[ad_1]

- Bitcoin Money’s mining reward per block has been decreased to three.125.

- Spot ETF approvals would possibly scale back the influence of BTC halving.

Within the buildup to the Bitcoin [BTC] halving, which is about to happen in a few weeks, Bitcoin Cash [BCH] not too long ago accomplished its halving course of.

Main as much as the BCH halving, there have been notable fluctuations in its value. May these actions point out what to anticipate with the BTC halving?

Bitcoin Money sees a discount in mining charge

Based mostly on information from Nice Hash, Bitcoin Cash not too long ago halved on the 4th of April at a block top of 840,000. This newest halving occasion decreased the mining reward from 6.25 BCH to three.125 BCH per block.

It’s value noting that BCH halvings happen roughly each 4 years, with the earlier one happening in 2022 and the next one anticipated for 2028.

Whereas Bitcoin Money has witnessed notable value fluctuations in latest weeks, it skilled declines over the previous few days.

How Bitcoin Money trended

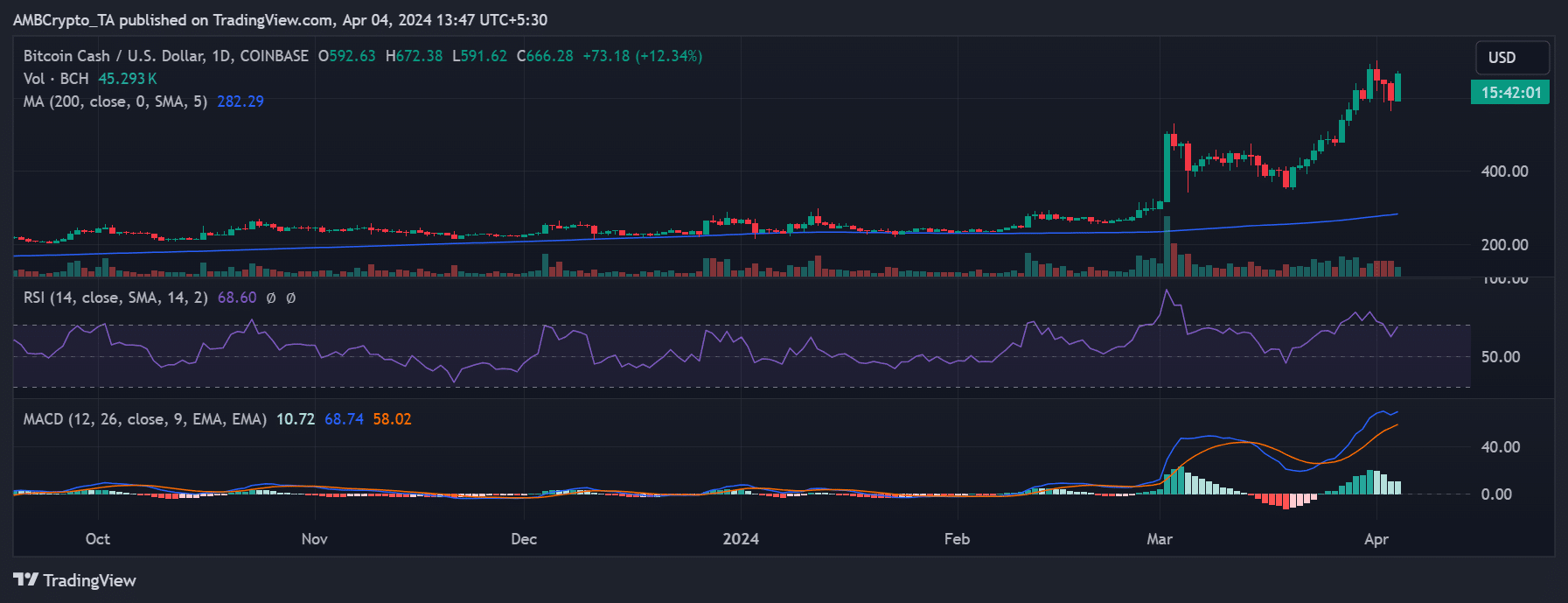

An evaluation of Bitcoin Money’s value pattern confirmed a major surge of 147.85% over the previous three months and a 24% improve during the last 30 days.

Nonetheless, within the days main as much as the halving occasion, it skilled consecutive declines. There was an over 9% decline simply hours earlier than the halving occurred.

