[ad_1]

- Solana has a powerful bullish bias whilst costs soar above a key resistance degree.

- Avalanche noticed its bullish momentum decelerate and will witness a minor pullback.

Solana [SOL] and Avalanche [AVAX] noticed a barely completely different trajectory on the worth charts over the previous two days. The previous continued to surge increased whilst the remainder of the crypto market shed some features, whereas the latter’s bullish momentum weakened.

Bitcoin [BTC] was a significant component within the efficiency of altcoins. The capital movement into ETFs has been monumental, however this didn’t imply the altcoin markets have been forgotten. Right here’s how merchants may navigate the incoming volatility.

Avalanche may retest a key demand zone, whereas Solana continues the uptrend

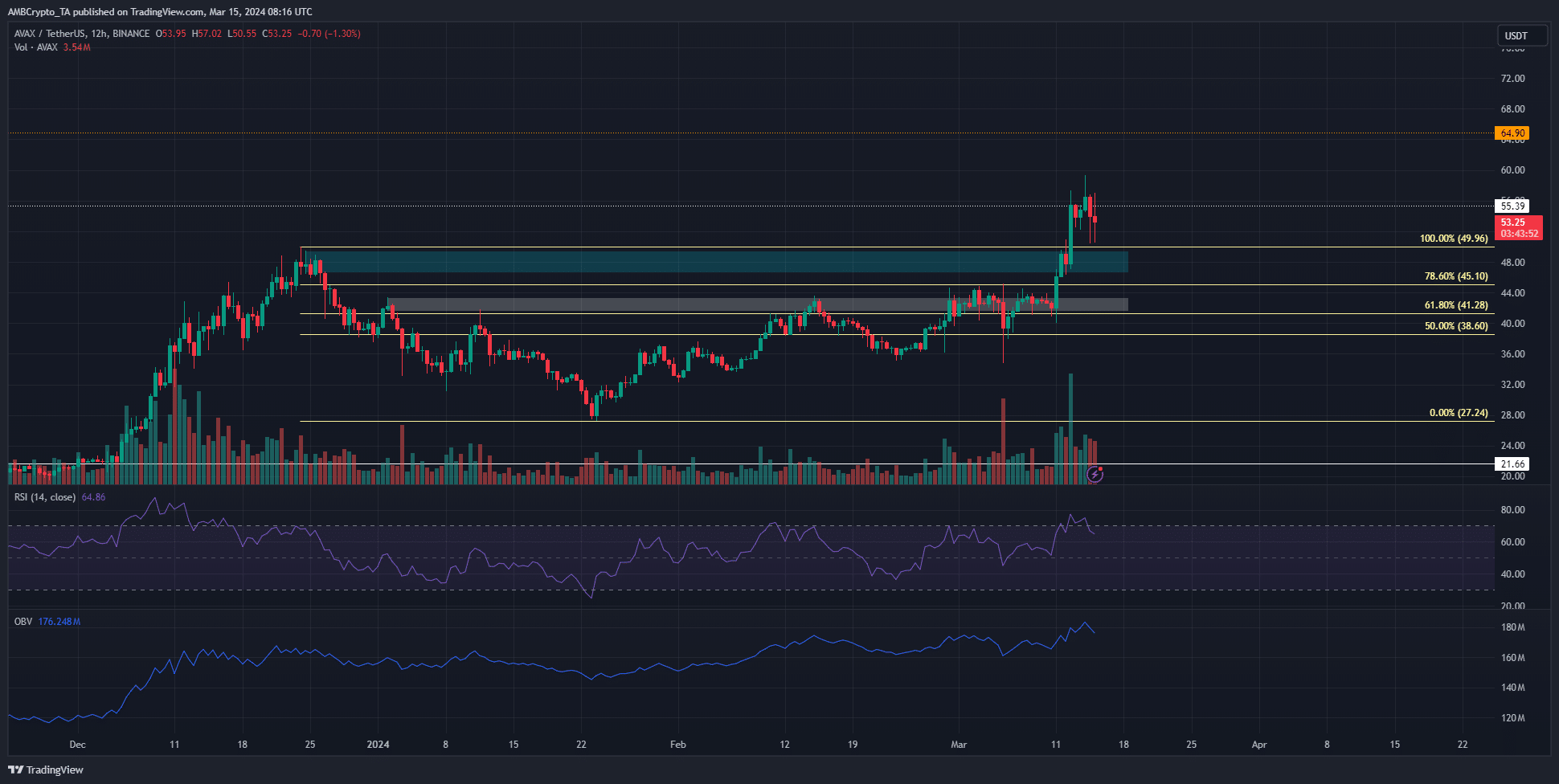

The AVAX chart confirmed two former bearish order blocks which were was bullish breaker blocks over the previous two weeks. These are highlighted by the white and cyan packing containers.

