[ad_1]

- PEPE and FLOKI have a long-term bullish outlook

- The approaching week may see the meme coin markets climb increased.

Pepe [PEPE] posted beneficial properties of 17.53% at press time. The weekend was favorable for FLOKI [FLOKI] too, however the meme coin solely posted beneficial properties of shut to eight% up to now 48 hours.

The beneficial properties of Dogecoin [DOGE] final week may arrange a bullish week for the remainder of the meme coin market. Of the 2 cash AMBCrypto analyzed right here, PEPE had a extra bullish short-term outlook.

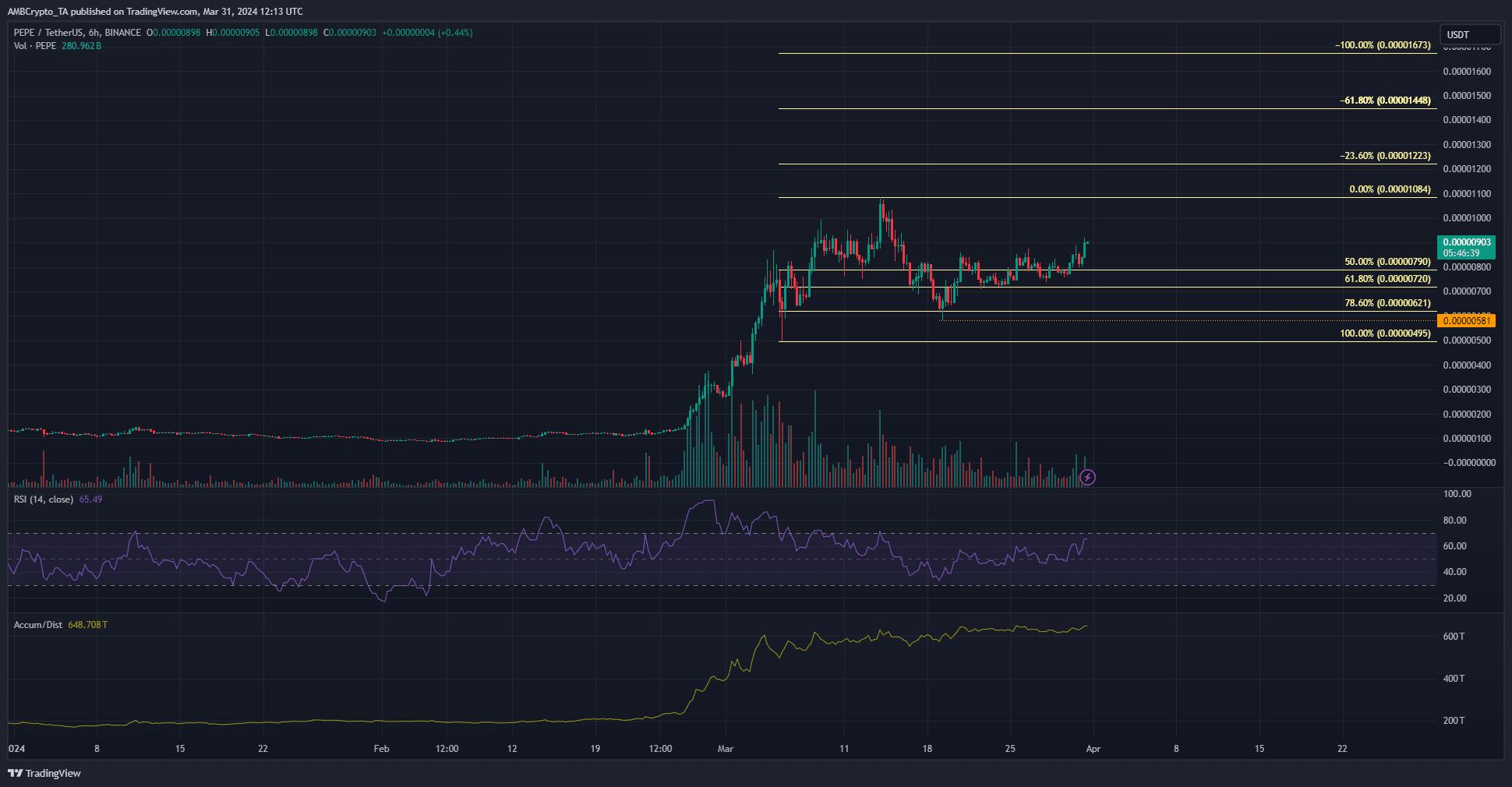

PEPE worth motion posts a bullish continuation

PEPE retraced from its all-time highs at $0.00001084, however didn’t strategy the swing low set at $0.00000581.