Inspecting its each day timeframe pattern, Bitcoin Money closed at round $593 on the third of April. Nonetheless, as of this writing, its value had risen to over $666, marking a exceptional improve of over 12%.

The chart confirmed that BCH was nearing the overbought zone on its Relative Energy Index (RSI) with this latest uptrend. AT press time, the RSI sat barely under 70, exhibiting an upward trajectory.

All eyes on Bitcoin

With Bitcoin Money not too long ago finishing its halving, consideration now turns to Bitcoin, as its halving occasion is lower than 16 days away.

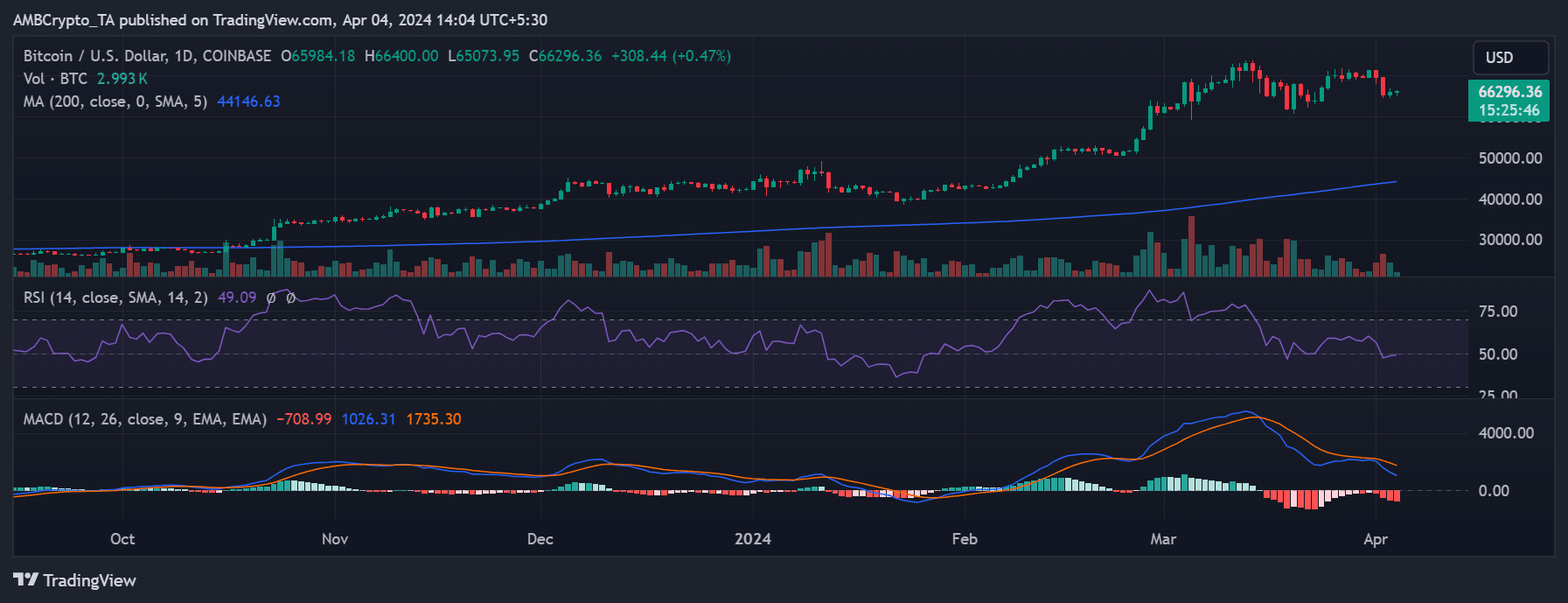

Like BCH, BTC has been on an upward value pattern over the previous few months. Nonetheless, its surge has largely been fueled by the anticipation and eventual approval of its spot ETF earlier within the yr.

Throughout this era, BTC has achieved new value highs, resulting in hypothesis that it may attain even larger ranges earlier than the yr concludes.

As of this writing, BTC was buying and selling at round $66,290, with a lower than 1% improve. Traditionally, after the primary halving in 2012, BTC surged by 5,500% over 4 years.

Is your portfolio inexperienced? Try the BTC Profit Calculator

Following the second halving, the rise was comparatively decrease, at 1,250%. Bitcoin’s efficiency lags behind within the present halving cycle, with solely a 700% improve noticed up to now.

The affect of the spot ETF approval might diminish the importance of the upcoming halving occasion on Bitcoin’s value.

[ad_2]

Source link