[ad_1]

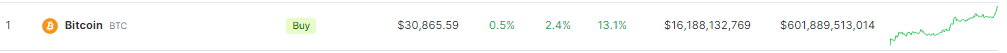

The value of Bitcoin is sustaining an upward trajectory, catching many off guard this weekend. As of now, BTC has surged by 2.4% within the final 24 hours, and sustaining a 13% rally within the final week. At $30,865, based on knowledge by Coingecko, the highest crypto is simply inches away from reaching the vaunted $31K, a territory it briefly crossed in April 10 this 12 months.

The $30,000 mark holds appreciable significance for Bitcoin, functioning as each a psychological milestone and a technical resistance level. Psychologically, it represents a spherical quantity that influences investor sentiment, inspiring confidence when surpassed and elevating issues when it turns into a barrier.

BTC nears the $31K stage. Supply: Coingecko.

Technically, $30,000 traditionally acts as a stage the place promoting strain tends to accentuate, impacting short-term and long-term worth actions. In consequence, this worth stage is intently monitored by merchants and buyers, making it a crucial reference level within the cryptocurrency market.

The Anticipated Increase: Bitcoin ETF’s Impression On The Crypto Market

There’s a whole lot of pleasure about the potential of the U.S. Securities and Trade Fee permitting a Bitcoin exchange-traded fund (ETF). This could possibly be a giant increase for the struggling cryptocurrency market. Mike Novogratz, the CEO of Galaxy Digital, thinks it’s very probably that the U.S. will approve this sort of funding fund for Bitcoin quickly. This information could possibly be a significant motive for Bitcoin’s worth to go up.

Bitcoin might quickly break over its overhead resistance and start a speedy surge, based on buying and selling group Stockmoney Lizards. They anticipate widespread participation within the ETF and a subsequent surge within the run-up to the halving in April 2024.

BTCUSD inching nearer to the important thing $31K territory. Chart: TradingView.com

The monetary trade is presently witnessing the energetic participation of main gamers reminiscent of BlackRock, which manages property above $10 trillion. These companies are additionally actively pursuing the approval of their functions for exchange-traded funds (ETFs), thereby creating an setting stuffed with keen expectation.

On account of Bitcoin’s regular ascent, tokens fashioned by the forking of the alpha coin, particularly Bitcoin Money (BCH) and Bitcoin SV (BSV), had a big surge of as much as 26%, surpassing different altcoins when it comes to positive factors. This surge might point out a possible manifestation of enthusiasm.

BTC worth motion within the final 24 hours. Supply: Coingecko

Prospects Of A Bitcoin ETF In Late 2023 Or Early 2024

A number of trade specialists are suggesting that the long-anticipated approval of a spot Bitcoin exchange-traded fund (ETF) may materialize someday between late 2023 and early 2024. This revelation has despatched ripples of pleasure all through the cryptocurrency group and the broader monetary world.

If BlackRock’s spot Bitcoin ETF is accredited, Matrixport, a supplier of cryptocurrency providers, tasks that the worth of Bitcoin would rise to between $42,000 and $56,000. The group of U.S. registered funding advisors and potential funding inflows from gold ETF buyers type the premise of the extraordinarily optimistic forecast.

A Bitcoin ETF is a giant deal as a result of it makes it straightforward for normal people to put money into Bitcoin without having to take care of all of the difficult stuff that comes with digital currencies. It’s like a bridge that connects the common cash world with the wild world of cryptocurrencies, which may assist extra individuals get into Bitcoin.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes threat. Once you make investments, your capital is topic to threat).

Featured picture from Assortment FRAC Lorraine

[ad_2]

Source link