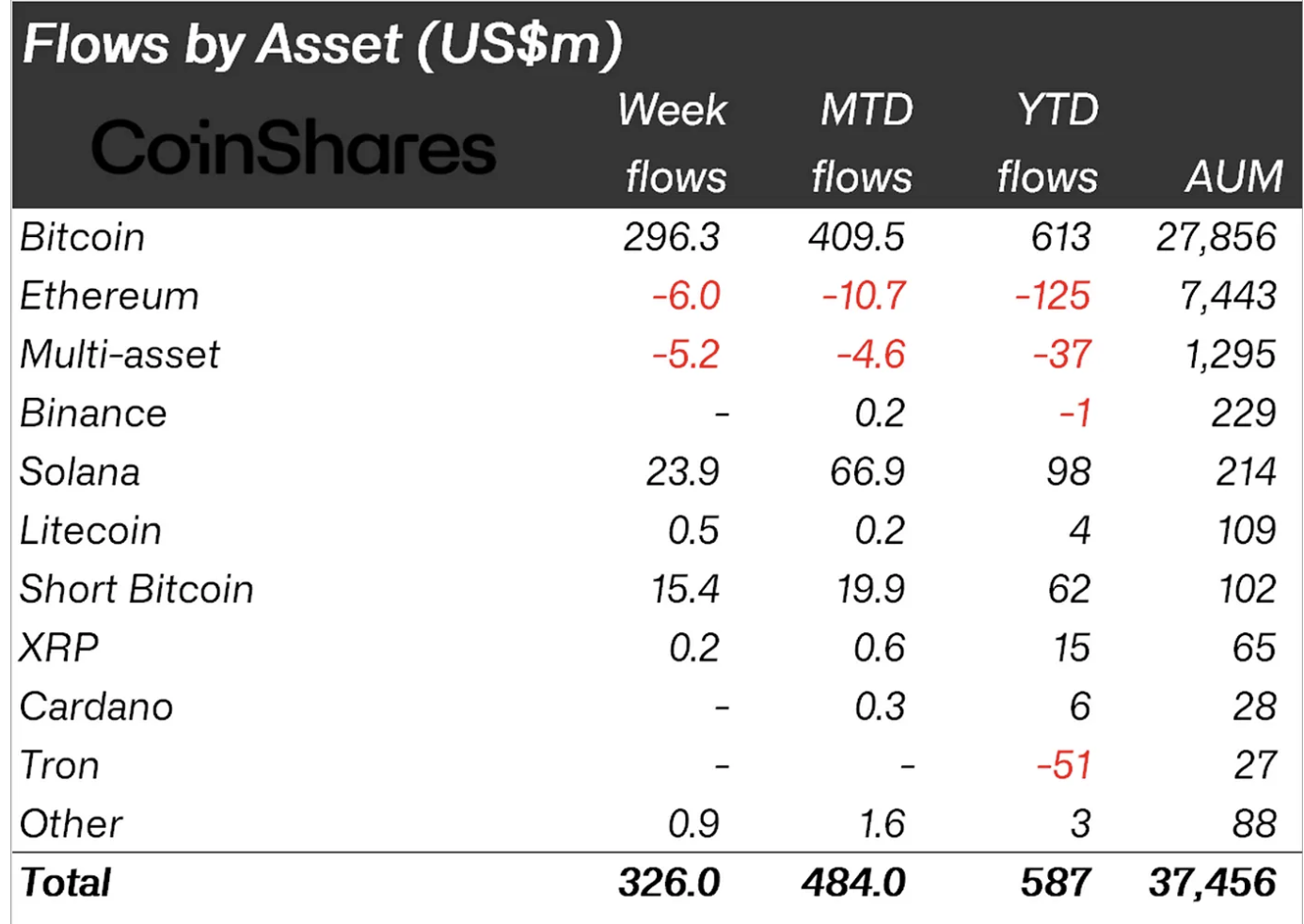

In its newest report, Digital belongings supervisor CoinShares says establishments put $326 million into crypto funding merchandise final week, the most important weekly influx since July of 2022.

CoinShares says the inflows coincide with rising optimism from traders that the US Securities and Trade Fee (SEC) is probably going on the verge of approving a spot-based Bitcoin (BTC) exchange-traded fund (ETF) within the US.

With the perceived probability of a Bitcoin ETF, BTC noticed 90% of the inflows from establishments, says CoinShares. Nevertheless, the agency says that the inflows had been nonetheless not traditionally vital for the king crypto, suggesting potential hesitancy amongst traders.

“Whereas optimistic for Bitcoin, this weekly influx ranks as solely the twenty first largest on document, suggesting continued restraint amongst traders, though we do consider a spot-based ETF is now extremely possible within the coming months, and can symbolize a step-change for the trade from a regulatory perspective.”

CoinShares knowledge exhibits that after once more, Ethereum (ETH) rival Solana (SOL) noticed essentially the most quantity of capital flows, making it a “favorite” amongst establishments in 2023.

CoinShares says that solely 12% of the flows got here from the US. The most important quantity of capital flows got here from Canada, Germany and Switzerland, with inflows of $134 million, $82 million and $50 million respectively. $28 million got here from Asia, which is the most important weekly circulate from the area in recorded historical past, says CoinShares.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Price Action

Observe us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/Agor2012

[ad_2]

Source link