[ad_1]

Right now, Bitcoin took one other dive, this time to its lowest stage since June 21. A examine on Bitfinex reveals a BTC worth droop to $28,641. Coinbase, America’s largest crypto change, reported an much more drastic drop to $28,478. Though the worth bounced again barely to hover just under $29,000 (-1.4% within the final 24 hours), the downward pattern sparks questions.

Why Is The Bitcoin Worth On The Decline?

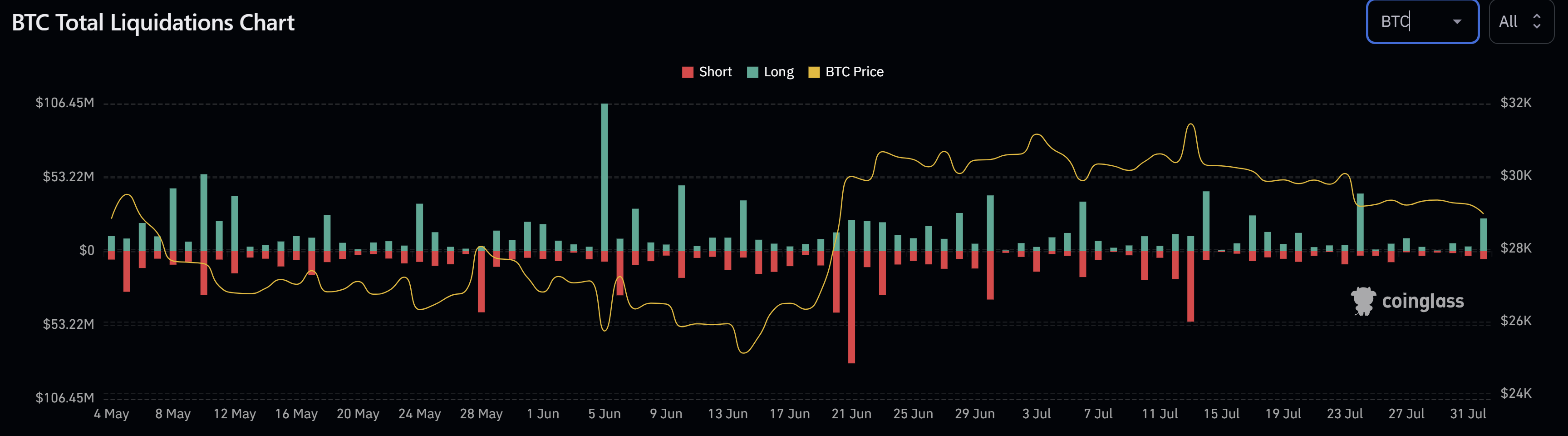

James V. Straten, a famend on-chain analyst, lately tweeted: “Bitcoin drops under $29,000 as open curiosity spikes whereas funding charges go decrease. Because of the largest lengthy liquidation since twenty fourth July.” Because the analyst states, Bitcoin’s worth pattern could be majorly attributed to lengthy liquidations. The liquidation information from Coinglass signifies that $23.6 million in BTC longs had been liquidated, a comparatively small quantity however important contemplating the market’s state.

In an illiquid market, smaller orders can considerably sway the market. In line with information from Kaiko, BTC and ETH have seen a decline in 90-day realized volatility this 12 months, with volatility ranges at the moment hovering round two-year lows.

Furthermore, Kaiko’s information additionally reveals that Bitcoin’s correlation with the S&P 500 continued to say no in July, falling to only 3%. The final time it was this low was again in August 2021. This means that the standard monetary market’s affect on Bitcoin’s worth is waning, an impulse a lot wanted in the mean time.

Analyst @52Skew noted that BTC Spot CVDs & Delta Retrospective had been hinting on the downtrend. “There have been clear indicators of spot provide & sellers, particularly on Coinbase. Mixture Spot CVD indicated heavy provide previous to dump: Worth grinding increased into restrict provide & market spot promoting.”

In the meantime, famend dealer @exitpumpBTC pointed out on Twitter: “Somebody sitting with 400 BTC purchase wall at $28,900 on Binance spot orderbook. Totally closed my brief.” This purchase wall would possibly present some assist for Bitcoin’s worth on the present stage.

Bitcoin Market Sentiment Weighs On Worth

The Bitcoin Market Sentiment, as represented by the Concern & Greed Index, is presently at 50 – impartial. Nonetheless, the sentiment on the Bitcoin and crypto market is lukewarm, regardless of BTC being up 76% year-to-date. The fading momentum appears to be because of the Bitcoin and crypto market’s present “summer season slumber.” The bullish information appears already priced in, and volumes on exchanges are dwindling.

Apparently, regardless of some main bullish developments for the broader crypto market, together with Blackrock’s filing for a spot ETF and the victory for XRP and Ripple, the retail and institutional curiosity stays low. That is mirrored within the low liquidity and volatility available in the market.

Remarkably, the crypto house has been rocked by an array of occasions lately. From the rise of liquidity absorbing meme cash to rip-off tokens, the market has seemingly descended into chaos. Within the midst of all these, impending occasions such because the Curve (CRV) hack in addition to fears of a possible DOJ motion towards Binance and Tether, proceed so as to add nervousness to the market. On this unsure state, there are not any new traders to catapult the market upward.

At press time, BTC traded at $28,990.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link