[ad_1]

On-chain knowledge reveals that 44.2% of all Ethereum traders at the moment are carrying their cash at a loss, an indication that the underside could also be shut for the asset.

Ethereum Proportion Of Holders In Loss Has Surged Not too long ago

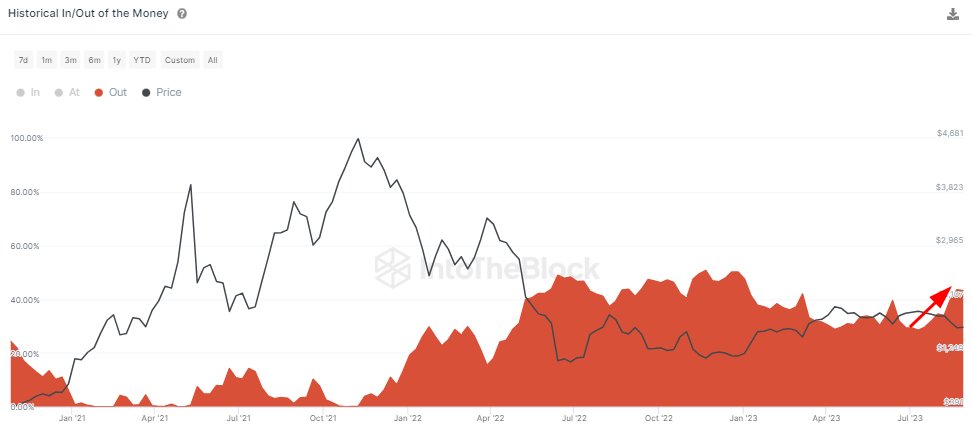

In accordance with knowledge from the market intelligence platform IntoTheBlock, the proportion of ETH traders in loss has grown sharply since early July. The related indicator right here is the agency’s “Historic In/Out of the Cash,” which tells us in regards to the share of Ethereum traders in earnings and losses and people which can be simply breaking even.

The metric determines whether or not an investor is in revenue or loss by taking a look at their tackle historical past to examine for the typical worth at which they acquired their cash. Naturally, if the asset’s present spot worth is lower than a holder’s value foundation, then that exact holder is carrying their cash at a internet revenue.

Equally, the price foundation being equal to and fewer than the spot worth would indicate that the investor is breaking even on their funding and holding at a loss, respectively.

Now, here’s a chart that reveals the development within the Historic In/Out of the Cash indicator for Ethereum over the previous few years:

The worth of the metric appears to have been going up in latest weeks | Supply: IntoTheBlock on X

IntoTheBlock has solely listed the info for the Ethereum traders in losses, as that is the variety of curiosity within the present dialogue. The mixed share of the traders breaking even and carrying earnings may also be deduced from this worth, as the whole share should add as much as 100%.

In early July, Ethereum holders underwater have been at about 27%. It’s seen within the graph, nevertheless, that the indicator has noticed a notable uplift since then, as the value of the cryptocurrency has registered a drawdown.

At this time, the indicator’s worth is at 44.2%, which means that nearly half of the Ethereum person base is holding their cash at losses. Typically, the extra the traders get into earnings, the extra possible they change into to promote to reap these features.

As a result of this motive, corrections within the asset change into extra possible to kind every time an excessive majority of the market is having fun with earnings. A big share of the holders being in losses as a substitute, nevertheless, can have the other impact on the value since they’ll lead in direction of bottoms as revenue sellers change into exhausted.

Associated Studying: This Could Be The Metric To Watch For A Bitcoin Bounce: Santiment

Because the begin of the bear market final yr, the best the metric’s worth has gone is 50%, implying that precisely half of the traders had been in losses again then. This worth isn’t too far off from the present one, suggesting that Ethereum could also be near forming a backside.

If the same loss share is hit with the underside this time, ETH would first endure from some extra downtrend in order that sufficient traders drop underwater.

ETH Worth

Ethereum has continued to maneuver flat lately; as of this writing, it trades at about $1,600.

Appears like ETH continues to be struggling to seek out any volatility | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, IntoTheBlock.com

[ad_2]

Source link