As an alternative, the patrons gained some momentum and compelled costs previous the native resistance at $0.0000085.

The A/D indicator resumed its uptrend as PEPE costs rose above this stage. It indicated demand was current behind the transfer. The RSI additionally climbed previous the 60 mark to indicate power.

Given BTC may face vital resistance close to $72k, it was unclear whether or not PEPE would handle to carve for itself one other northward run prefer it did in late February.

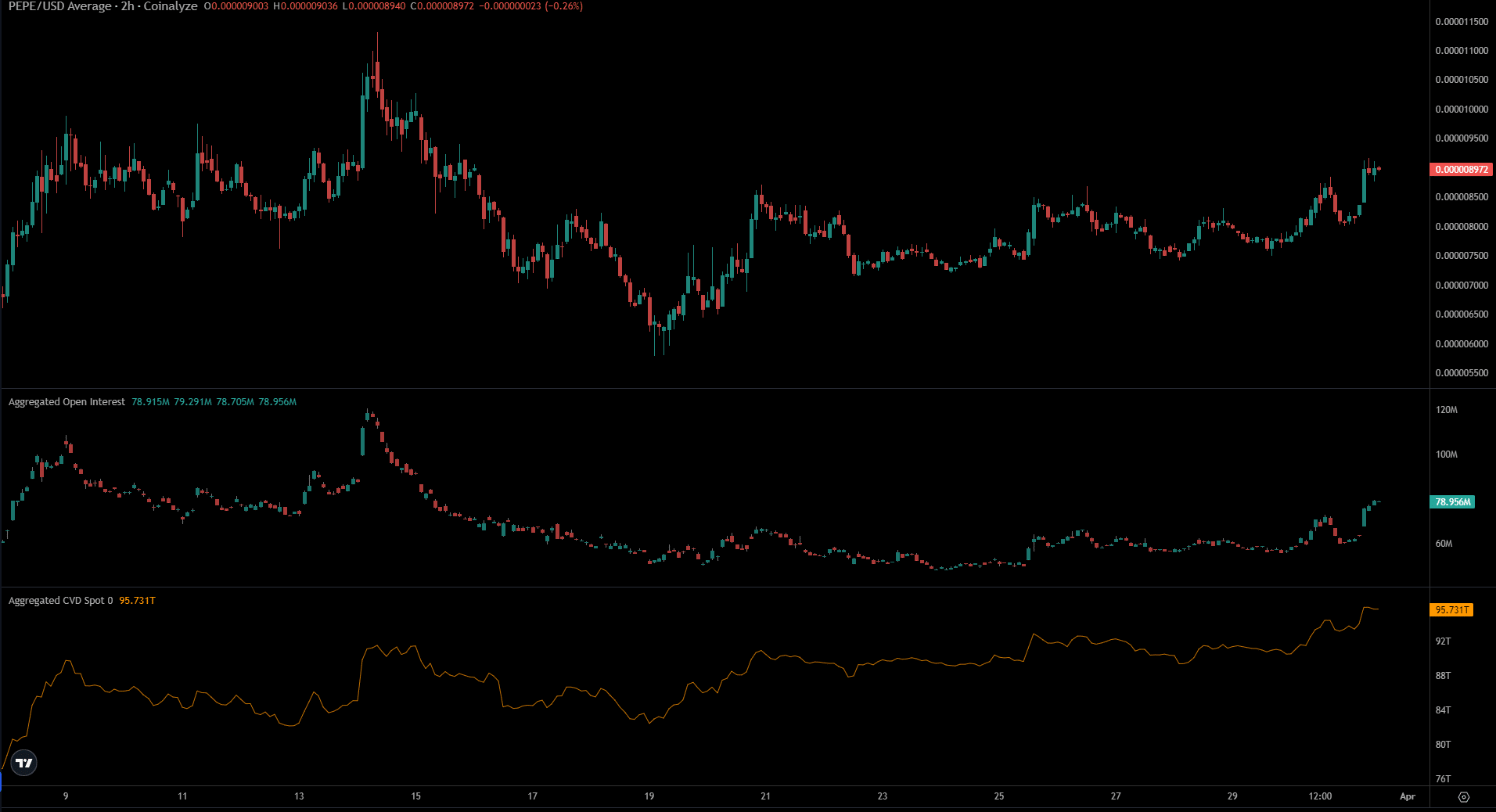

Supply: Coinalyze

The metrics on Coinalyze had been encouraging. The spot CVD trended increased because the nineteenth of March, reflecting demand. It additionally corroborated the findings from the A/D indicator.