The Fibonacci ranges confirmed {that a} bullish development was established as soon as the white field resistance on the $43.35 mark was damaged.

The $55.4 and $64.9 ranges have been increased timeframe resistance ranges that merchants have to be careful for. The OBV and the RSI have been trending increased in latest weeks, exhibiting bullish domination. Extra features are anticipated to return after a pullback.

A retest of the $49 and $43 demand zones may happen, and would current a shopping for alternative upon a retest.

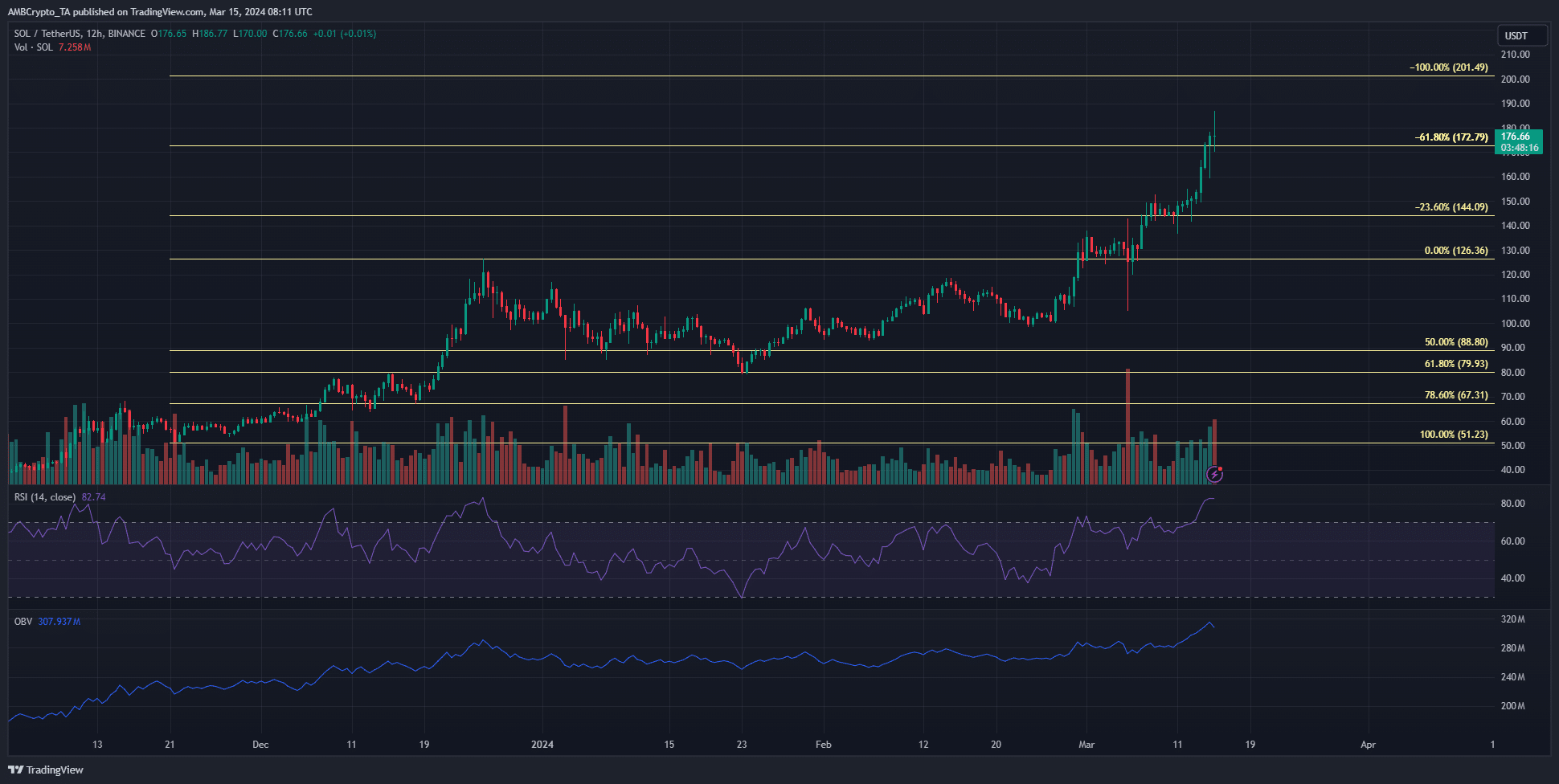

Whereas Avalanche noticed a pullback from the $56 resistance because of the Bitcoin value drop, Solana didn’t decelerate its bullish march. Its RSI on the 12-hour chart was at 82 to point sturdy bullish momentum.

The OBV additionally climbed increased to sign an influx of consumers into the market. Conversely, whales have taken revenue, as AMBCrypto reported.