The Open Curiosity slowly trended increased because the twenty fifth of March and noticed a big soar increased because the native resistance was breached.

It was a sign that speculators had been prepared to go lengthy on PEPE’s short-term breakout.

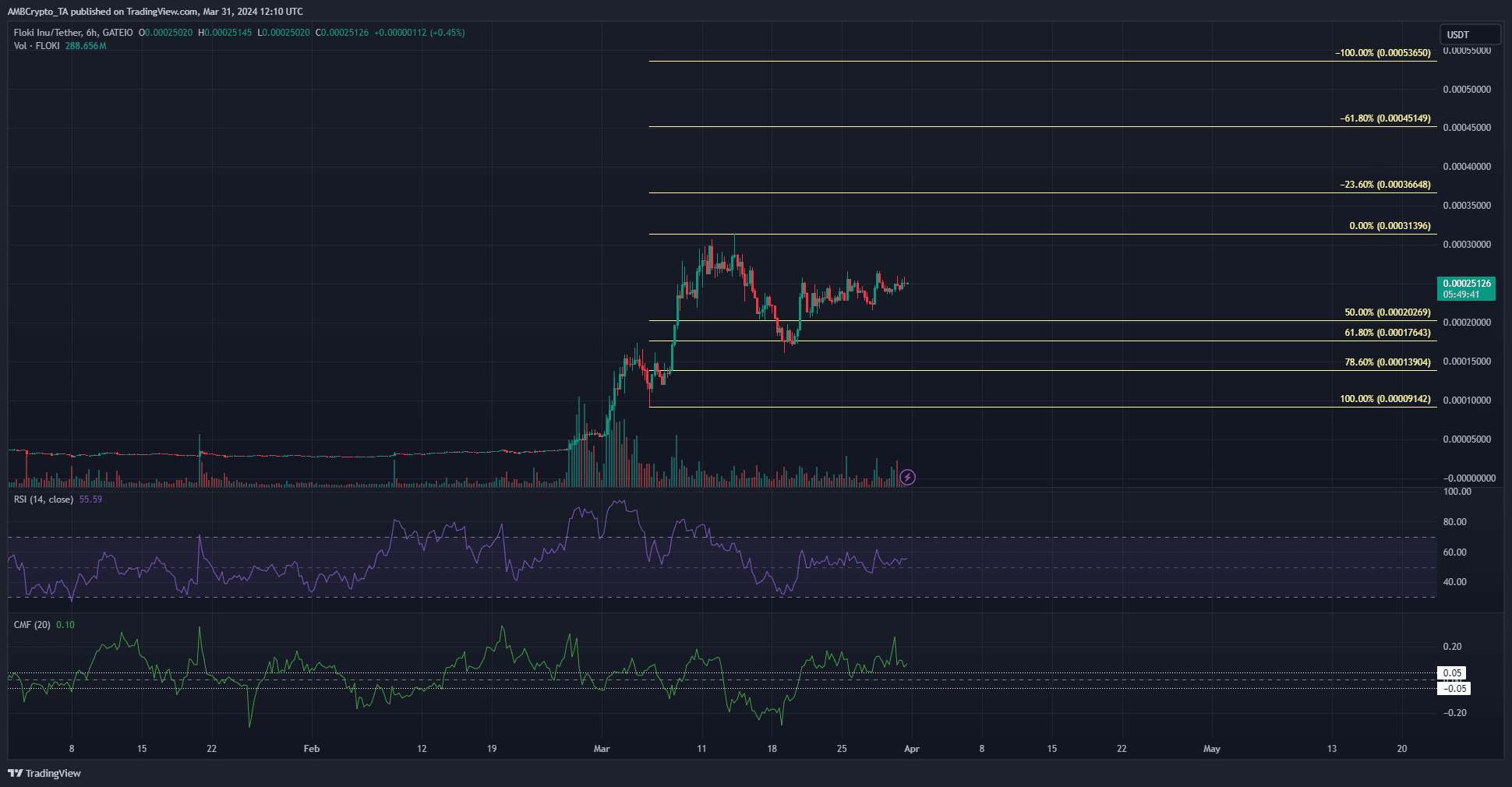

FLOKI was slower off the mark

FLOKI bulls had been extra hesitant than Dogecoin and Pepe. The CMF indicated a wholesome inflow of capital into the FLOKI market. The RSI additionally remained above impartial 50 on the 6-hour chart.

Like PEPE, it has a bullish market construction. Moreover, the 61.8% Fib retracement stage noticed a superb response from the bulls. Within the brief time period, volatility was possible.

The upper timeframe bias was strongly bullish.

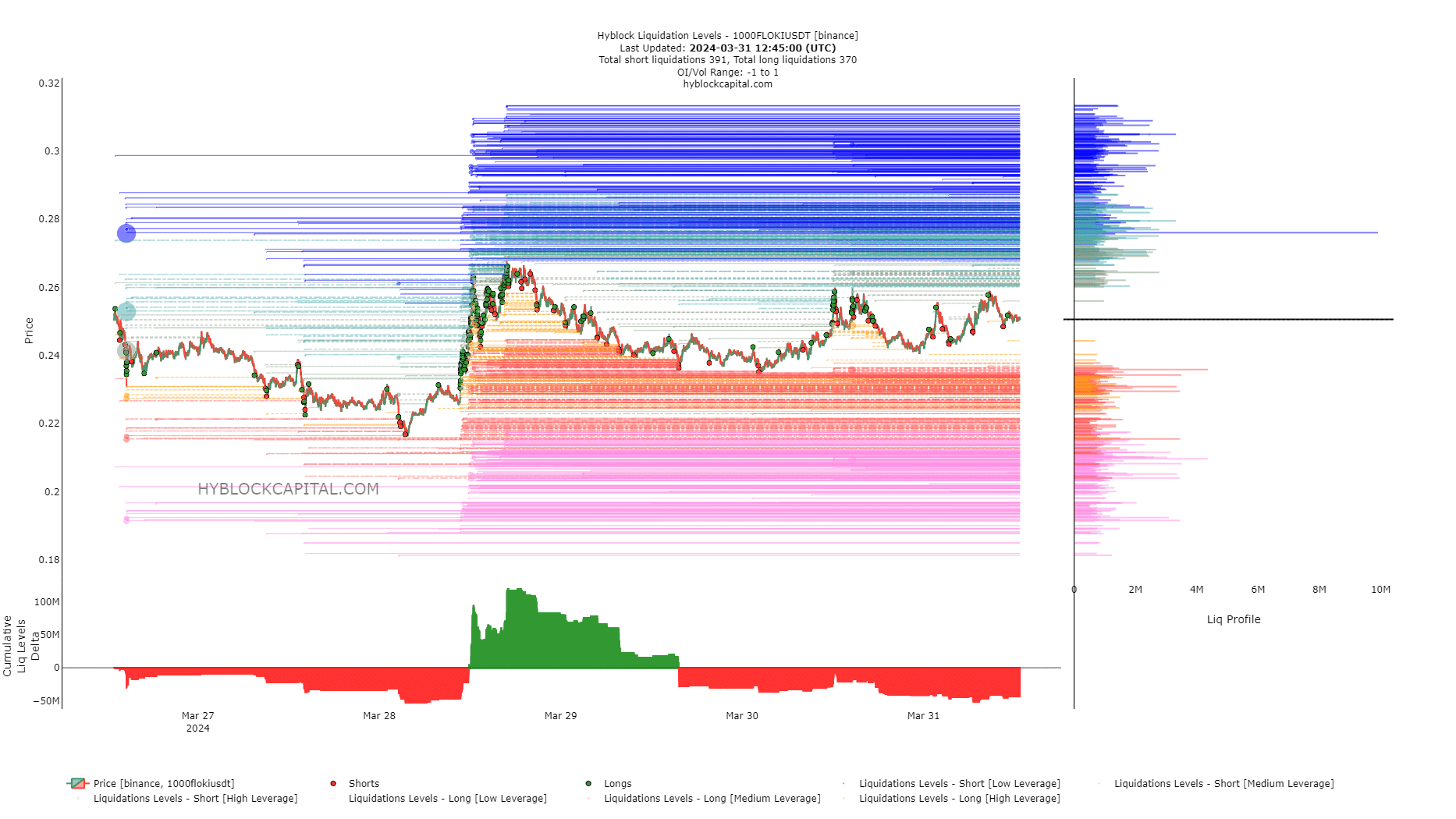

Supply: Hyblock

The Cumulative Liquidation Ranges had been mildly damaging, exhibiting a transfer upward to flush the brief positions. Costs are drawn to vital pockets of liquidity.

Practical or not, right here’s PEPE’s market cap in BTC’s terms

The $0.00027 was estimated to have near $10 million in liquidation.

As a assist zone, the $0.000235 stage was additionally an space of curiosity. We might even see a pointy transfer upward to liquidate the low-leverage brief positions close to $0.00027 earlier than a downturn.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

[ad_2]

Source link