At press time, the 61.8% extension degree at $172.8 has been flipped to assist. The $200 degree is the subsequent goal, as specified by a recent report.

Is your portfolio inexperienced? Verify the SOL Profit Calculator

Assessing the slide in Open Curiosity

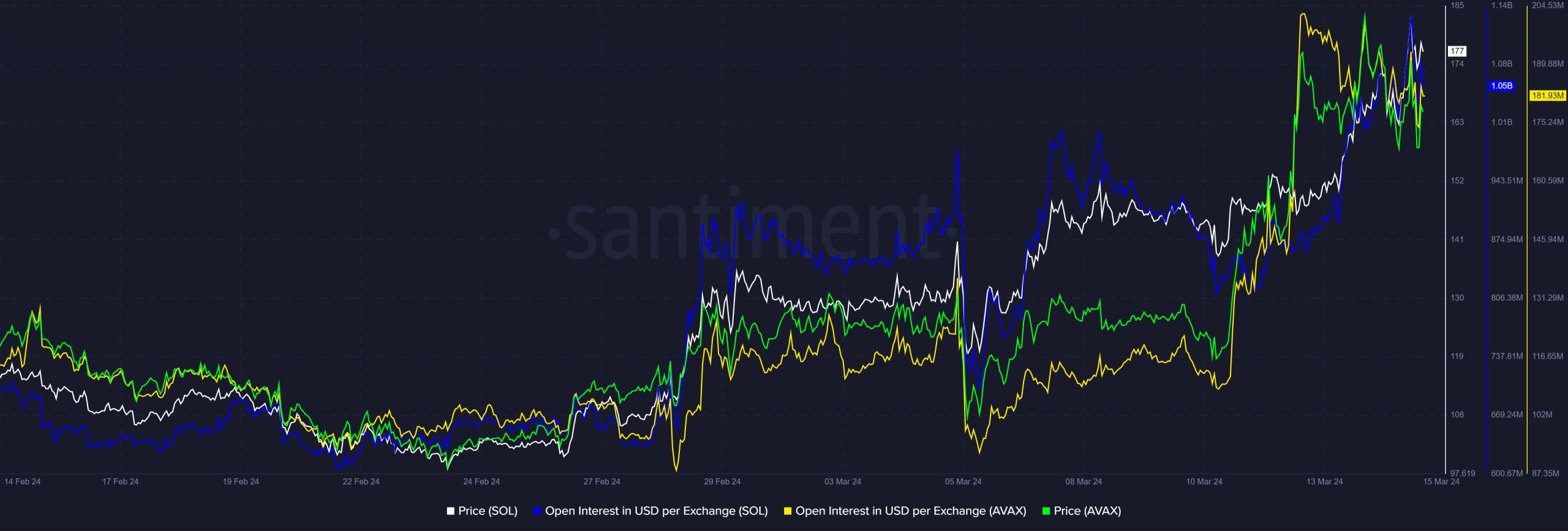

Supply: Santiment

The OI of AVAX has slid decrease over the previous three weeks. It fell from $202 million to $181 million at press time whereas costs stagnated across the $55 mark. This indicated bearish expectations towards the token.

Alternatively, the Open Curiosity behind Solana rose from $880 million to $1.05 billion as costs went from $146 to $177. This was a sign that short-term conviction continued to be biased in favor of the bulls.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.

[ad_2]

Source link